TRD Issue 92 - Briefing: How AEON and Walmart Are Outlasting Disruptors

Legacy retailers reinvent while challengers stumble: AEON turns 50, Temu falters, Slack goes AI.

Hello Subscribers,

Our industry never stands still, and as we wrap up another eventful week, I wanted to share some key developments that caught my attention in the retail and e-commerce space.

AEON, celebrating its 50th anniversary as a public company, has strategically pivoted towards drugstore operations. This move, positioning drugstores as their next significant growth engine in the face of a challenging general merchandise landscape, showcases their foresight and business acumen.

Slack is quietly reinventing itself as an AI agent hub in the digital realm—a move reminiscent of other tech companies jumping on the AI bandwagon. This transition raises important questions about whether users actually want this functionality or if it's simply chasing market trends without addressing core user needs.

On the competitive battlefield, Walmart continues its methodical march toward an Amazon-like ecosystem, with advertising now serving as its flywheel's core. They're building something that looks increasingly formidable by connecting their retail media network with its growing marketplace and subscription services. This strategy enhances Walmart's competitiveness and sets a new benchmark for other retailers. Meanwhile, Temu, despite its explosive growth and aggressive marketing, faces troubling headwinds: declining customer retention, mounting legal challenges from Shein, and regulatory scrutiny that could threaten its discounting model.

For smaller players, Shopify's Collective cross-selling tool is gaining modest but meaningful traction. With its potential to provide alternatives while maintaining independence, this tool offers hope when subscription businesses are contending with record-high credit card debt and increasing chargebacks.

I hope these insights prove valuable as you navigate your own strategic decisions. As always, I welcome your thoughts on any of these developments.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

AI

Slack repositions as an AI agent hub amid questions about necessity

Why it matters: Slack is expanding beyond messaging to become a "work operating system" by integrating AI tools from major tech companies, signaling a significant strategic shift under Salesforce ownership.

The big picture: CEO Denise Dresser believes Slack is the ideal platform for AI agent integration because of its conversational nature and position in daily workflows.

New features in Slack's premium AI tier include:

- AI-generated Huddle summaries

- Integration with Salesforce's AI agents

- Third-party AI tools enabling web search and image generation

- Agentforce for analyzing business data directly in Slack

- Partnerships with Cohere, Anthropic, Perplexity, and Adobe for specialized AI services

Between the lines: The platform faces legitimate questions about whether this AI pivot addresses actual user needs or represents another case of AI feature creep.

Flashback: Earlier this year, Slack faced criticism over its data policies when developers discovered language suggesting customer data was being used to train AI systems by default.

The bottom line: Slack executives insist "no LLMs are trained on Slack data, period," but privacy concerns persist as the platform evolves from messaging to an AI-powered workspace hub.

Source: Tech Crunch

Google's NotebookLM now explains complex topics through audio

Why it matters: Google's AI note-taking app adds an "Audio Overview" feature that converts uploaded content into spoken explanations, expanding how users can consume and understand complex information.

How it works: AI-generated virtual hosts use conversational speech to summarize source materials, explain complex concepts with metaphors, highlight key facts, and help users discover new connections between documents.

Getting started: Users can access the feature by opening a notebook, navigating the Notebook guide, and clicking "generate" on the right-hand side. Audio conversations take up to five minutes to generate and can be downloaded for on-the-go listening.

The fine print: The audio feature remains in beta with potential inaccuracies and currently only supports English. Conversations can be generated from materials like course readings or legal briefs.

The background: NotebookLM debuted as "Project Tailwind" in June 2023 before launching widely in December. Previously text-only, the app is now available in over 200 countries and supports more than 108 languages.

Source: Tech Crunch

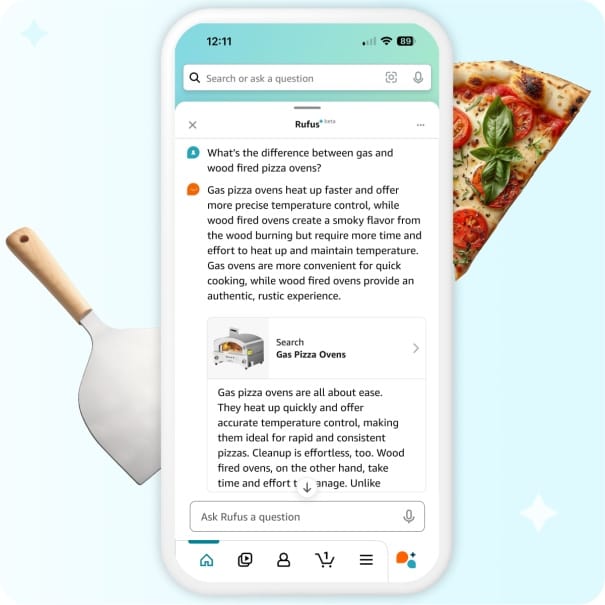

Amazon tests ads in Rufus AI shopping assistant

Why it matters: Amazon is monetizing its AI chatbot Rufus with sponsored ads, signaling a shift toward revenue generation in AI assistants as companies seek returns on costly AI investments.

The details: According to a changelog published in September and first reported by AdWeek, Amazon will display sponsored ads in Rufus placements for U.S. users based on search queries and conversation context. In some cases, Rufus may generate text to accompany existing ad copy.

Amazon's perspective: A company spokesperson stated they are "improving brand and product discovery by introducing relevant sponsored ads that help customers discover selections related to their conversation with Rufus."

The bigger picture: This move parallels Microsoft's earlier experiments with ads in its Copilot chatbot. It highlights an industry trend of tech companies seeking revenue streams from AI investments, which are notoriously expensive to develop and operate.

Background: After testing, Rufus, Amazon's shopping-focused AI assistant, launched fully to all U.S. customers in July 2024.

Source: Tech Crunch

e-Commerce

Temu pitches merchants amid slowing growth and increasing challenges

Why it matters: As Temu seeks to expand its seller base after two years of rapid U.S. growth, the e-commerce upstart faces significant headwinds, including declining customer retention, competitive threats, and regulatory scrutiny.

The big picture: A recently obtained slide deck reveals Temu's pitch to Chinese merchants, highlighting its market success while glossing over mounting challenges threatening its business model.

By the numbers:

- Temu's app reached 74 million downloads by July 2023

- Topped Android's Google Play store for 293 days

- New customer acquisition is down about 50% year-over-year (May-July)

- Customer retention dropped from 51% in Q1 2023 to 35% in Q1 2024

The value proposition: Temu emphasizes its seller-friendly approach with:

- No annual fees, commission fees, or advertising fees.

- "Semi-managed" logistics allowing merchants to use their warehouses

- Subsidized international shipping costs

- Promotion of lightning deals and sales events

The competition heats up:

- With a similar business model, TikTok Shop aims to grow to $17.5 billion by 2024.

- Amazon reportedly plans to launch a discount store shipping directly from China.

- Shein launched a U.S. marketplace about a year ago.

The challenges ahead:

- Parent company PDD lost $55 billion in market value in August, citing slowing growth.

- Merchant protests over alleged arbitrary fines and withheld payments

- Legal battles with Shein, including allegations that Temu loses "$30 on every sale."

- Potential changes to the $800 de minimis exemption that currently allows duty-free imports

What they're saying: "That level of spend is just unsustainable from a marketing standpoint because all you're driving is downloads," said Juan Pellerano-Rendón, CMO at e-commerce logistics startup Swap.

Source: Modern Retail

Marketing

Walmart builds an Amazon-like flywheel with advertising at the center

Why it matters: Walmart is strategically expanding its digital services ecosystem with advertising as a core component, aiming to create a self-reinforcing business model similar to Amazon's famous flywheel effect.

The big picture: Seth Dallaire, Walmart's EVP and Chief Revenue Officer, who previously led advertising at Amazon and Instacart, outlined how Walmart Connect (its retail media network) works alongside Walmart+ (subscription service) and Walmart Luminate (data service) to drive the company's digital transformation.

By the numbers:

- Walmart Connect's year-over-year growth increased from 22% in late 2023 to 30% in Q2 2024

- The company's global advertising business reached $3.4 billion last year (compared to Amazon's $47 billion)

- Walmart's global e-commerce sales surpassed $100 billion in 2023

How the flywheel works:

- Advertising helps marketplace sellers gain visibility and drive sales

- A thriving marketplace expands product selection for Walmart+ subscribers

- Walmart Luminate's data capabilities allow advertisers to optimize inventory and ad spend

- Revenue from these services gets reinvested to reinforce Walmart's "everyday low prices" positioning

The Walmart difference: Unlike pure e-commerce players, Walmart is leveraging its physical store footprint as a competitive advantage in building its digital ecosystem.

Industry perspective: "The evolution of a retailer's economic model is such that they are going to make a decreasing amount of their money from buying and selling stuff and an increasing amount of money from selling other things," said Bryan Gildenberg, founder and CEO of Confluencer Commerce.

What's next: Dallaire emphasized that while these new businesses create revenue, Walmart remains focused on customer experience and will reinvest in lower prices, new technology, and improved logistics.

Source: Modern Retail

Shopify Collective gains traction as brands test cross-selling opportunities

Why it matters: Shopify's cross-selling tool is helping direct-to-consumer brands expand product offerings and test new categories without inventory risk, creating mini-marketplaces that offer alternatives to Amazon.

By the numbers:

- Active selling connections increased 765% between August 2023 and 2024.

- For early adopters like Dryft, partner products appear in 5-10% of orders.

- Revenue from Collective sales makes up only about 1% of total sales for most brands.

How it works:

- Brands can list their products on other Shopify merchants' sites

- Partner brands handle fulfillment via dropshipping

- Host brands receive a percentage of each sale

- All listing requests require approval from the product's brand

The strategic benefits:

- Low-effort additional revenue stream with no inventory costs

- Market research opportunity to test customer interest in new categories

- Alternative distribution channel for brands with marketing restrictions

- Creates curated product bundles that complement core offerings

The challenges:

- Partner brand visibility is limited on product listings

- Successful third-party products might inspire copycat offerings

- Some brands face regulatory limitations on cross-listing

Looking ahead: "I think the future of online retail is a marketplace model," said Lindsey Rosenberg, co-founder of Dryft. "We all want to see alternatives to Amazon that align with our interests and needs."

Source: Modern Retail

Payment

Subscription brands battle record credit card debt and chargebacks

Why it matters: Subscription businesses face rising payment disputes and cancellations, threatening their recurring revenue model.

By the numbers:

- $11 billion in disputed transactions (2023), up from $7.2 billion in 2019

- Credit card debt hit a record $1.14 trillion in August 2024

- Each chargeback costs merchants $25-$50 to process

The drivers:

- Inflation is impacting discretionary spending

- Simplified dispute processes from banks

- Consumers are increasingly using chargebacks for purchase dissatisfaction

- Growing credit card debt levels

Brand responses:

- Advanced payment reminders

- SMS notifications for expiring cards

- More generous refund policies

- Partnerships with retention specialists

The outlook: Experts expect payment disputes to grow as consumer behavior shifts and economic pressures persist.

Source: Modern Retail

Asia

Malaysia's 99 Speed Mart jumps in country's largest IPO since 2017

Why it matters: 99 Speed Mart's successful market debut signals strong investor confidence in Malaysia's retail sector and could catalyze more listings in the region's improving IPO market.

By the numbers:

- Raised 2.36 billion ringgit ($542.8 million)

- Shares opened 12.1% higher than the IPO price

- Stock rose as high as 16.4% on the first trading day

- Q2 profit jumped 66.3% year-on-year to 125.5 million ringgit

Expansion plans: The mini-market chain will use proceeds to open about 250 stores annually by 2027, aiming to reach 3,000 outlets from the current 2,526.

Market context:

- Malaysia's largest IPO since Lotte Chemical Titan's listing in 2017

- Southeast Asia's biggest IPO since July 2023

- Malaysian IPO proceeds have doubled to $1.3 billion this year

- Malaysian benchmark stock index up 13.7% in 2024

What's next: U Mobile is planning a domestic IPO that is expected to raise over $500 million in early 2025, as Malaysia's strong stock market attracts more listings.

Source: Reuters

Japanese loyalty program Ponta partners with Temu despite legal risks

Why it matters: Ponta, Japan's veteran loyalty points program, is attempting to regain market relevance by partnering with Chinese e-commerce platform Temu, despite ongoing legal disputes between Temu and competitor Shein.

The partnership: Since July, Ponta members can earn points worth 1% of purchases made through Temu via a dedicated site. According to Loyalty Marketing executive Kazuya Noda, sales have exceeded targets during the first two months.

Market context:

- Ponta ranks fourth in Japan's loyalty program market with 8.2% usage

- Market leader Rakuten Points dominates with 33.7% share

- PayPay Points (14.5%) and d-Points (14.2%) hold second and third positions

- Ponta lacks the integrated ecosystem advantages of its competitors

The risk calculation: Despite Temu's legal battles with Shein and EU scrutiny over counterfeit goods, Loyalty Marketing prioritized Temu's rapid growth potential. However, executives acknowledge the partnership could be terminated depending on litigation outcomes.

Looking ahead: Ponta plans to launch promotional campaigns and potentially allow points to be used for Temu purchases, as it attempts to rebuild its position in Japan's competitive loyalty program market.

Source: NIKKEI

AEON marks 50 years as a public company, eyes drugstore business for future growth

Why it matters: Japanese retail giant AEON celebrates 50 years since its public listing, having transformed from a small regional supermarket into Japan's second-largest retailer through aggressive M&A and diversification.

By the numbers:

- Sales grew 49 times since IPO to ¥9.55 trillion ($65.7 billion)

- Expanded from 13 to 309 consolidated subsidiaries

- Store count increased 125 times from 140 to 17,000 locations

- Private brand "TopValu" sales exceed ¥1 trillion

- Drugstore business profits grew 6x in the past decade

The growth strategy: AEON has built Japan's most prominent retail conglomerate through acquisitions, now operating in eight business segments with market-leading positions in general supermarkets, food supermarkets, and drugstores.

The next growth driver: Drugstore operations, led by subsidiary Welcia Holdings, now contribute nearly 20% of total profits. AEON is furthering this expansion through the announced merger between Welcia and second-ranked Tsuruha Holdings.

Remaining challenges:

- GMS (general merchandise store) profit margins remain low at 0.8%

- Urban market penetration, particularly in Tokyo, remains limited

- Responding to e-commerce competition and population decline

Metropolitan strategy: AEON targets Tokyo with three initiatives: expanding online delivery service "Green Beans," growing small-format stores "My Basket," and creating a ¥1 trillion supermarket alliance through acquisitions.

Source: NIKKEI

Comments ()