TRD Issue 78 - Briefing: Gen Z's Thrift, Temu's Rise, and Apple's Boring AI Edge

Gen Z flocks to off-price retailers, Temu challenges Amazon, Apple's practical AI gains traction. ByteDance cuts jobs, and Watsons expands stores in Asia's evolving retail landscape.

Hello Subscribers,

Remember when off-price retailers were where your grandma shopped? Well, not anymore. Gen Z is flocking to these stores, drawn by the thrill of the hunt and wallet-friendly prices. It's a trend giving established e-commerce giants a run for their money.

Speaking of e-commerce, Temu is making waves. This Chinese upstart is luring repeat customers away from eBay and even giving Amazon a reason to sweat. It's a David and Goliath story that's just beginning to unfold.

But it's not all smooth sailing in the tech-meets-retail world. ByteDance is trimming its workforce in Indonesia following its Tokopedia deal. It's a reminder that even in high-growth markets, efficiency is key.

On a bright critical note, Watsons is betting big on brick-and-mortar, pouring a cool quarter-billion into new and upgraded stores across Asia. It seems the physical shopping experience isn't going out of style anytime soon.

And let's not forget Apple's typically understated approach to AI. While others shout from the rooftops, Apple's "boring and practical" AI might be the secret sauce keeping customers returning.

It's a week of contrasts in retail - from bargain hunters to big spenders, from online disruptors to physical store investments. Let's dive in and see what it all means for the future of shopping. Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

Retail

Off-Price Retailers Are Becoming a Hit With Gen Z

Off-price retailers win Gen Z's hearts and wallets

- TJ Maxx, Ross, and Nordstrom Rack report strong Q1 sales growth, attracting younger shoppers.

- 48% of Gen Z consumers shop most at discount retailers vs. 24% at specialty stores. (ICSC survey)

Why it matters: Gen Z's spending power drives growth for off-price chains while traditional department stores struggle to keep up.

The big picture:

- Off-price retailers are expanding store footprints to cater to Gen Z's in-store shopping preference.

- Home goods are a key focus as young shoppers furnish their first apartments.

- Product curation is crucial: "People come for the 'treasure' they can find," says Neil Saunders, GlobalData Retail.

What's next: Watch for continued expansion and product innovation from off-price retailers as they compete for Gen Z's attention and dollars.

Source: Modern Retail

AI

Apple's AI, Apple Intelligence, Is Boring and Practical — That's Why It Works

AI gets practical: Apple's smart, cautious approach

- Apple unveils "Apple Intelligence" in iOS 18, focusing on everyday usefulness over flashy features.

- New AI tools enhance writing, notifications, search, and photo editing without overwhelming users.

Why it matters: As AI faces trust issues, Apple's practical approach could win over consumers wary of chatbot hallucinations and privacy concerns.

The big picture:

- Apple Intelligence integrates AI into existing apps, solving specific problems.

- Features include intelligent writing tools, prioritized notifications, and guided image creation.

- Apple limits risks by avoiding open-ended chatbots and unrestricted image generation.

What's next: Apple Intelligence beta launches this fall, setting new standards for AI in consumer devices.

Source: TechCrunch

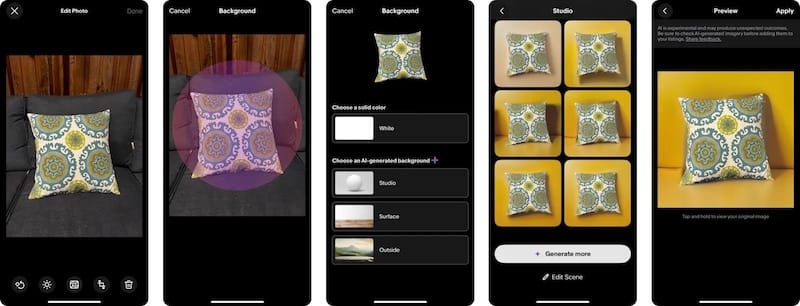

eBay Debuts AI-Powered Background Tool to Enhance Product Images

eBay's AI spruces up seller photos

- eBay launches an AI tool to replace image backgrounds for product listings.

- Available now for iOS users in the US, UK, and Germany; Android rollout coming soon.

Why it matters: This levels the playing field for sellers without professional photography skills or equipment, potentially boosting sales through more appealing listings.

The big picture:

- Follows similar moves by Amazon and Google for advertisers

- Powered by an open-source Stable Diffusion model

- Builds on eBay's previous AI initiatives, like auto-generated listing titles and descriptions

What's next: Watch for increased adoption of AI tools across e-commerce platforms to enhance product presentation and streamline selling processes.

Source: TechCrunch

As Brands Look for AI Edge, B&Q Retail Owner Kingfisher Is Expanding In-House Development

Kingfisher DIYs its AI chatbot.

- Retail giant Kingfisher built an AI chatbot in-house for its Castorama brand.

- Success prompts plans to expand the tech across brands like B&Q and Screwfix.

Why it matters: Brands are finding they can develop AI solutions without agency partners, potentially saving costs and retaining control.

The big picture:

- 78% of in-house agencies use generative AI for content creation.

- Kingfisher's approach offers flexibility and transparency in a rapidly evolving AI landscape.

- The chatbot, "Hello Casto," handles 60,000 customer conversations monthly.

What's next: Watch for more brands to experiment with in-house AI development, balancing cost savings with the need for specialized expertise.

Source: Modern Retail

e-Commerce

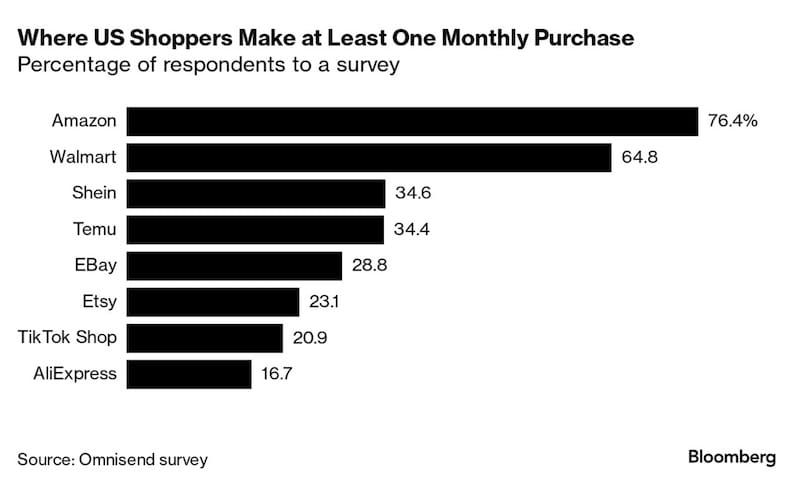

Temu Lures More Repeat Customers Than eBay, Pressures Amazon

Temu challenges e-commerce giants

- 34% of surveyed consumers shop on Temu monthly, surpassing eBay's 29%. (Omnisend survey)

- Amazon leads with 75%+ of respondents shopping there at least once a month.

Why it matters: Temu's rapid growth shows how aggressive marketing and low prices can quickly win market share from established players.

The big picture:

- Temu's success comes amid shifting consumer behavior, with more shoppers starting on search engines vs. marketplaces.

- Amazon faces criticism on pricing, while Temu's weak points are product quality and delivery speed.

- Deal-hunting consumers are prioritizing low prices over fast delivery.

What's next: Watch for established e-commerce players to adjust strategies to compete with Temu's low-price model and aggressive marketing.

Source: Bloomberg

Walmart Expects Profits in Its US E-Commerce Business Within Two Years

Walmart eyes e-commerce profit milestone

- Walmart expects its U.S. e-commerce business to be profitable within two years.

- This includes its advertising and consumer data business.

Why it matters: Achieving e-commerce profitability would mark a significant turning point for Walmart's digital strategy, challenging Amazon's dominance.

The big picture:

- Walmart's e-commerce sales grew 22% in the latest quarter.

- Sam's Club's e-commerce operations are already profitable.

- The company is focusing on reducing costs while increasing order volume.

What's next: Watch for Walmart's continued efforts to streamline operations and boost digital sales as it races toward e-commerce profitability.

Source: Bloomberg

Asia

ByteDance to Cut 450 Jobs in Indonesia After Tokopedia Deal

ByteDance trims Indonesian e-commerce workforce

- ByteDance is cutting about 450 jobs (9%) from its Indonesian e-commerce arm.

- Cuts follow the January merger of TikTok Shop with local rival Tokopedia.

Why it matters: This move signals ByteDance's efforts to streamline operations and reduce costs in the highly competitive Indonesian e-commerce market.

The big picture:

- Cuts affect various teams, including advertising and operations.

- ByteDance joined a $1.5 billion deal with GoTo's Tokopedia to restart Indonesian operations.

- The move aligns with the broader tech industry trend of job cuts amid the economic slowdown.

What's next: Watch for further restructuring as ByteDance aims to strengthen its position in Indonesia's e-commerce landscape while navigating regulatory challenges.

Source: Bloomberg

VF Corp CCO Martino Guerrini Talks Southeast Asia Expansion, GMG Partnership

VF Corp expands in Southeast Asia with GMG partnership

- VF Corp and GMG will open 300+ mono-brand stores across Southeast Asia and MENA over five years.

- Expansion focuses on Saudi Arabia first, then key Southeast Asian markets.

Why it matters: This strategic move aims to capitalize on Southeast Asia's growing young, active consumer base and e-commerce potential.

The big picture:

- VF sees significant growth opportunities for brands like The North Face in the region.

- The strategy includes both brick-and-mortar and e-commerce expansion.

- The partnership leverages GMG's local expertise to penetrate markets more effectively.

What's next: Watch for VF Corp's gradual rollout of new stores and e-commerce initiatives across Southeast Asia, starting with The North Face's recent Singapore store opening.

Source: Retail in Asia

Watsons Invests USD250 Million in 6,000 New and Upgraded Stores Across Asia

Watsons invests heavily in store upgrades and expansion

• Watsons is investing $250 million to open and enhance 6,000 stores across Asia and EMEA.

• Plan includes 1,200 new stores and 4,800 refitted stores by the end of 2024.

Why it matters: This significant investment shows Watsons' commitment to enhancing in-store experiences and adapting to changing consumer preferences across diverse markets.

The big picture:

- 75% of Watsons' store portfolio will be upgraded.

- New concepts include experiential zones, health services, and market-specific designs.

- Emphasis on blending online and offline (O+O) experiences for customers.

Key market initiatives:

- China: Introducing the "Watsons Pink" concept for younger customers

- Taiwan: New makeup zones and color analysis studios

- Malaysia: K-pop-themed areas and children's zones

- Hong Kong: HealthQ stations with personalized consultations

- Thailand: Enhanced health product selection and consultation rooms

What's next: Watch for Watsons' continued rollout of these upgraded stores and new concepts across its markets, potentially setting new standards for health and beauty retail experiences.

Source: Retail in Asia

YouTube, Coupang Offer Shopping Affiliate Program in Korea

YouTube expands Shopping features in South Korea

- YouTube launched its shopping affiliate program in Korea, partnering with Coupang.

- Creators can now tag products and earn commissions on sales.

Why it matters: This move expands revenue opportunities for Korean creators and strengthens YouTube's e-commerce presence in a key Asian market.

The big picture:

- Korea is the second country to receive the Shopping Affiliate Program after the US.

- YouTube plans to partner with more companies beyond Coupang.

- The platform will soon offer Korean shopping creators their own YouTube storefronts.

Key stats:

- 30 billion hours of shopping-related videos watched on YouTube in 2023

- 25% increase in watch time for shopping helper videos

What's next: Watch for YouTube's rollout of creator storefronts later this month and the potential expansion of shopping features to other markets.

Source: KED Global

Comments ()