TRD Issue 93 - Briefing: Meta AI Hits 500M Users as Amazon Expands Off-Platform

Meta AI reaches 500M users as Amazon's off-platform shipping surges 70%, likely driven by TikTok Shop. Retail boundaries blur while tech giants bet on AI assistants and smart wearables.

Hello Subscribers,

Hope your week's going well! Just wrapped up this week's digest, and it's fascinating to see how the AI and retail landscapes continue to evolve at breakneck speed.

Meta AI is crushing it with nearly 500M users globally (more than double ChatGPT's numbers) in 2024, despite not even launching in the EU yet. Meanwhile, Amazon's making strategic moves on two fronts: launching Project Amelia to help sellers manage their businesses with AI, while seeing a massive 70% growth in their off-platform fulfillment services - likely fueled by TikTok Shop's rapid rise.

Speaking of partnerships, EssilorLuxottica and Meta have extended their Ray-Ban smart glasses collaboration "into the next decade," signaling continued belief in wearable tech as the next computing platform. And on the retail front, Fast Retailing's GU (Uniqlo's sister brand) is making its first serious U.S. push with a permanent NYC store and nationwide e-commerce - a bold move in an already crowded fast-fashion market.

There's also fascinating platform evolution happening with YouTube's Communities feature and Pinterest's collage updates, which I've covered below.

Let me know what interests you most - I'm particularly intrigued by Amazon's multi-channel strategy and what it means for the broader e-commerce ecosystem.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

AI

Meta AI nears 500M users, challenges OpenAI for AI assistant dominance

Why it matters: Meta AI is poised to become the world's most widely used AI assistant with "almost" 500 million monthly active users in 2024, more than double OpenAI's ChatGPT, positioning Meta as a dominant force in the consumer AI space despite not yet launching in major markets like the EU.

By the numbers:

- Nearly 500 million monthly active users globally

- India is Meta AI's largest market, driven by WhatsApp's 500M+ user base there

- For comparison, ChatGPT has over 200 million weekly users at the time.

New capabilities announced:

- Llama 3.2 model family with new multimodal capabilities

- Lightweight Llama 3.2 models (1B and 3B parameters) launching in Europe

- Celebrity voice options and lip-synced translations

- Expanded "Imagine" feature across Facebook, Instagram, and Messenger

- Photo understanding and editing capabilities

What's next: Meta AI's user base is expected to grow significantly once it launches in the EU and other major markets, potentially cementing its position as the most widely used AI assistant globally.

Source: TechCrunch

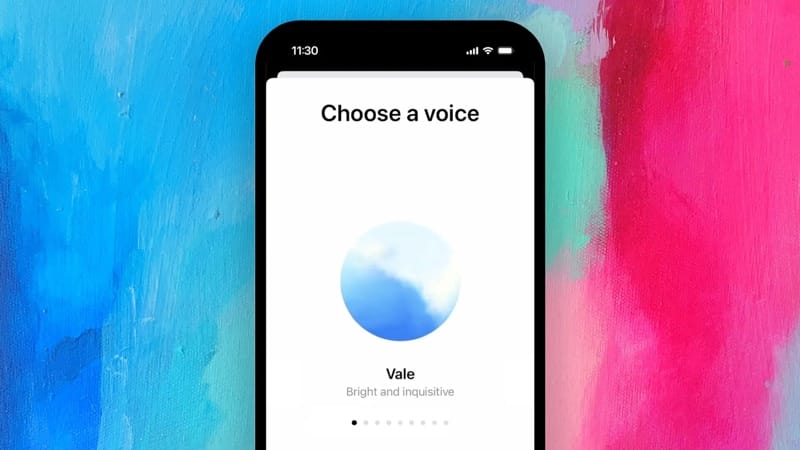

OpenAI expands Advanced Voice Mode with new design and voices

Why it matters: OpenAI is rolling out its more natural-sounding Advanced Voice Mode (AVM) to paid subscribers, enhancing its competitive position against Meta AI by offering more personalized voice interactions while still facing regional restrictions in key markets like the EU and UK.

The rollout plan:

- Initially available to ChatGPT Plus and Teams subscribers this week

- Enterprise and Education customers gain access next week

- Not yet available in the EU, UK, Switzerland, Iceland, Norway, and Liechtenstein

What's new:

- Redesigned interface featuring a blue animated sphere (replacing black dots)

- Five additional nature-themed voices: Arbor, Maple, Sol, Spruce, and Vale

- Integration with Custom Instructions and Memory features

- Improved accent recognition and conversation flow

What's missing:

- The "Sky" voice showcased in May (removed after legal concerns from Scarlett Johansson)

- Video and screen sharing capabilities were demonstrated four months ago

- No timeline for releasing these multimodal features

Between the lines: While OpenAI continues enhancing ChatGPT's voice capabilities, the company faces ongoing challenges with regional regulations and potential intellectual property concerns that could impact global adoption.

Source: Tech Crunch

Amazon launches AI assistant for sellers, expands retail AI strategy

Why it matters: Amazon's new AI assistant for sellers, Project Amelia, represents the company's aggressive push into AI-powered commerce tools that could reshape how millions of merchants operate on its platform while further extending its lead in retail technology infrastructure.

The initial rollout:

- Now in beta for select U.S. sellers with English language support

- Built on Amazon's Bedrock AI platform

- Broader U.S. release coming soon, with international expansion planned later this year

Current capabilities:

- Retrieves and summarizes business metrics like sales data and website traffic

- Provides year-over-year comparisons

- Answers specific product performance questions

Coming soon:

- Issue resolution assistance with support team connections

- Task management features

- Potential automated problem-solving on the sellers' behalf

The bigger picture: Project Amelia joins Amazon's growing AI toolkit that includes Rufus (consumer shopping assistant), AI-powered fit recommendations, enhanced product reviews, listing creation tools, and background generation for advertisers.

Bottom line: Amazon continues integrating AI across its ecosystem, potentially giving sellers powerful tools to streamline operations while further embedding them in Amazon's platform.

Source: TechCrunch

Snapchat partners with Google to supercharge My AI chatbot

Why it matters: Snap's expanded partnership with Google Cloud integrates Gemini's advanced multimodal AI into Snapchat's My AI chatbot, marking a strategic shift from OpenAI's technology and delivering a significant engagement boost as tech giants compete for AI dominance in social platforms.

By the numbers:

- Partnership has driven over 2.5x increased engagement with My AI in the United States

- Builds on a decade-long relationship between Snap and Google Cloud

What's new:

- My AI now processes multiple information types simultaneously (text, audio, images, videos)

- Visual recognition features similar to Google Lens functionality

- Practical applications include translating foreign text and analyzing food options

The shift:

- Initially launched in February 2023, powered by OpenAI's ChatGPT.

- Now leveraging Google's Gemini models for expanded capabilities

The concerns:

- Enhanced AI functionality raises additional safety questions, particularly regarding child users

- Follows existing concerns about My AI's potential risks identified by critics

The bigger picture: This strategic move positions Snapchat to compete with other platforms that are investing heavily in AI integration while deepening its technology partnership with Google rather than continuing solely with OpenAI.

Source: TechCrunch

e-Commerce

Amazon's off-platform fulfillment business surges 70%, likely driven by TikTok

Why it matters: Amazon's Multi-Channel Fulfillment (MCF) service is growing significantly faster than its core marketplace business, signaling Amazon's strategic expansion beyond its own platform to become the backbone infrastructure for e-commerce across the internet, including for potential rivals.

By the numbers:

- 70% year-over-year increase in MCF orders in 2024

- Service now used by over 200,000 U.S. sellers

- Amazon holds approximately 40% of the U.S. e-commerce market share

The TikTok factor:

- Evidence suggests TikTok Shop is likely driving much of this growth

- TikTok's e-commerce business is projected to sell billions this year despite launching just 12 months ago

- Other major U.S. e-commerce players aren't growing at 70% rates

Recent improvements:

- Shipping speeds reduced from 5 to 3 business days

- Historically, MCF faced challenges with competitive pricing and reliability

The bigger picture: This represents Amazon's strategic effort to monetize the 60% of e-commerce outside its platform through infrastructure services, including MCF, Supply Chain services, Buy with Prime, and Amazon Pay.

Bottom line: Amazon is positioning itself as the retail infrastructure provider even when shopping happens elsewhere, a significant shift in its long-term strategy.

Source: Marketplace Pulse

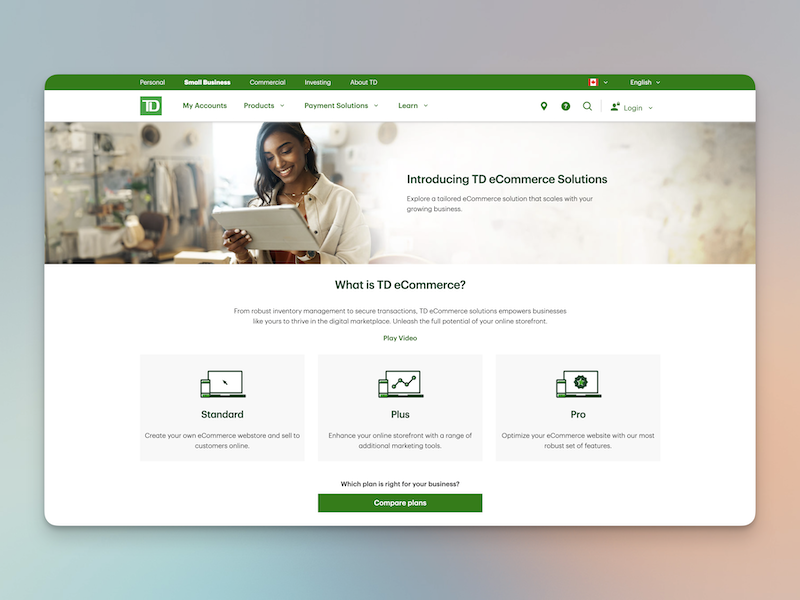

TD Bank challenges Shopify with new small business e-commerce platform

Why it matters: TD Bank has become the first Canadian bank to enter the e-commerce platform space through a partnership with BigCommerce, directly challenging Shopify's dominance while blurring the lines between traditional banking and digital commerce services as financial institutions seek new growth avenues.

The partnership:

- TD has partnered with Nasdaq-listed BigCommerce (Austin, Texas)

- Builds upon TD's established payment processing services

- First e-commerce platform offering from a Canadian bank

Market context:

- Comes as tech companies like Shopify, Square, and Lightspeed expand their financial services.

- Accelerated by pandemic-driven shift to online shopping

- Competition intensifies to become one-stop shops for merchants

Potential advantages:

- Simplified financial management with banking and e-commerce under one roof

- Potential preferential rates on payment processing

- Enhanced security from an established financial institution

- Leverages TD's existing small business relationships

The challenges ahead:

- Competing with well-established players with refined platforms

- Developing an intuitive user experience

- Building a robust app ecosystem

- Providing specialized e-commerce technical support

Bottom line: TD's move signals a potential trend for financial institutions to offer integrated e-commerce solutions, further blurring the boundaries between banking and technology sectors in the rapidly evolving digital commerce landscape.

Source: Retail Insider

Retail

EssilorLuxottica and Meta extend smart glasses partnership into next decade

Why it matters: EssilorLuxottica and Meta Platforms have signed a new long-term partnership extending into the next decade, solidifying their collaboration on Ray-Ban smart glasses and signaling major tech companies' continued investment in wearable AR technology as an alternative to headsets and screens.

The partnership:

- Collaboration began in 2019, now extended "into the next decade"

- No mention of Meta's rumored 5% stake acquisition in EssilorLuxottica, which the Wall Street Journal previously reported

- Meta CEO Mark Zuckerberg stated they have "the opportunity to turn glasses into the next major technology platform."

The product trajectory:

- The latest Ray-Ban Meta smart glasses (late 2023) have already outsold the previous generation's two-year sales total in just months.

- Current features include calls, music, photo capture, and multimodal AI (limited to the US and Canada).

- EssilorLuxottica CEO Francesco Milleri called the partnership "an important milestone in our journey to making glasses the gateway to the connected world."

Market reaction: EssilorLuxottica shares closed down 1.2% following the announcement

Looking ahead: This partnership represents a strategic bet on consumer adoption of wearable tech that seamlessly blends fashion with connectivity, potentially avoiding the adoption challenges that have plagued more conspicuous AR/VR headsets.

Source: Reuters

Uniqlo's sister brand GU makes major U.S. push with omnichannel strategy

Why it matters: Fast Retailing's GU brand has launched its first permanent U.S. store in New York City alongside a new e-commerce website and app, marking a significant international expansion beyond Asia for the $610 million fashion retailer as it enters the highly competitive U.S. fast fashion market dominated by incumbents and challenged by digital disruptors.

The expansion:

- Opened first permanent store outside Asia in New York's Soho neighborhood

- Launched nationwide e-commerce website and app for U.S. consumers

- Previously operated a pop-up in NYC from October 2022 to July 2024

By the numbers:

- GU generated ¥86.8 billion ($610 million) in Q1 2024 revenue, up 5.4% year-over-year.

- Contributed ¥44.7 billion ($310 million) in gross profit to Fast Retailing

- Currently operates 476 locations worldwide, primarily in Japan, China, Hong Kong, and Taiwan.

The U.S. strategy:

- Modified product designs for American preferences (less "sweet, feminine" styling)

- Adjusted clothing proportions for U.S. body types.

- Maintained "mini edit max" philosophy of streamlined, versatile collections.

- Some U.S.-exclusive products include Undercover collaboration items.

Market challenges:

- Enters a crowded landscape with H&M, Zara, Forever 21, Shein, and Temu.

- Less brand recognition than Uniqlo, though different positioning may reduce cannibalization

- Needs measured expansion approach despite "big bang" entry

Bottom line: GU plans to focus on New York before potentially expanding to other U.S. cities, taking a "crawl, walk, run approach" to build its presence in the challenging North American market.

Source: Modern Retail

Social

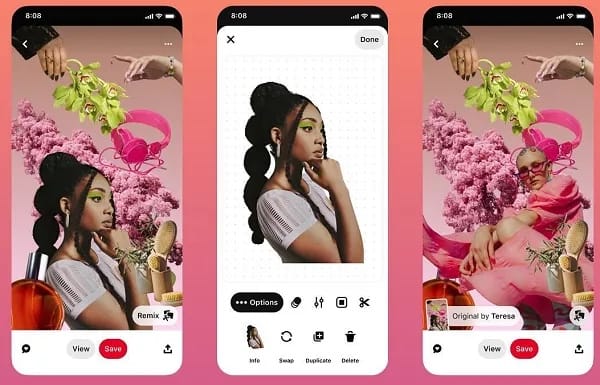

Pinterest expands collage features to boost engagement and sharing

Why it matters: Pinterest's new collage remix and sharing options expand on one of its most successful features among Gen Z users, increasing content virality potential while maintaining shopping functionality that could strengthen the platform's commerce strategy against rivals like Instagram that are already copying the format.

The new features:

- Collage Remixing: Allows users to build upon or edit existing collages created by others

- Collage Sharing: Enables downloading collages as videos that can be shared on other platforms

- Both features maintain attribution to the original creators

The context:

- Pinterest launched its collage tool last September, based on its popular "Shuffles" app.

- Collages allow users to digitally cut objects from Pins and combine them while maintaining product links

- The format has proven especially popular with Gen Z users

Strategic implications:

- Pinterest is developing a collage ad option for brands

- Instagram has begun experimenting with its own collage format (a sign of the feature's success)

- Cross-platform sharing could drive users back to Pinterest through watermarks and stickers

Bottom line: With these updates, Pinterest continues to evolve features that balance creative expression with shopping functionality, potentially enhancing user engagement and the platform's commercial opportunities.

Source: Social Media Today

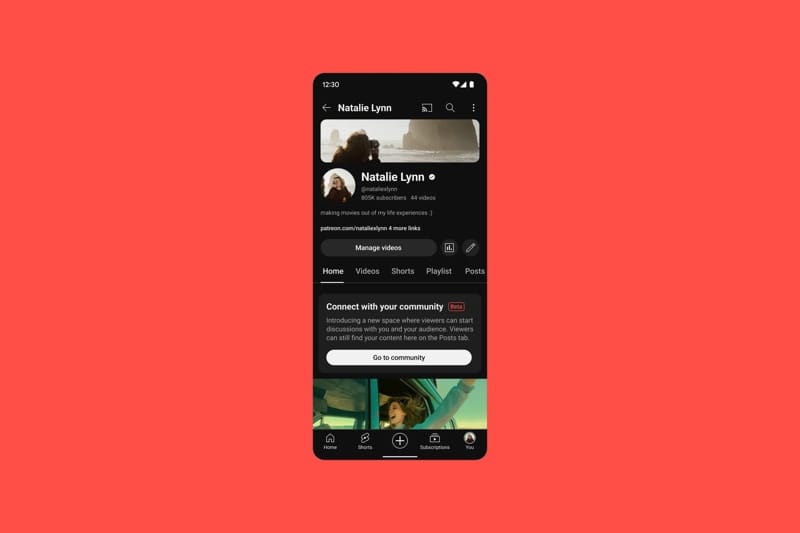

YouTube unveils Communities feature to keep fans and creators together on the platform

Why it matters: YouTube's new Communities feature aims to keep creators and their fans interacting on YouTube rather than migrating to competing platforms like Discord, Instagram, or Reddit, potentially increasing user retention while creating new moderation challenges for both the platform and creators.

The new experience:

- Allows fans to post directly on creators' channels and interact with each other

- Creates dedicated sections for community discussions and creator posts

- Enables text, image, and other non-video content sharing within each community.

- Replaces the existing limited "Community" feature that was rarely utilized

Creator management tools:

- New Community Hub replaces comments section in YouTube Studio

- AI systems help surface valuable comments and suggest replies

- Designed to help creators manage increased interaction volume

The rollout plan:

- Currently live on a limited number of channels

- Wider availability planned for 2025

- An opt-in system where creators can choose to enable the feature

The bigger picture: This feature represents YouTube's recognition that social interaction is crucial for platform stickiness, as it attempts to position itself not just as a video platform but as a complete creator ecosystem where fans can "hang out" while creators monetize their content.

Source: The Verge

Comments ()