TRD Issue 95 - Briefing: Why Even Microsoft Can't Win Everything

Microsoft exits retail media, Japan kills convenience store cafés, TikTok Shop's billion-dollar problem and FinTech battle in PH.

Hello Subscribers,

After burning through years of investment, Microsoft just pulled the plug on its retail media dreams (spoiler: even Big Tech can't crack everything). Meanwhile, Japan's convenience stores are removing tables and chairs because their aging society can't support café culture anymore—a pretty stark preview of what demographic decline looks like in practice.

Uniqlo's sister brand GU made an audacious bet on the global expansion front by jumping straight into NYC's most competitive retail district to take on Zara. It's either brilliant or completely wild, and the lessons from their approach are fascinating regardless of how it plays out.

In emerging markets, the Philippines' fintech battle between GCash and Maya has become a complete rout, with one prepping for the country's largest-ever IPO. At the same time, the other chairman admits defeat with a hilarious ice cream vendor story.

And suppose you thought TikTok Shop was the future of social commerce. In that case, success built on impulse buying and questionable advertising practices might not be as sustainable as the billion-dollar GMV numbers suggest.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

Retail

7-Eleven takeover talks advance after family bid fails

Why it matters: The founding Ito family's failed $58 billion management buyout clears the path for Canada's Couche-Tard to acquire Japan's Seven & i Holdings in the largest foreign takeover of a Japanese company ever.

The situation: Seven & i confirmed "there is no actionable proposal from Mr. Junro Ito and Ito-Kogyo for 7&i to consider at this time" after the founding family couldn't secure financing. Shares plunged 11.7% in the most significant one-day drop over a decade.

Where talks stand: Couche-Tard and Seven & i signed a non-disclosure agreement in May, giving the Canadian company access to financial data for its $47 billion bid. Both companies are working together on plans to divest over 2,000 U.S. stores to address antitrust concerns.

The defense strategy: Seven & i is still accelerating asset sales as planned in October 2024, including its supermarket business and stake in Seven Bank, to boost shareholder value and focus on its core 22,800 convenience stores in Japan and 13,000 in the U.S.

What's next: "It gives ACT a fresh opening because there's no competition now and the board can no longer rely on the management buyout," said analyst Travis Lundy. The deal would create the world's largest convenience store company.

Source: FT

e-Commerce

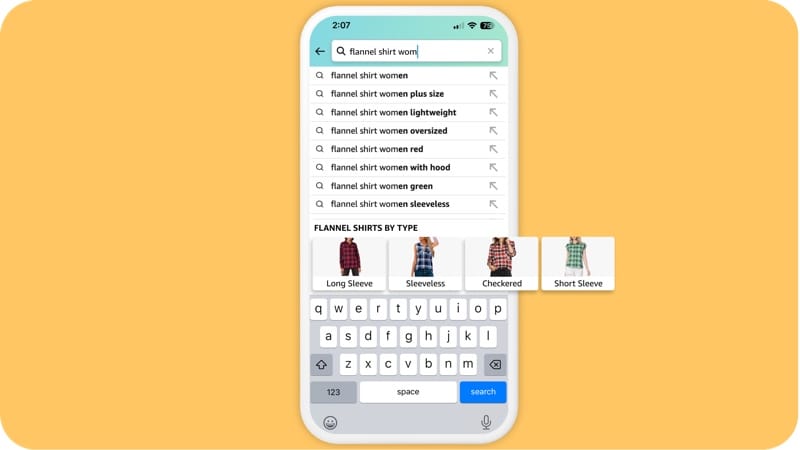

Amazon's Visual Search blitz reshapes retail competition

Why it matters: Amazon's October 2024 visual search launch triggered a 70% surge in image-based shopping and forced every central platform to respond as consumers abandon text search for pictures.

What Amazon launched:

- Visual suggestions while typing

- Enhanced image search with text

- Circle-to-search functionality

- In-line product videos

- iOS camera widgets

The market shift:

- 56% of US consumers now start shopping searches on Amazon vs 42% on Google

- 70% jump in visual searches immediately after launch

- Visual search market projected to hit $27 billion by 2030

Competitive response:

- Google launched shoppable visual search in the same month

- Pinterest enhanced AI-powered visual features

- Microsoft boosted Bing's visual capabilities

- Meta expanded visual advertising in Reels

The stakes:

- Retail media search will capture 27.2% of US search ad spend in 2025

- Google's search revenue share is dropping from 55% to 50%

- Amazon's search market share is rising

What you need to do: Visual search is now table stakes. Retailers without robust visual search capabilities risk customer defection as shopping behavior fundamentally shifts.

Bottom line: Traditional text search is becoming obsolete. 82% of e-commerce sites are expected to adopt AI-powered visual search by 2030. Invest in high-quality product imagery and visual search capabilities now, or watch market share erode to more sophisticated competitors.

Source: Retail Dive

Marketing

Amazon Prime Video Ad surge sparks user revolt

Why it matters: Amazon delivered on its October 2024 promise to increase Prime Video ads in 2025, triggering subscriber backlash while securing $1.8 billion in advertiser commitments and positioning itself as the world's largest ad-supported streaming service.

What Amazon delivered:

- Started increasing US ad loads in early 2025 as promised

- Expanding ads to 5 new markets: Brazil, India, Japan, Netherlands, and New Zealand.

- Interactive/shoppable ads are now live, viewers can add items to the cart with remote clicks.

- Secured over $1.8 billion in upfront commitments for 2025

The numbers:

- 80% of US Prime Video viewers watch with ads

- 115 million monthly viewers in the US alone

- 200 million global ad-supported reach

- Only $2.99/month to remove ads, most users are staying with the ad version.

User backlash intensifies:

- "I'm done then, tried watching something last week and it was already at an unbearable level," Reddit users complain.

- Subscribers call increased ad frequency "leading to further user dissatisfaction."

- Some are canceling subscriptions or returning to piracy.

Strategic impact: Amazon's approach differs from that of competitors - it forced ads on existing subscribers rather than creating separate tiers like Netflix and Disney+. The move "instantly made Prime the largest ad-supported subscription streaming service in the world, " causing rival streaming services to miss internal targets as Amazon floods the market with inventory.

What's next: Thursday Night Football, averaging 15 million viewers (up 25% year-over-year), proves Amazon's reach. With interactive commerce integration and global expansion, Amazon is betting advertisers will pay premium rates for its unique shopping conversion capabilities despite growing subscriber frustration.

Bottom line: Amazon prioritizes advertiser revenue over user experience, banking that Prime's broader benefits will retain subscribers even as streaming satisfaction declines.

Source: FT

TikTok Shop's wild west success story hits reality

Why it matters: TikTok Shop generated $33.2 billion globally in 2024, nearly tripling year-over-year, but its success is built on impulse buying, questionable targeting practices, and products that can't advertise elsewhere, creating an unsustainable foundation as buyer's remorse grows.

The explosive growth:

- $9 billion in US sales in 2024, just 16 months after launch

- 33% of Americans have used TikTok Shop

- Over 500,000 US sellers registered.

- Monthly US sales have exceeded $1 billion since mid-2024

What's actually selling:

- Beauty & personal care leads with $2.49 billion (22% of total sales)

- Supplements, cosmetics, and intimate apparel still dominate.

- Products banned from Meta/Google advertising due to emotional targeting restrictions

- The average order value is just $43 - half of Instagram's

The uncomfortable reality:

- 24% admit to impulse purchases on the platform

- 23% regret at least one purchase (quality issues cited)

- 55% of social shoppers regret impulse buys overall

- 81% of sales from repeat customers, but satisfaction is declining.

The "Wild West" problem persists: TikTok allows targeting around depression, body image, and health claims that Meta banned after the 2022 cleanup. Top sellers include nipple covers, supplements targeting insecurities, and products demonstrated by women getting dressed, raising exploitation concerns.

Market position: TikTok ranks 3rd in social commerce behind Facebook and Instagram, but it leads in purchase frequency, with 49.7% of users buying monthly.

Bottom line: TikTok Shop proves US consumers will buy impulsively through social video, but its foundation on questionable advertising practices and buyer's remorse makes long-term sustainability doubtful. Success metrics mask a business model that exploits emotional vulnerabilities rather than genuine consumer value.

Source: AdExchanger

Brand birthday sales: the marketing "cheat code" retailers love

Why it matters: More brands are throwing themselves birthday parties with deals attached, creating intimate promotional moments that drive sales while avoiding the crowded holiday shopping calendar—and the trend has accelerated in 2025 as retailers seek value-driven marketing that doesn't break the bank.

The birthday boom:

- Third Love offered deals for "10 years of support."

- Lulus gave 28% off through its app for its 28th birthday, doubling app revenue.

- Old Whaling Company celebrated shower steamers' first anniversary with 20% off.

- Small businesses under 30 employees are finding major success with targeted anniversary promotions.

Why it works now: Anniversary sales are "sort of a cheat code for the brand," says VML's Julianne Hudson. They answer shoppers' demand for something intimate while letting brands offer deals on their terms rather than competing during Black Friday chaos.

The timing advantage: With price sensitivity dominating purchasing decisions globally, anniversary sales let brands:

- Reconnect with dormant customers

- Boost sales during slower seasons

- Launch new products with built-in story hooks

- Create emotional connections beyond just discounts

2025 evolution: The trend has intensified as retailers embrace "micro-occasions" and value-driven messaging. Brands combine anniversary promotions with personalization technology and authentic storytelling to create deeper customer connections.

Bottom line: In an era of deal fatigue and promotional noise, anniversary marketing gives brands a familiar, emotionally resonant way to offer value while maintaining control over their promotional calendar. As one expert noted: "Brands are feeling vulnerable—they want something familiar with emotional connotations that can gain traction with consumers."

Source: Modern Retail

Microsoft abandons retail media dreams, hands keys to Criteo

Why it matters: Microsoft quietly shuttered PromoteIQ after five years, signaling that even tech giants struggle to build profitable retail media platforms and highlighting the industry's shift toward partnerships over in-house development in the $150+ billion retail media market.

The quiet exit:

- Microsoft began notifying PromoteIQ clients of the shutdown in summer 2024

- Simultaneously announced "strategic collaboration" with Criteo as preferred partner

- Pushing existing clients to migrate to Criteo's platform

- Employees told Microsoft is "focusing on other parts of its retail media strategy."

Why Microsoft gave up: Microsoft acquired PromoteIQ in 2019 to compete with Amazon's advertising dominance, initially winning major clients like Kroger and Home Depot. However, profitability never materialized at the scale Microsoft expected.

"They just looked at the general profitability of the business and realized it was going to be a while until you get to $1 billion," said former PromoteIQ executive Harsh Jiandani.

The Criteo handoff:

- Criteo gains access to Microsoft's 500,000+ global advertisers

- Microsoft maintains a retail media presence without the tech headache

- Partnership expected to generate significant revenue by 2025

- Criteo's network of 225 retailers becomes Microsoft's retail media solution

Industry implications: The shutdown underscores retail media's brutal economics—even Microsoft couldn't make the math work. It signals a broader trend toward consolidation, with tech giants preferring partnerships over building competing platforms.

Microsoft's spin: "We are 100% in the retail media business," says Microsoft's Paul Longo. "It's not an exit but a shift in focus to driving commerce media solutions at scale."

Bottom line: Microsoft's retreat proves that retail media success requires more than deep pockets—it demands specialized expertise and patience for long-term profitability that even Big Tech struggles to maintain.

Source: Modern Retail

D2C

TikTok's poster child proves physical retail still rules

Why it matters: Beachwaver's successful return to 1,900+ Target stores after eight years away proves that even TikTok-viral brands need physical retail to scale beyond niche audiences, signaling the limits of social commerce and the enduring power of brick-and-mortar distribution.

The comeback story:

- Launched in Target stores nationwide in October 2024

- Previously exited physical retail in 2016 due to slow sales

- Now generates $11+ million on TikTok Shop (4th biggest beauty brand on platform)

- Curling irons rank among TikTok Shop's top 3 selling sub-categories in 2024

Why they returned: Beachwaver built a 750,000+ member "Text Fam" and expanded beyond their single curling iron product since 2016. The brand learned that one-trick ponies don't work in retail—customers need reasons to return.

"We only had the one stock keeping unit for a long time, and that wasn't a big assortment for our retailers," said COO Erin Potempa-Wall.

The broader trend: TikTok viral brands flood into physical stores as they hit the social commerce ceiling. Morning Consult data shows TikTok scores 20.5 trust with Gen Z but -3.3 with other adults, creating an urgent need to reach older, more affluent shoppers through traditional retail.

Global expansion: Beachwaver is now setting up a TikTok Shop in the UK and EU while expanding physical retail internationally, proving their omnichannel strategy extends beyond TikTok ban fears.

Strategic insight: Even brands that generate millions monthly on TikTok Shop recognize that "consumers still want to shop in stores, and most retail sales will still take place in stores," as eMarketer's Sky Canaves notes.

Bottom line: TikTok can create viral brands, but Target creates sustainable businesses. Physical retail remains the ultimate validator and growth engine for digital-native brands seeking mainstream success.

Source: Modern Retail

Asia

Japan's convenience store crisis kills the café dream

Why it matters: FamilyMart's decision to eliminate 2,000 eat-in spaces signals the end of convenience store expansion dreams in Japan, as the industry pivots from growth-by-opening-stores to efficiency-and-automation survival mode amid demographic collapse and market saturation.

The strategic retreat:

- Converting 30% of eat-in locations (2,000 stores) to retail space by the end of 2024

- Adding clothing and daily goods to replace tables and chairs

- Targeting a 5-7% sales increase per store over 3 years

- Equivalent to gaining 150 new stores' worth of shelf space

Why eat-in failed: COVID killed usage that never recovered, but the real culprit is Japan's tax policy—eating in-store costs 10% sales tax versus 8% for takeout. "It's more expensive if you eat or drink it in-store, and less expensive if you instead have it back at your home or office," making eat-in spaces economically unviable.

Industry in crisis mode:

- Japan's 58,000 convenience stores declined for the first time in 2023 (down 0.3%)

- New store openings dropped to 1,194 from a peak of 4,480 in 2013

- 66% of Japanese companies are experiencing severe labor shortages

- Industry could be short 11 million workers by 2040

The pivot strategy: FamilyMart is shifting to digital signage (targeting ¥10 billion in retail media revenue by 2028), unmanned stores, and automation. Competitors are following similar paths—Lawson partnering with Uber Eats, Seven-Eleven deploying micro-stores.

Broader implications: This represents Japan as the world's "policy laboratory" for aging societies. The convenience store industry's evolution from expansion to optimization foreshadows challenges facing developed nations with shrinking populations.

Bottom line: When Japan's convenience stores—the ultimate symbol of customer service—sacrifice comfort for shelf space, it signals a fundamental shift from growth economics to survival efficiency in aging societies.

Source: Nikkei

Japan's retail giant bets everything on beating Zara

Why it matters: Fast Retailing's bold decision to launch GU in New York's ultra-competitive SoHo district represents Japan's most aggressive attempt to crack Western markets and fulfill founder Tadashi Yanai's 40-year dream of becoming the world's largest fashion retailer by reaching 10 trillion yen in sales.

The 10-year reversal: In 2014, Yanai told GU CEO Osamu Yunoki his New York expansion was "10 years too early" and would result in "getting blood splattered back." Ten years later, GU opened its first overseas flagship in SoHo in September 2024, betting everything on lessons learned from Uniqlo's global failures.

The numbers race:

- Fast Retailing hit 3.1 trillion yen revenue in 2024 (first time exceeding 3 trillion)

- Zara's parent, Inditex, still leads at €38.6 billion (≈6.2 trillion yen).

- GU contributes 319 billion yen vs Uniqlo's much larger scale

- Yanai’s goal: 10 trillion yen to claim the global #1 position

GU's positioning gamble: While Uniqlo sells timeless basics, GU targets "trend-focused fashion at even lower cost" for Gen Z consumers. The strategy positions GU between Uniqlo's functional clothing and pure fast fashion like H&M, focusing on "the dead center of trends" with limited SKUs for mass production efficiency.

Learning from failure: Uniqlo's early global expansion was a disaster—failed launches in London, China, and the US led to store closures and took 20 years to achieve profitability in America. The key lesson: "We weren't selling Uniqlo" because they adapted too much to local markets and lost brand identity.

The strategic bet: GU deliberately chose SoHo—the most competitive retail battleground—as a "final destination jump" rather than gradual expansion. "We'll face failures, but that's intentional," Yunoki says, believing rapid failure and iteration in the most challenging market will accelerate global learning.

Bottom line: This represents Japan's most ambitious retail globalization since Toyota's automotive expansion. Success in New York could unlock Yanai's decade-long quest to dethrone Zara. At the same time, failure might signal the limits of Japanese retail's global ambitions in an increasingly crowded fast-fashion landscape.

Source: Nikkei

Philippines' fintech IPO race: GCash surges ahead as Maya struggles

Why it matters: GCash has emerged as the clear winner in the Philippines' fintech battle, preparing for the country's largest-ever IPO while rival Maya's plans remain stalled, highlighting how dominance in digital payments translates to capital market success.

GCash's IPO momentum:

- January 2025: Hired major banks (Citi, Jefferies, UBS) for up to $1.5 billion IPO

- Target timeline: Second half of 2025, aiming for at least a $8 billion valuation.

- Market position: 94 million registered users vs Maya's 2 million active users

- It would become the Philippines' largest IPO ever, surpassing the 2021 $1 billion Monde Nissin record.

Maya's admission of defeat: PLDT Chairman Manny Pangilinan publicly acknowledged GCash's dominance with a telling anecdote: When buying ice cream in Batangas, vendors asked, "Sir, can you use GCash?" His response: "I said to myself, oh no!"

"To dream of an IPO in the next two years is simply an illusion," Pangilinan said about Maya's prospects, calling IPO speculation "misplaced optimism."

The numbers tell the story:

- GCash: $5 billion valuation, targeting $8+ billion at IPO.

- Maya: Must prove profitability through 2025 before considering public listing.

- Market shift: Cash usage dropped from 96% (2022) to 87% (2023) in the Philippines

Strategic divergence: GCash doubled down on e-wallet services and achieved scale, while Maya pursued digital banking but struggled with profitability. Maya reached EBITDA-positive only in Q4 2024, years behind GCash's profitable trajectory.

Regional implications: GCash's IPO could boost Southeast Asia's struggling IPO market, where proceeds fell 43% to $3.28 billion in 2024. Success would demonstrate fintech viability and attract more regional capital.

Bottom line: In winner-take-all digital payments, market dominance creates a virtuous cycle: more users, more data, more profitability, easier access to capital markets. Maya's struggle shows that being second in fintech often means being left behind entirely.

Source: Tech in Asia

Comments ()