TRD Issue 81 - Briefing: Amazon Goes Temu, FamilyMart Expands in Retail Media

When giants pivot, markets shake. Amazon's copying Temu, Nike's reversing course, Oracle's cutting losses, and FamilyMart in Japan expanding retail media.

Hello Subscribers,

Big retail players are having quite an identity crisis this week. Amazon is eyeing Temu's playbook with a new China-direct discount section, Nike is reconsidering its D2C strategy, and Oracle is quitting the ad business entirely.

When industry giants start copying competitors and reversing strategies, it signals a major shift. The old playbooks are being rewritten, and nobody seems sure what page they're on.

Today's menu:

- Why Amazon is building its own Temu

- What went wrong with Nike's D2C dreams

- How Oracle's $4B ad business vanished overnight

- PLUS: What's brewing in Southeast Asia's e-commerce scene

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

Retail

Walmart's $13 American-Made Tee Takes On Fast Fashion

Why it matters: This groundbreaking partnership between Walmart and American Giant demonstrates how U.S. manufacturing could compete with ultra-cheap foreign imports through scale, smart operations, and strategic pricing.

The big picture: Walmart will launch a $12.98 American-made cotton T-shirt on July 4th - challenging the notion that U.S. manufacturing can't compete on price.

By the numbers:

- Original American Giant T-shirt price: $45

- New Walmart version price: $12.98

- Walmart's "Made in USA" commitment: $600bn

Key drivers making this possible:

- Walmart's massive scale (hundreds of thousands of units)

- Multi-year purchase commitments

- Supply chain optimization

- Strategic margin adjustments

Market signals:

- 86% of Walmart customers want more U.S.-made goods

- Growing political push for re-industrialization

- Rising concerns about fast fashion's environmental and labor practices

Yes, but challenges remain:

- 17 U.S. textile factories closed recently

- $800 "de minimis" import loophole favors foreign manufacturers

- Need for sustained demand signals to maintain competitiveness

What's next: The success of this initiative could provide a blueprint for reshoring other industries, particularly in strategic sectors like semiconductors and clean tech.

Bottom line: The project tests whether American consumers will pay slightly more for locally-made products - potentially reshaping U.S. manufacturing's future.

Source: FT

Walmart's Digital Shelf Push: Late But Strategic Move

Why it matters: Walmart's rollout of digital shelf labels (DSLs) to 2,300 stores by 2026 marks a shift from their usual first-mover approach, potentially indicating a more measured strategy in retail tech adoption.

The big picture:

- Unlike past tech initiatives (barcodes, RFID), Walmart isn't leading but following proven success from retailers like Kohl's and HEB.

- Major investment: ~60,000 DSLs are needed per store for the grocery section alone.

- Two-year rollout plan suggests careful capital management

Key benefits:

- More frequent price updates without labor constraints

- Better competition with online retailers

- Enhanced consumer digital experience

- Potential retail media network opportunities

What it's not:

- Not for dynamic pricing (like Wendy's controversial attempt)

- Not requiring supplier participation (unlike RFID initiative)

Challenges ahead:

- High-display compliance needs

- Operational monitoring requirements

- Significant capital investment

- Power and connectivity infrastructure

Bottom line: This cautious approach to DSL adoption, learning from other's successes, might prove more effective than Walmart's traditional first-mover strategy in retail technology.

Source: Forbes

e-Commerce

Amazon Takes On Temu With New China Direct Shipping Channel

Why it matters: Amazon's planned discount marketplace signals a major shift in strategy to compete with fast-growing Chinese rivals Temu and Shein in the ultra-low-price segment.

The big picture: The e-commerce giant will launch a new section featuring unbranded fashion, home goods, and daily necessities shipped directly from Chinese warehouses to U.S. consumers. Delivery times are expected to be between 9-11 days.

Key moves:

- Merchant signup begins this summer

- Inventory acceptance starts in fall

- Chinese sellers get more control over pricing

- Small-batch production testing allowed

The strategy marks Amazon's first direct China-to-consumer shipping program, potentially leveraging the same $800 duty-free exemption that competitors use.

What we don't know: Amazon hasn't clarified whether shipments will use the duty-free provision, revealed its pricing strategy, or announced a consumer launch date.

Bottom line: Amazon is adapting its traditional marketplace model to counter the rising threat from Chinese discount retailers, potentially reshaping the U.S. e-commerce landscape.

Source: Reuters

Amazon Sellers Revolt Over Planned China-Direct Discount Store

Why it matters: Amazon's move to launch a Temu-style discount section has sparked a backlash from existing sellers, who view it as a threat to their businesses, already squeezed by recent fee increases.

The big picture: The new storefront will allow Chinese sellers to ship directly to U.S. customers, bypassing Amazon's domestic warehouses. The platform will launch with merchant signup this summer and inventory acceptance in the fall.

Market dynamics:

- 68% of U.S. shoppers bought from Temu last year

- Only 7% trust Temu, suggesting Amazon's reputation could accelerate adoption

- Delivery times expected at 9-11 days

Key seller concerns:

- Impact on private-label brands without name recognition

- Increased risk of counterfeits

- Product safety and quality control

- Compressed profit margins

- Competition with ultra-low prices

What sellers say: "We're all getting squeezed so hard, and there's going to be a lot of business that will go under," says Cara Sayer, CEO of SnoozeShade. "It's a bit of a slap in the face."

Bottom line: The initiative highlights Amazon's shifting priorities, potentially sacrificing existing seller relationships to compete with Chinese discount retailers.

Source: Modern Retail

Amazon Prime Day Set for Record Sales Despite Economic Pressures

Why it matters: Despite inflation and rising competition, Amazon's Prime Day is expected to generate $14.7 billion in sales - a 14% jump from last year's record of $13 billion, showing consumers' increasing appetite for deals.

The big picture: Set for July 16-17, this year's event comes as shoppers face continued economic pressures and new competition from Chinese retailers like Temu and Shein.

Key indicators driving growth:

- Amazon.com revenue up 10% year-over-year

- Units sold increased 14%

- Site traffic climbed 7%

- Average selling price down 3%

Shifting consumer behavior:

- Electronics sales dropped 10% in May, suggesting shoppers await Prime Day deals.

- Meanwhile, 1 in 5 Americans now shop weekly on Chinese platforms, with 21% viewing Amazon as too expensive.

New strategies: Amazon is countering competition through influencer partnerships, TikTok engagement, and expanded beauty offerings. The company tapped Megan Thee Stallion for promotion and added prestige brands like Clinique and Kiehl's.

What to watch: While Prime Day remains significant, multiple sales events may dilute its impact throughout the year. The event also boosted Amazon's growing advertising business by $47 billion.

Bottom line: Despite economic headwinds and increased competition, Prime Day continues to grow as deal-seeking consumers prioritize discounts over brand loyalty.

Source: Modern Retail

D2C

Nike's Struggles Run Deeper Than DTC Strategy

Why it matters: Nike's 2% revenue decline and lowered 2025 outlook have sparked debate over whether its aggressive direct-to-consumer push is to blame, but analysts suggest the problems are more fundamental.

The big picture: While Nike has partially reversed its DTC strategy by returning to previously cut wholesale partners, experts say product innovation and talent retention may be bigger factors in its current challenges.

Key issues facing Nike:

- Missed opportunities in the running category

- Declining sales of classic footwear franchises

- Loss of experienced talent through cost-cutting

- Digital sales down 10% due to softer traffic

- First-quarter sales projected to fall up to 10%

Market perspective: Running brands like Hoka and On have gained ground through better local marketing and technical innovation. Nike's CEO acknowledged that the company is "hustling to accelerate our running innovations."

Bottom line: Nike remains the dominant in sneakers, but its recent underperformance can't be blamed solely on DTC strategy. Product innovation and market adaptation will be key to recovery.

Source: Modern Retail

Marketing

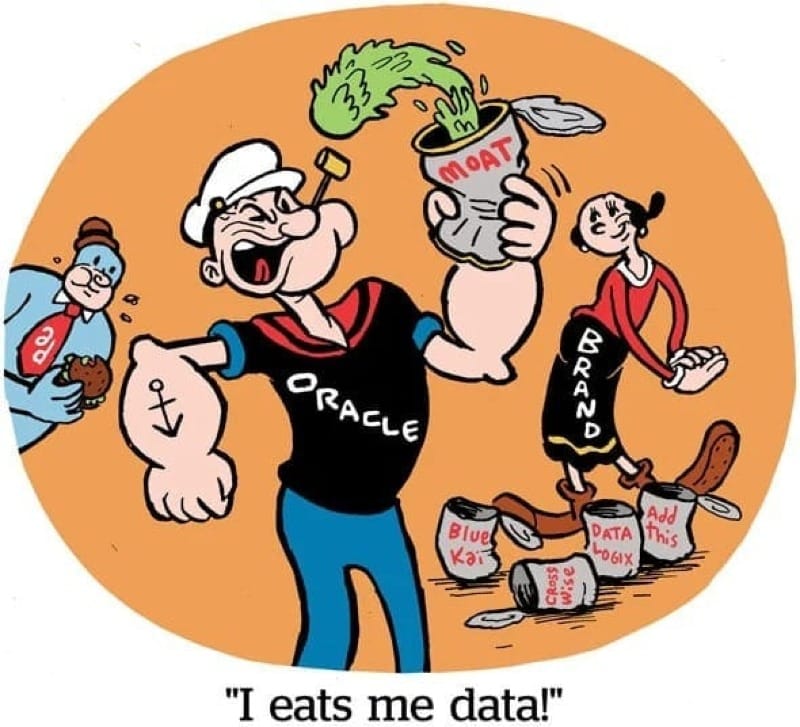

Oracle's Ad Business: A $4 Billion Dream Dies

Why it matters: Oracle's decision to shut down its advertising division marks the end of what was once the industry's most prominent data seller, revealing how rapidly changing privacy regulations and market dynamics can upend even well-funded tech initiatives.

The big picture: The Oracle Data Cloud (ODC), built through acquisitions of Datalogix, Grapeshot, Moat, and BlueKai, will cease operations by September 2024 after declining to $300 million in revenue.

Key factors in the collapse:

- Facebook's removal of third-party data sellers post-Cambridge Analytica

- GDPR enforcement threatening data business viability

- Healthcare division conflicts after $28B Cerner acquisition

- Regulatory risks outweigh revenue potential

Market impact:

- IAS and DoubleVerify positioned to absorb Moat clients

- LiveRamp benefits from OnRamp's closure

- Contextual vendors racing to hire Grapeshot talent

- Experian well-timed with new data onboarding business (source)

Bottom line: Oracle's abrupt exit, without attempting to sell valuable assets like Grapeshot and Moat, suggests that advertising data businesses' regulatory and reputational risks now outweigh their potential returns for major tech companies.

Source: AdExchanger

Asia

FamilyMart Launches New Customizable Manufacturer Coupons in Payment App Advertising

Why it matters: FamilyMart is expanding its retail media capabilities through a new smartphone-based advertising service, allowing manufacturers to create custom ads and coupons through its payment app, signaling a major shift in convenience store digital marketing.

The big picture: The initiative will launch in July 2024, partnering with about 10 companies, including Coca-Cola Japan, leveraging FamilyMart's FamiPay app with its 20 million users.

Key developments:

- Installation of beacons in 15,000 stores by October.

- Digital signage in 10,000 stores.

- Data sharing with manufacturers starting November

- Target of ¥10 billion in after-tax profit by 2028

Market context:

- Global retail media market: $119.4 billion (2023)

- Expected growth: 8% in 2024

- Japanese market forecast: ¥933.2 billion by 2027 (2.6x growth from 2023)

Competition landscape:

- Seven-Eleven Japan launched a dedicated division in 2022

- Don Quijote operates through an e-money app

- Seiyu partnering with Rakuten for data analysis

Bottom line: FamilyMart's early move into retail media, backed by ¥45 billion investment, positions it to capitalize on the rapidly growing retail advertising market while strengthening manufacturer relationships and customer engagement.

Source: NIKKEI

FamilyMart Introduces Purchase-Based Discount Membership Program Through App

Why it matters: FamilyMart is launching Japan's first purchase-based loyalty program in convenience stores, aiming to differentiate itself in a market dominated by three major chains.

The big picture: The program leverages FamiPay's 20 million users, offering four tiers from Regular to Ambassador based on monthly spending and visit frequency.

Key features:

- The top tier requires ¥15,000+ in spending and 15+ monthly visits

- Benefits range from ¥10 to ¥100 discount coupons

- Free product vouchers for highest tier members

- Monthly benefit adjustments based on usage

Market context: With nearly 60,000 convenience stores nationwide and stagnant market growth, the program aims to secure customer loyalty in Japan's competitive retail landscape.

Bottom line: This innovative approach could reshape customer retention strategies in Japan's mature convenience store market.

Source: NIKKEI

Southeast Asia's Ecommerce Landscape Shows Growth Despite Funding Cool-Down

Why it matters: Southeast Asia's ecommerce sector is evolving rapidly despite a funding slowdown, with retail penetration expected to reach 32% by 2029, up from 23.3% in 2024.

The big picture: While deals dropped to 19 in Q1 2024 from 35 in Q1 2023, the market remains dynamic, with Shopee leading regional market share and the TikTok-Tokopedia merger reshaping competition.

Key developments:

- Shopee's GMV grew to $78.5B in 2023

- Lazada secured $230M from Alibaba in 2024

- TikTok Shop-Tokopedia merger completed in January

- Rural markets emerging as next growth frontier

What's next: McKinsey projects 15-25% annual growth through 2027, with Vietnam, the Philippines, and Thailand (15% penetration) offering significant expansion opportunities.

Bottom line: Despite current funding challenges, Southeast Asia's ecommerce sector continues to mature, with players focusing on profitability and new market opportunities.

Source: Tech in Asia

Comments ()