TRD Issue 82 - Briefing: Retail's Premium Push + AI's Limitations

In an inflationary market, leaders like P&G and Unilever bet on premium pricing. Plus: Why today's AI has its limitations.

Hello Subscribers,

Hope your week's going well!

This week's highlights dive into how retailers get creative with pricing - from P&G's new "upflation" strategy (think $14 body deodorant) to Abercrombie & Fitch's remarkable turnaround story. Meanwhile, Amazon faces a crucial decision about competing with Shein and Temu's aggressive pricing model.

On the tech side, we're unpacking why current AI models struggle with basic tasks (spoiler: it's all about tokens), and there's an interesting development from Japan, where PayPay is doubling its payment limits to compete with credit cards.

Quick reads below that I think you'll find valuable. Let me know what catches your eye. Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

Economy

‘Upflation’ Is the New Retail Trend Driving Up Prices for US Consumers

Consumer giants like P&G and Unilever are introducing premium versions of basic products at higher prices to combat declining sales volumes.

Why it matters: This "upflation" strategy represents a major shift in how consumer packaged goods companies try to maintain revenue growth as inflation-weary shoppers buy fewer essential items.

By the numbers:

- Retail razor blade sales: down 20% vs 2019

- Deodorant sales: down 6.5% vs 2019

- P&G body deodorant: $14 (2x standard price)

- Gillette intimate razor: $15 ($5 premium)

Key examples:

- P&G launching all-over body deodorants

- Gillette introducing specialized intimate area razors

- Head & Shoulders Bare with fewer ingredients at 2x price

- Food companies marketing snacks as meal replacements

The big picture: Two main factors driving this trend

- Consumers are becoming more cost and waste-conscious

- Companies needing new revenue sources as traditional "shrinkflation" tactics lose effectiveness

Yes, but: Critics question whether these premium products solve real consumer needs or just repackage existing solutions at higher prices.

What's next: The trend appears largely U.S.-focused for now, while Asian markets are seeing demand for multi-benefit products at standard prices.

Source: Bloomberg

Why more young people are signing up for AARP memberships

Young adults are increasingly joining AARP (formerly the American Association of Retired Persons) to access member discounts, despite the organization's traditional association with seniors 50+.

Why it matters: This shift signals how inflation drives younger consumers to seek creative ways to save money through membership programs.

By the numbers:

- AARP membership cost: $16/year

- Current membership: 22 million households

- Member examples: AT&T offers a $10 discount, Walmart+ provides a $20 discount, and the Calm app has a 30% discount for three years.

Key drivers:

- Viral TikTok content showcasing membership benefits

- Inflation pushing consumers to seek savings

- Membership is open to anyone 18+

- Quick ROI through various discounts

Zoom out:

- Club store memberships are also rising

- Sam's Club: Record membership levels

- Costco: 74.5M paid members (+7.8% YOY)

- Gen Z and Millennials driving growth

What's next: AARP is modernizing its offering with

- Digital platform expansion

- Celebrity content

- New partnerships (Walmart+, Calm, Paramount+)

- Focus on universal, ageless benefits

Source: Modern Retail

Retail

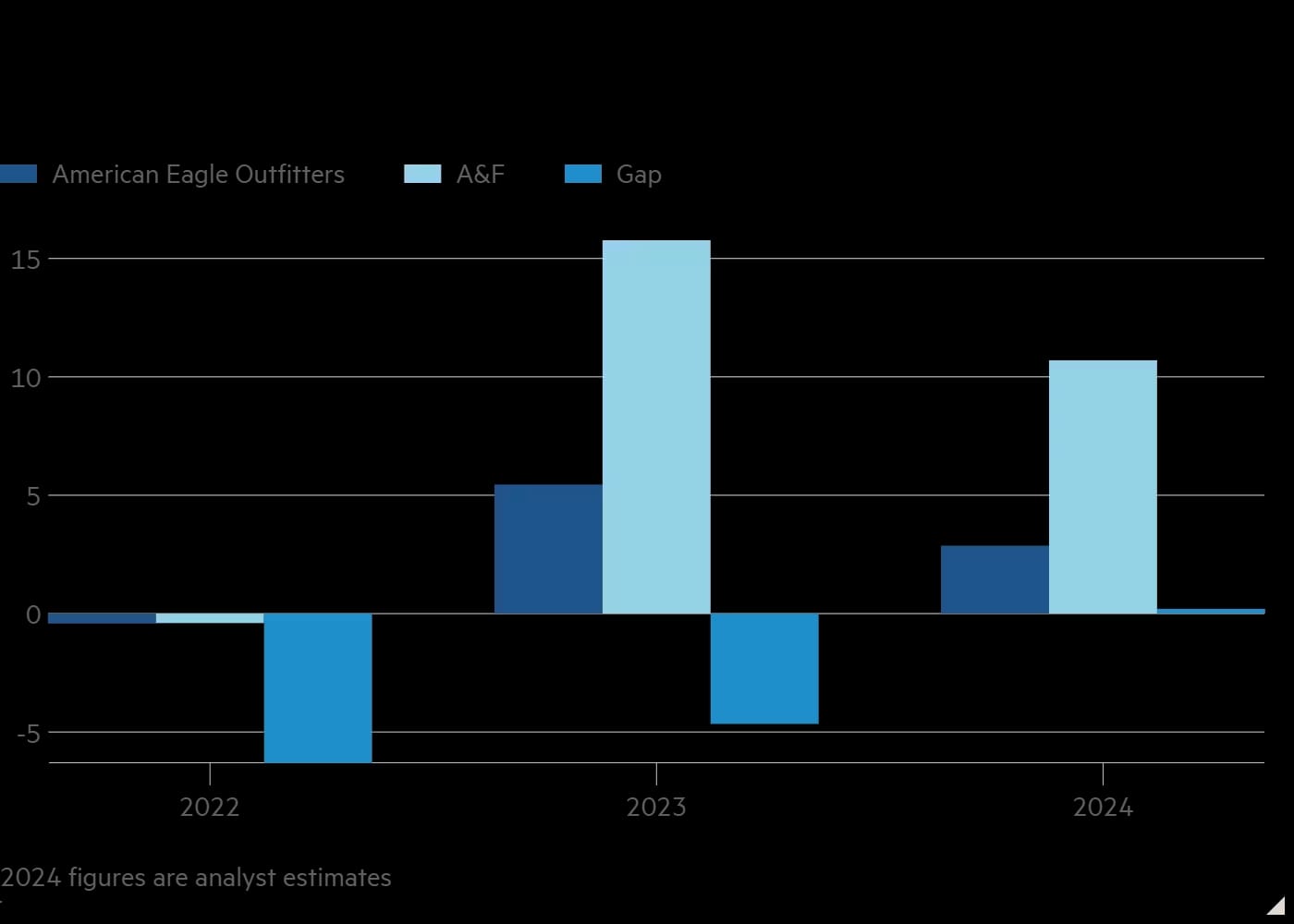

How Abercrombie & Fitch turned from teen castoff to market trend

Abercrombie & Fitch has successfully transformed from a fallen teen brand to a market outperformer, even surpassing Nvidia's stock performance.

Why it matters: The retailer's dramatic turnaround shows how strategic rebranding and operational changes can revive a seemingly dead brand in the competitive retail space.

By the numbers:

- Expected 2024 sales growth: 10%

- 2023 sales growth: 16%

- Q1 gross profit margin: 66.4% (vs competitors' ~40%)

- International sales: <20% of net sales

Key transformation elements:

- Shifted from exclusive teen brand to inclusive adult fashion

- Expanded size range

- Focus on well-fitting "core" items

- Agile inventory management

- Higher-priced premium offerings

- Reduced reliance on promotions

Behind the success:

- New leadership under CEO Fran Horowitz since 2014

- Faster inventory ordering (weeks vs. traditional 9 months)

- Data-driven trend anticipation

- Quality and fit improvements

- Strategic pricing strategy

What's next: Global expansion plans with:

- New teams in Shanghai and London

- Localized assortments

Source: FT

Why some brands are being more cautious about wholesale expansion

Despite its previous appeal as a customer acquisition channel, D2C brands are becoming more cautious about wholesale expansion.

Why it matters: The shift indicates a growing realization that wholesale isn't always the path to profitability, especially for cash-strapped startups in today's economic climate.

By the numbers:

- Wholesale average: 60% of total company sales

- Marketing costs: Up 7% YOY for wholesale distribution

- Customer acquisition: Digital costs remain volatile

- Timeline: 6-12 months runway extension by focusing on D2C

Key challenges with wholesale:

- High upfront inventory costs

- Field rep hiring requirements

- Marketing investments needed

- Limited funding options

- Risk of unsuccessful launches (e.g., Parade at Target)

The new strategy:

- Focus on existing channels

- Prioritize digital marketplaces

- Target fewer, strategic retail partners

- Wait for "dream retailer" opportunities

- Build stronger D2C foundations

What's working:

- Amazon marketplace presence

- Direct-to-consumer focus

- Selective retailer partnerships

- Digital marketing control

- Conservative growth approach

Bottom line: While wholesale remains profitable for established brands, startups increasingly view it as a long-term goal rather than an immediate priority.

Source: Modern Retail

e-Commerce

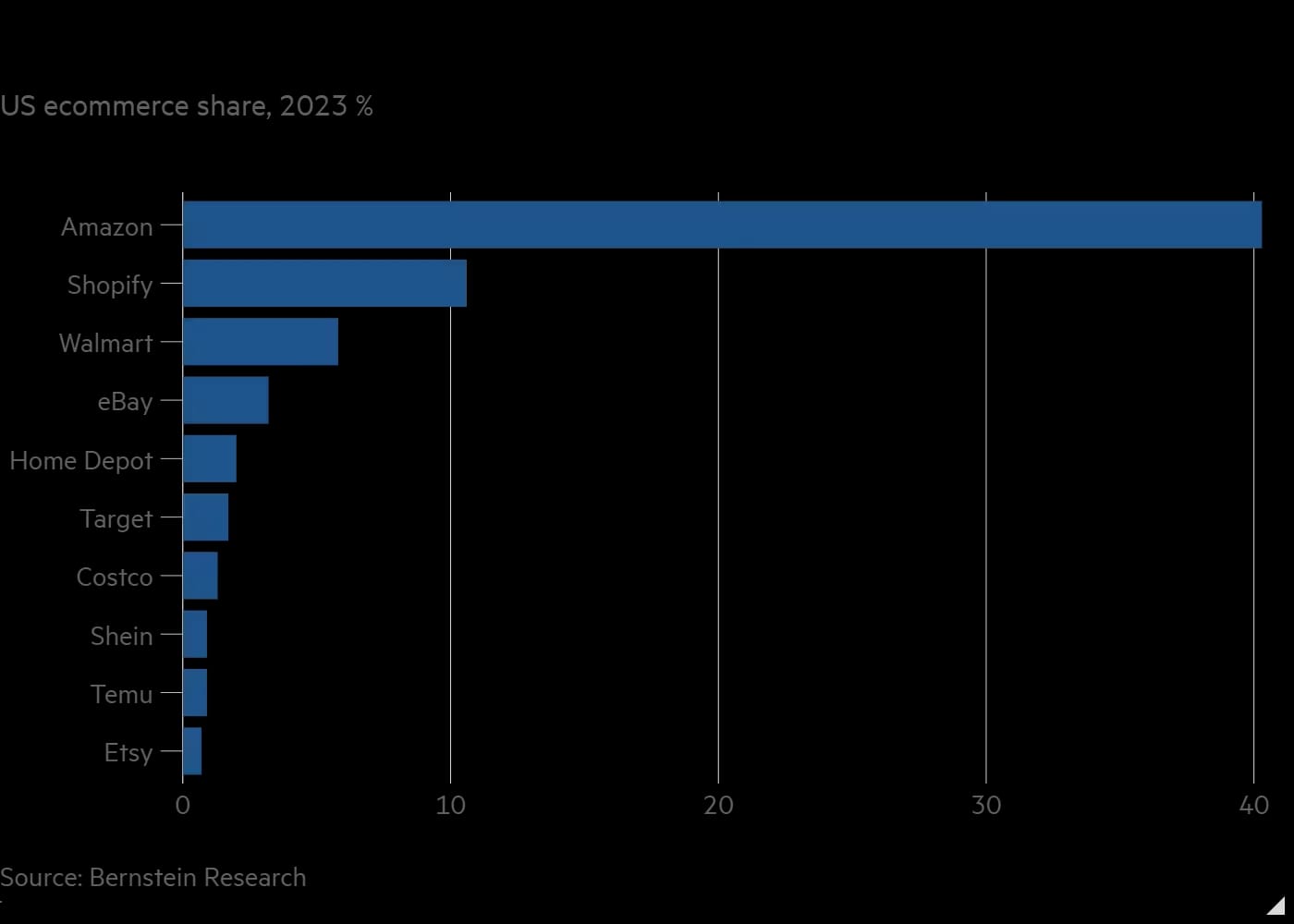

Amazon should not join Shein and Temu’s race to the bottom

As we covered last week, Amazon is launching a direct-from-China discount marketplace to compete with fast-growing rivals Shein and Temu.

Why it matters: This strategic move could be risky for Amazon, given regulatory scrutiny and the unsustainable business models of its competitors.

By the numbers:

- US ecommerce market: $1.1 trillion annually

- Amazon's market share: 40%

- Shein & Temu: Each 1% market share

- Temu's projected GMV: $40B in 2024

- Temu's estimated 2023 loss: $4.6B

The competition dynamics: Temu's aggressive growth comes at a steep cost - about $11 per package in shipping and handling, plus billions in marketing spend for customer acquisition.

Why Amazon should wait it out:

- Regulatory headwinds: Both the US and EU are looking to restrict tariff-free imports

- Limited China presence: Amazon lacks the logistics network to match Shein/Temu's efficiency

- Antitrust concerns: Amazon faces lawsuits in US and Europe

- Unsustainable model: Competitors' growth relies on heavy losses

Bottom line: With its dominant market position, Amazon would be better served watching competitors burn cash than joining a race to the bottom.

Source: FT

Walmart+ Subscribers Break the 30% Mark

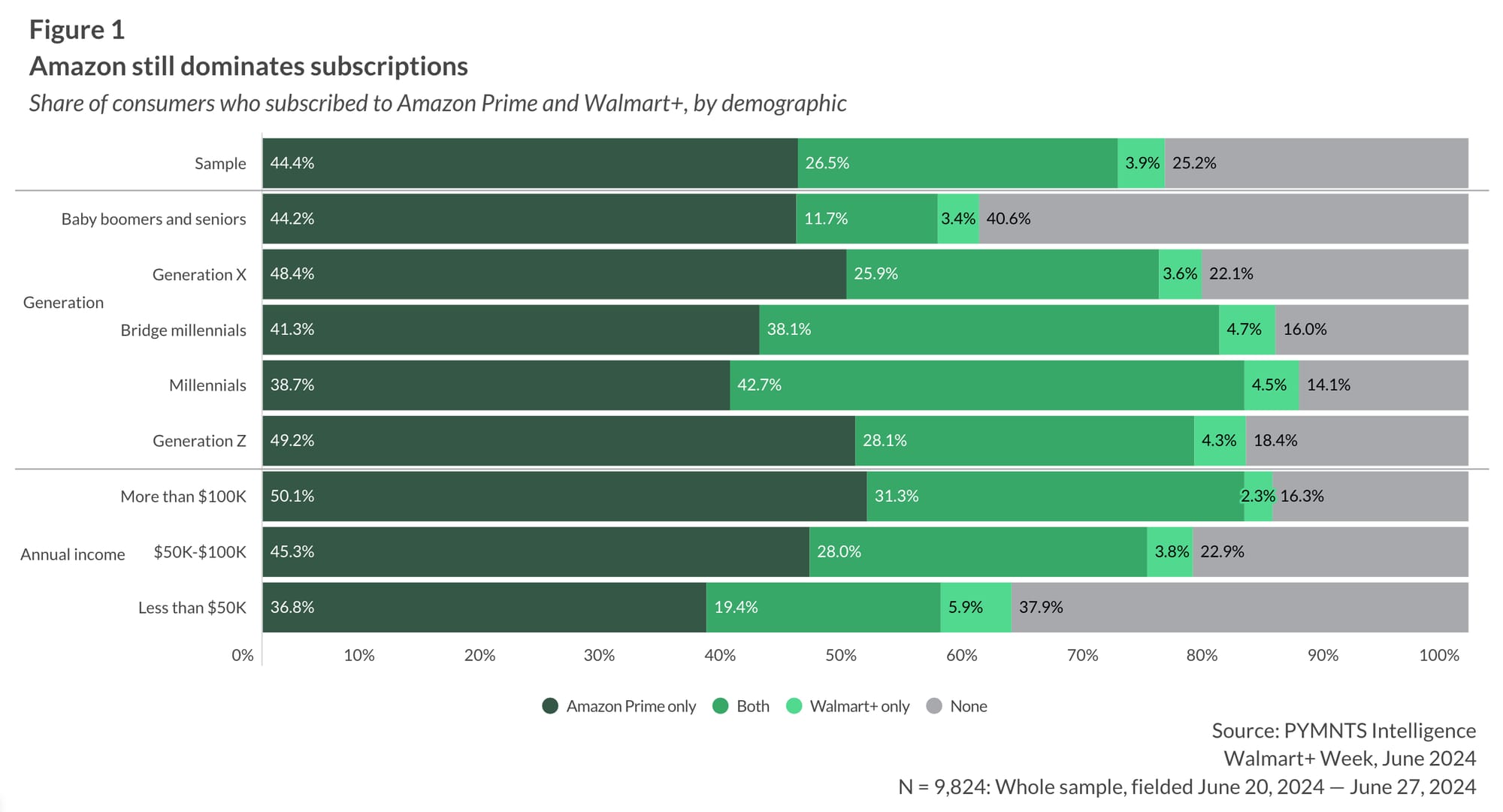

A study by PYMNTS Intelligence shows that Walmart+ has reached 30% consumer penetration, with millennials leading the adoption rate at a nearly 50% subscription rate.

Why it matters: The strong growth of Walmart+ shows the retailer's success in competing with Amazon Prime for paid memberships, particularly among younger shoppers.

By the numbers:

- Overall Walmart+ penetration: 30% of consumers

- Millennial subscription rate: 47%

- Boomer/Senior subscription rate: 15%

- Cross-membership: 87% of Walmart+ members also have Prime

- Millennial cross-membership: 90% have both services

The bigger picture: Walmart+ is experiencing double-digit growth, with members showing higher engagement and spending than non-members. The success stems from improved fulfillment capabilities and strategic targeting of younger demographics.

What's next: Both Walmart and Amazon are prioritizing their membership programs as key drivers of customer loyalty and international expansion.

Bottom line: Walmart is successfully building a competitive subscription service to rival Amazon Prime, with particularly strong traction among millennial consumers.

Source: PYMNTS

AI

Tokens are a big reason today’s generative AI falls short

Current AI models' reliance on "tokenization" - breaking text into smaller pieces - creates significant limitations and biases in their performance.

Why it matters: Understanding tokenization helps explain why today's AI struggles with basic tasks like math, language translation, and text manipulation that humans find simple.

Key problems with tokenization:

- Inconsistent handling of spacing and capitalization

- Unfair treatment of non-English languages

- Poor mathematical reasoning

- Difficulty with anagrams and word reversal

The language bias: The same content requires vastly different token counts

- English: Most efficient

- Thai: 6 tokens for "hello"

- Chinese/Japanese: Each character has a separate token

- Some languages: Up to 10x more tokens than English

What's next: New approaches like MambaByte show promise by

- Working directly with raw bytes

- Eliminating tokenization entirely

- Handling text variations better

- Maintaining competitive performance

Bottom line: Until new architectures mature, tokenization remains a fundamental limitation of current AI models, particularly affecting non-English languages and mathematical operations.

Source: TechCrunch

Etsy adds AI-generated item guidelines in new seller policy

Etsy introduces new "Creativity Standards," requiring sellers to clearly label products based on human involvement, including AI-generated items.

Why it matters: The policy change addresses growing concerns about AI-generated products flooding the marketplace while maintaining Etsy's position as a platform for creative commerce.

The new labels:

- Handmade: Physical products made by sellers

- Designed: Items created using AI or other digital tools

- Handpicked: Vintage goods

- Sourced: Craft and party supplies

Key policy changes:

- Sellers must disclose AI use in listings

- AI-prompted creations are allowed with proper labeling

- AI prompt pack listings are now banned

- All 100M+ items must be classified

Behind the move: Etsy faces pressure to balance innovation with its handmade marketplace identity, having removed 4x more policy-violating listings than last year.

Bottom line: The new guidelines represent Etsy's attempt to embrace AI technology while preserving its reputation for authentic, human-created goods.

Source: TechCrunch

Asia

PayPay Doubles Transaction Limit to 1 Million Yen to Compete with Credit Cards

PayPay dominates Japan's QR payment market as digital payments increasingly become an essential infrastructure, with 93 billion transactions in 2023.

Why it matters: QR payments now exceed half of credit card usage in Japan, signaling a significant shift in consumer payment habits while forcing market consolidation.

By the numbers:

- Total QR transactions: 93B (+30% YOY)

- Credit card transactions: 178B (+13% YOY)

- E-money transactions: 61B (+5% YOY)

- PayPay users: 64M+

- PayPay market share: ~70%

Key developments:

- LINE Pay announcing service termination by April 2025

- JR East is planning to integrate 20 payment services by 2027

- Growing concerns about system reliability after recent outages

Bottom line: While QR payments are becoming essential infrastructure in Japan, providers must balance growth with security and reliability as the market matures and consolidates.

Source: NIKKEI

Korean platforms respond to YouTube’s foray into live commerce

YouTube's zero-commission entry into South Korea's live commerce market triggers competitive responses from local platforms Naver, Kakao, and Coupang.

Why it matters: The move could reshape commission structures in Korea's growing live commerce sector, particularly benefiting small sellers.

Current commission rates:

- YouTube: 0%

- Naver: 6.98-8.63%

- Grip: 12%

- Kakao: 13%

- Coupang: 15.9%

How platforms are responding:

- Naver

- Relaxed streaming rights criteria

- New "Blooming Days" support program

- Lowest existing commission rates

- Kakao

- 3.3% commission for new sellers

- Free tools package

- 7% customer cashback promotion

- Coupang

- Expanded marketplace access

- Same-day streaming approval

- VOD service addition

Bottom line: Korean platforms are racing to retain sellers through reduced fees and enhanced benefits as YouTube's zero-commission model threatens to disrupt the market.

Source: Pulse

Comments ()