TRD Issue 85 - Briefing: Surveillance Pricing, Social Commerce, and Luxury's Slowdown

FTC investigates AI pricing practices, LVMH signals luxury slowdown, Temu merchants protest fines, and social platforms seek new revenue streams with publishers.

Hello Subscribers,

The FTCs are making waves with their probe into "surveillance pricing" – they're investigating how companies use AI to personalize prices, which could reshape how dynamic pricing works across the industry.

Speaking of industry shifts, even luxury isn't immune to the slowdown – LVMH reported its lowest growth since 2009 earlier this year, showing that even the high-end market isn't bulletproof. Will the downfall continue in 2025?

There's drama brewing in the fast-growing Temu world, with hundreds of Chinese merchants protesting over what they claim are unfair penalties. It's a reminder of the growing pains in rapid e-commerce expansion.

On the social commerce front, there are some interesting moves: Pinterest and LinkedIn are trying a new approach by partnering with publishers to boost their ad game, while in Southeast Asia, GoTo's bringing BNPL to TikTok's ShopTokopedia – a clever play for Indonesia's substantial unbanked population.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

AI

FTC launches major probe into AI pricing practices

Why it matters: The Federal Trade Commission is investigating how companies use AI and consumer data to set personalized prices, potentially affecting how much you pay for products across retail, travel, and financial services.

The big picture: Eight major companies, including Mastercard, Bloomreach, and McKinsey, must explain their AI pricing tools within 45 days.

Key details:

- FTC is targeting tech providers and consultants, not retailers directly.

- The investigation focuses on "surveillance pricing" - using personal data for price targeting.

- Companies have 45 days to respond about their data collection and pricing methods.

- The order received unanimous FTC support, though some commissioners cautioned against prejudging the practice.

Industry response:

- Revionics states it doesn't use individual consumer data or recommend personalized pricing

- Bloomreach confirms receipt and welcomes the investigation

What's next: This investigation represents FTC Chair Lina Khan's latest effort to regulate tech companies following actions against Amazon and fake reviews. The findings could lead to new consumer protection regulations.

Bottom line: While dynamic pricing isn't new, AI capabilities have raised fresh concerns about privacy and fairness in how companies set prices for different consumers.

Source: Modern Retail

The chatbot tipping point: Promise vs. reality in retail

Why it matters: While 80% of consumers want AI help with shopping issues, only one-third are satisfied with current chatbot experiences, highlighting a critical gap between expectations and delivery in retail customer service.

By the numbers:

- 39% of CEOs see chatbots as the most promising AI application

- AI chatbots cost about 1/8 of human service agents

- Expected 20-30% reduction in customer service staff by 2026

The case for chatbots:

- 24/7 instant response capability

- Excellent at handling routine queries (password resets, shipping status)

- Scalable during high-traffic periods like Black Friday

- Significantly lower operational costs

The case against:

- Struggles with complex or nuanced customer issues

- Risk of AI "hallucinations" providing incorrect information

- Challenge maintaining authentic brand voice

- High customer frustration when interactions fail

What's working: Hybrid models where AI handles basic queries and humans manage complex issues are showing promise.

Bottom line: While AI chatbots aren't ready to fully replace human customer service, they're becoming an essential first-line support tool for retailers seeking efficiency and scale.

Source: Modern Retail

Fashion's billion-dollar guessing game persists

Why it matters: Despite AI advances, the $1.7 trillion apparel industry relies heavily on manual, intuition-based forecasting, leading to massive waste and costly mistakes like Burberry's recent market miscalculation.

The big picture: At New York's Tex World trade show, 5,000 buyers faced overwhelming choices from 600 exhibitors, highlighting the industry's outdated approach to predicting consumer demand.

By the numbers:

- Burberry's stock dropped over 50% in one year

- The company disposed of $115M in unsold products (2018-2023)

- The show featured ~1 million product samples

The innovation gap:

- Manufacturing: Advanced (moisture-wicking, stretch materials)

- Design/forecasting: Still largely manual

- AI adoption: Limited, despite proven benefits in testing.

What's next: Companies are slowly adopting AI for:

- Digital product testing

- Consumer behavior analysis

- Design visualization

Bottom line: The apparel industry's resistance to modern forecasting technology creates unsustainable waste and financial risk, making it increasingly vulnerable in a fast-moving market.

Source: Forbes

Retail

Luxury's growth engine hits the brakes

Why it matters: LVMH's disappointing Q2 results signal the most significant luxury market slowdown in a decade (excluding the pandemic), with even the industry leader feeling pressure from weakening US and China demand.

By the numbers:

- Q2 sales growth: 1% (lowest since 2009, excluding pandemic)

- Operating margin: Dropped to 25.6% from 27.4%

- Stock reaction: Fell up to 6.5%

Market dynamics:

- Chinese consumers are shifting to Japan for better prices

- US middle-class shoppers pulling back

- Premium brands (Hermès, Brunello Cucinelli) outperforming mid-tier

- Luxury stocks lost all 2024 gains

Winners and losers:

- Strong: Loewe, Louis Vuitton, Cartier.

- Struggling: Burberry (suspended dividend), Gucci (-18% Q1 sales).

What's next:

- Recovery unlikely before 2025

- Easier comparisons coming in H2 2024

- US showing signs of improvement

- Chinese demand remains soft

Bottom line: The luxury sector faces its biggest test since 2009, with only the highest-end brands showing resilience in a challenging market.

Source: Bloomberg

Startups join big retailers in price-cutting race

Why it matters: As Walmart, Target, and CVS slash prices on essentials, startup brands face mounting pressure to reduce costs or risk losing shelf space despite their smaller economies of scale.

The big picture: Emerging brands are finding creative ways to cut prices without sacrificing quality, viewing it as crucial for retailer relationships and consumer trials.

By the numbers:

- Proper Good: Reduced soup prices from $5.98 to $4.98

- Kokada: Dropped spread prices from $11.99 to $9.99

- Behave: Cut candy pouch prices from $5 to $3.50

How startups are cutting costs:

- Streamlining packaging

- Negotiating better supplier rates

- Reducing marketing spend

- Increasing order volumes

- Simplifying production

Success factors:

- Data-driven price targeting

- Retailer collaboration

- Focus on permanent price cuts vs. promotions

- Maintaining premium quality

Bottom line: While risky for margins, strategic price reductions are becoming essential for CPG startups to compete in mass retail and capture price-conscious consumers.

Source: Modern Retail

e-Commerce

Tension rises between Temu and its suppliers

Why it matters: Hundreds of Chinese merchants are protesting against PDD Holdings (Temu's owner) over escalating penalties, threatening to disrupt the supply chain of one of the fastest-growing global e-commerce platforms.

The big picture: The protests highlight growing friction between Temu's aggressive global expansion and supplier relationships as it challenges Amazon and Shein.

Key details:

- Location: PDD's Guangzhou offices

- Issue: Merchants claim unfair payment withholding and unclear fines

- Scale: Penalties often several times retail prices

- Impact: PDD shares fell 3.5%, the most significant drop since June.

Behind the protests:

- Multiple rallies since May

- Dozens of merchants in disputes over "after-sales issues"

- Conflicts worth several million yuan

- Growing merchant dissatisfaction with penalty systems

What's next:

- Temu may need to offer merchant subsidies

- Risk of suppliers moving to competing platforms

- Potential impact on the platform's growth

- Increased regulatory scrutiny in US and EU markets

Bottom line: As Temu races for global market share, mounting tension with its merchant base threatens to undermine its expansion strategy and profit margins.

Source: Bloomberg

Marketing

Social platforms seek publisher help to boost ad sales

Why it matters: Pinterest, TikTok, and LinkedIn are testing revenue-sharing models with publishers to sell ads, marking a significant shift in platform-publisher relationships and potentially creating new revenue streams for media companies.

The big picture: Smaller social platforms are pursuing these partnerships as publishers face declining website traffic from social media and seek new monetization opportunities.

Key initiatives:

- Pinterest: Testing publisher access to the ad auction system

- LinkedIn: Launched LinkedIn Wire for video ad sales

- TikTok: Exploring custom video content partnerships

By the numbers:

- Pinterest revenue 2023: $3B (9% growth)

- Meta revenue 2023: $134B (16% growth)

- Pinterest Q1 2024: 23% growth

What's driving this:

- Platforms need quality content for advertisers

- Publishers seeking compensation as social referral traffic drops

- Smaller platforms competing with Meta's ad dominance

Bottom line: This shift could create a more symbiotic relationship between social platforms and publishers, as both seek to capitalize on changing content consumption patterns.

Source: The Information

Asia

GoTo takes BNPL to TikTok shoppers

Why it matters: GoTo's launch of GoPay Later on ShopTokopedia targets Indonesia's massive unbanked population (90M+), potentially accelerating digital financial inclusion in Southeast Asia's largest economy.

The big picture: The partnership between GoTo and TikTok expands payment options in Indonesia's growing digital economy while addressing the significant gap in accessible financial services.

By the numbers:

- Credit limit: Up to 10M IDR ($627)

- GoTo Q1 revenue growth: 18% YoY

- Q1 losses narrowed to: $25.8M

- Target market: 90M+ unbanked Indonesians

Key features:

- No minimum transaction requirement

- Flexible payment terms

- Risk-based pricing model

- Integrated with the existing GoPay system

Bottom line: This strategic move strengthens GoTo's financial services portfolio while supporting TikTok's e-commerce ambitions in Southeast Asia's largest market.

Source: Tech in Asia

Korean e-commerce giant faces payment crisis

Why it matters: KKR-backed Qoo10's failure to pay merchants triggered a government probe and disrupted Korea's e-commerce ecosystem, affecting sellers and consumers.

By the numbers:

- Unpaid transactions: 170B won ($123M)

- Annual transactions: 7T KRW across three platforms

- The affected platforms are TMON, WeMakePrice, and Interpark.

Crisis impacts:

- Merchants halting deliveries

- Travel agencies canceling packages

- Payment processors suspending services

- Surge in consumer refund requests

Government response:

- Fair Trade Commission launching emergency inspection

- Financial Supervisory Service monitoring situation

- Dedicated response team for claims

- On-site investigations planned

Bottom line: This payment crisis threatens Qoo10's Korean expansion strategy and highlights risks in rapid e-commerce consolidation.

Source: Bloomberg

Korea cracks down on AliExpress privacy violations

Why it matters: South Korea has imposed its first-ever privacy violation fine on a foreign e-commerce platform, signaling stricter oversight of Chinese platforms expanding in the Korean market.

By the numbers:

- Fine: 2B KRW ($1.4M)

- Additional penalty: 7.8M KRW

- Affected sellers: ~180,000

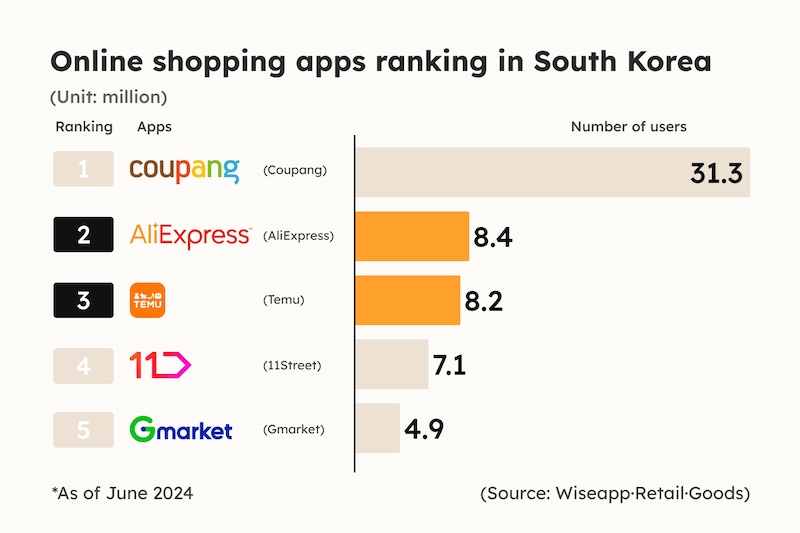

- AliExpress monthly users: 8.4M (2nd largest)

Key violations:

- Shared Korean customer data with overseas sellers

- Failed to obtain proper user consent

- Inadequate privacy protection measures

- Non-compliant vendor contracts

Broader context:

- Part of a larger crackdown on Chinese platforms

- A similar investigation is pending for Temu

- Antitrust probe launched in March

- New e-commerce regulations being introduced

Bottom line: This penalty reflects Korea's growing concerns about Chinese e-commerce platforms' rapid expansion and their handling of consumer data.

Source: KED Global

Comments ()