TRD Issue 83 - Briefing: AI Agents, EssilorLuxottica-Supreme Deal & The RMN Gold Rush

Inside AI agents' murky definition, EssilorLuxottica's streetwear gambit, the truth about consumer spending, and why every company suddenly wants to be an ad network.

Hey there!

EssilorLuxottica dropped $1.5B on Supreme, and no, that's not a typo. The eyewear giant's move into streetwear raises eyebrows, but it might be onto something bigger than trendy frames. Speaking of surprises, banks and airlines suddenly act like retailers, jumping into the media network game. (Imagine getting targeted ads while checking your account balance – that future is closer than you think.)

Meanwhile, there's a darker story brewing in D2C land. Remember all those venture-backed brands that were supposed to disrupt retail? Many are now "zombie brands" – not quite dead, but barely alive. It's a sobering reminder that not every direct-to-consumer darling gets a happy ending.

But here's the real kicker: While some retailers blame poor sales on consumer spending, the data tells a different story. Shoppers aren't keeping their wallets closed; they're just being pickier about where they open them.

Oh, and everyone's talking about AI agents, though no one seems to agree on what exactly they are. (Spoiler: They're more than just chatbots with attitude.)

Dive in for the full scoop on what's happening in retail and tech.

Catch you next week,

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

AI

AI Agents: The Next Big Thing That No One Can Define

Why it matters: The tech industry is betting on AI agents as the future of automation, but there's no consensus on what they are or what they can really do - creating both opportunity and confusion in the $market.

The big picture: At their core, AI agents are AI-powered software designed to perform complex tasks traditionally handled by human workers. But that's where the agreement ends.

How different players see it:

- Google views them as specialized task assistants (coding, marketing, IT)

- Asana positions them as AI coworkers handling assigned tasks

- Sierra (by former Salesforce co-CEO) envisions them as advanced customer service tools

Reality check: Three key challenges stand in the way

- System integration hurdles: Legacy systems often lack basic API access

- Multi-model requirement: Single large language models can't handle complex agent tasks alone

- Autonomous reasoning: Current AI can't independently handle contingencies

Expert insights:

- Rudina Seseri (Glasswing Ventures) says it's too early for a single definition but sees agents as autonomous systems using multiple AI technologies.

- Aaron Levie (Box CEO) predicts rapid improvement through a "self-reinforcing flywheel" of GPU advancement, model efficiency, and infrastructure improvements.

The counterpoint: MIT's Rodney Brooks warns against over-optimism, noting people tend to overestimate AI capabilities by comparing them to human performance.

What's next: The industry is working toward truly autonomous agents that can handle abstract goals independently, but significant technological breakthroughs are still needed.

Between the lines: While the lack of definition creates some market confusion, it also leaves room for innovation and diverse approaches to automation solutions.

Source: TechCrunch

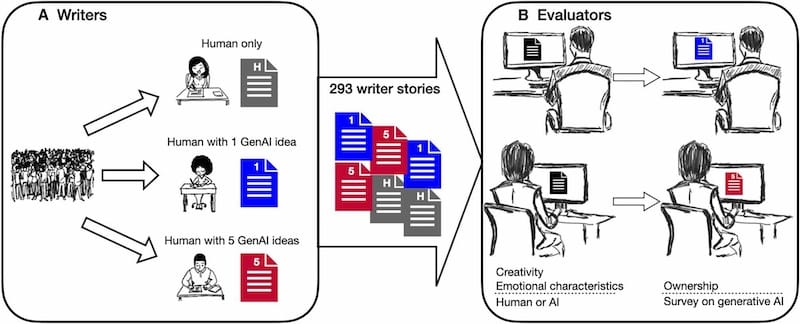

AI's Creative Paradox: Boosting Individual Writers While Dulling Collective Originality

Why it matters: A groundbreaking UCL/Exeter study reveals AI's double-edged impact on creativity - helping struggling writers while potentially homogenizing creative output, raising crucial questions about AI's role in creative industries.

The experiment setup:

- Hundreds of participants wrote short stories

- Three test groups: no AI, one GPT-4 prompt, or five prompts.

- Stories evaluated on novelty, usefulness, and emotional impact.

Key findings:

- Individual Impact:

- Less creative writers saw significant improvement with AI assistance

- More creative writers showed no benefit or slight decline in quality

- AI prompts improved writing quality, enjoyment, and novelty for struggling writers.

- Collective Impact:

- Stories became 9-10% more similar when AI was involved

- Reduced overall creative diversity

- Created potential "downward spiral" of decreasing originality

Between the lines: The study exposes a potential "social dilemma" - while individuals benefit from AI assistance, widespread adoption could lead to creative homogenization.

Expert insight: Study co-author Oliver Hauser emphasizes the need for rigorous evaluation of AI's impact rather than assuming positive outcomes.

The bottom line: As AI integration in creative fields accelerates, finding ways to preserve creative diversity while leveraging AI's benefits becomes crucial for maintaining artistic innovation.

Source: TechCrunch

Retail

EssilorLuxottica's $1.5B Supreme Gamble: Eyewear Giant Goes Streetwear

Why it matters: The surprising acquisition marks EssilorLuxottica's first major move into apparel, signaling a strategic pivot to reach younger consumers and expand beyond traditional eyewear.

The deal breakdown:

- Price: $1.5B cash deal (VF Corp paid $2.1B in 2020)

- Supreme's revenue: $523.1M (FY ending March 2023)

- Timeline: Expected to close by the end of 2024

Strategic rationale:

- Access to Supreme's young, loyal customer base.

- Expansion into lifestyle/fashion categories

- Potential cross-brand collaboration opportunities

- Enhancement of fashion credentials for eyewear sales

Market perspective: Analysts are divided

- Positive: Could leverage EssilorLuxottica's luxury positioning (80% of sales)

- Cautionary: The company lacks apparel management experience

Between the lines: VF Corp's quick flip of Supreme (bought for $2.1B in 2020, sold for $1.5B) suggests challenges in growing the streetwear brand, which missed its $600M revenue target.

What's next: Industry watchers expect more unconventional M&A deals, with EssilorLuxottica potentially acquiring additional fashion brands to build portfolio synergy.

The bottom line: While risky, this acquisition could serve as a test case for luxury groups expanding beyond their core competencies in a consolidating retail market.

Source: Modern Retail

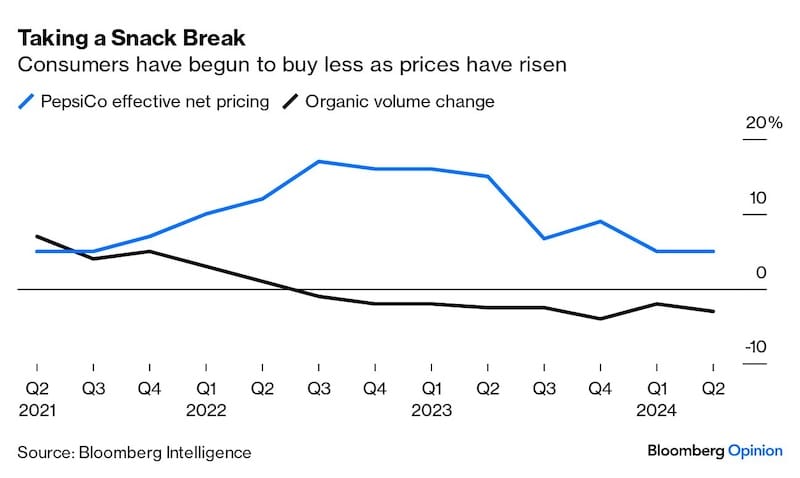

Retail Reality Check: Consumers Are Spending, Just More Selectively

Why it matters: Despite retailers blaming poor results on consumer pullback, June retail sales rose the most in three months, revealing a more nuanced reality of modern shopping behavior.

The big picture: Consumers aren't stopping spending - they're being more strategic about where and how they spend.

What's working:

- Value proposition:

- Sweet spot pricing (e.g., Adidas Samba at $100 vs Nike Air Max DN at $160)

- Off-price retailers like TJX are seeing strong clothing sales

- Walmart's upscale private labels gaining traction

- Product innovation:

- Hot products still drive sales (Adidas Samba example)

- Color variety matters (Lululemon's limited palette hurt sales)

What's not:

- Aggressive pricing:

- PepsiCo saw 2% volume drop after multiple price hikes

- Helen of Troy's 32% stock drop after warning

- Consumer shift to private labels

Between the lines: Companies can't hide behind "consumer health" excuses when competitors thrive in the same market conditions.

Looking ahead: With inflation cooling and potential rate cuts, consumer pressure may ease - but new shopping habits formed during tough times likely won't reverse completely.

The bottom line: Success in today's retail environment requires delivering clear value and innovation, not just relying on brand legacy or pricing power.

Source: Bloomberg

e-Commerce

Shein's €200M Green Gambit Ahead of London IPO

Why it matters: Fast-fashion giant Shein is launching a sustainability fund amid scrutiny over its environmental impact and labor practices as it seeks approval for a London listing over New York.

By the numbers:

- Fund size: €200M for circularity initiatives

- Additional investment: €50M for UK/EU brands and designers

- Company valuation: $66B (last funding round)

- 2023 profits: $2B

The bigger picture:

- Strategic timing:

- Filed confidential paperwork with UK regulators

- Meeting with the new business secretary

- Labour Party supports London listing

- Sustainability challenges:

- Over 50% of fast fashion discarded within a year

- Growing criticism of industry's environmental impact

- Need for collaborative industry solutions

Between the lines:

- The fund represents less than 10% of Shein's annual profits

- The move comes amid broader geopolitical tensions between US and China

- Hong Kong remains a backup listing option

What's next:

- Awaiting Chinese securities regulator approval

- Investment in recycling startups and sustainable materials

- Expansion of resale platform (currently 115,000+ items listed)

The bottom line: While Shein positions this as a sustainability commitment, the relatively small investment suggests it's more focused on securing regulatory approval for its IPO than transforming its business model.

Source: FT

Marketing

The Race to Create Retail Media Networks: Everything's Becoming an Ad Space

Why it matters: Companies are transforming every customer touchpoint into an advertising opportunity, with U.S. advertisers expected to pour $54.48B into retail media in 2024 - representing $1 of every $7 in ad spending.

The evolution story: From simple in-store "shopper marketing" signs and shelf displays, retail media has exploded into the digital realm. Amazon led this transformation, creating a blueprint that now attracts players far beyond traditional retail:

- Traditional retailers: Walmart, Target, Kroger.

- Financial services: Chase Bank

- Airlines: United (Kinective Media)

- Tech companies: T-Mobile Advertising

- Convenience stores: Wawa's Goose Media Network

What's driving the gold rush: The impending death of third-party cookies has made first-party data invaluable. Companies sitting on customer data treasure troves see an opportunity to create new revenue streams while solving advertisers' targeting challenges.

The strategic pivot: Retail media networks are pushing beyond simple product promotion. They're expanding into brand awareness through:

- Streaming partnerships (Instacart-YouTube)

- Strategic acquisitions (Walmart-Vizio)

- Social media integration

- Connected TV offerings

Market reality check: Despite the rush, challenges loom. Georgia-Pacific's experience of testing 25 networks before consolidating to seven shows the practical limits facing advertisers. This suggests eventual market consolidation favoring sophisticated players with comprehensive offerings.

The bottom line: While retail media networks represent the future of digital advertising, not every company that builds one will succeed. The winners will be those who can prove value beyond direct response metrics while delivering sophisticated targeting and measurement capabilities.

Source: DigiDay

Banks Join the Ad Network Gold Rush: What Financial Media Networks Mean for Retail

Why it matters: Financial institutions are creating their own advertising networks, with spending projected to grow 107% annually to reach $1.5B by 2026. While small compared to retail media's $54B, banks' extensive customer data could reshape digital advertising.

The new players:

- JPMorgan Chase: Targeting based on card transactions

- PayPal: Leveraging 400 million active accounts

- Klarna: In-app Ads Manager

- More expected: Citigroup, Capital One, American Express.

Why now: Third-party cookie deprecation and stricter privacy laws have made first-party data invaluable. Banks possess comprehensive spending data across retailers - potentially more valuable than single-retailer insights.

The competitive edge: Financial institutions offer unique advantages:

- Cross-retailer purchase history

- Return data visibility

- Loan and investment insights

- Comprehensive customer profiles

Key challenges ahead:

- Privacy concerns and regulatory scrutiny

- Limited app engagement time (31 minutes daily by 2026)

- Consumer sensitivity to ads in financial contexts

- Need for retailer partnerships to access product-level data

The bottom line: While financial media networks face hurdles, their rich customer data and cross-retailer visibility position them as powerful players in the evolving digital advertising landscape. Success will depend on balancing advertiser value with consumer privacy and experience.

Source: Modern Retail

D2C

The Rise of Zombie D2C Brands: When Survival Isn't Thriving

Why it matters: A wave of direct-to-consumer brands are caught in limbo - not dead, but barely alive - as founders grapple with stagnant growth, depleted capital, and difficult exit decisions in a challenging market.

The zombie brand indicators:

- Social media silence

- Staff reductions

- Desperate fundraising attempts

- Sales plateau or decline

- Store closures

- Product line cuts

The perfect storm: Multiple factors created today's "peak zombie" environment:

- Inflated 2020-2021 valuations

- Post-pandemic e-commerce slowdown

- Rising costs and inflation

- Dried-up venture funding

- Shifting investor expectations

The founder's dilemma: Many face a stark choice:

- Continue cost-cutting for minimal profits

- Accept a dramatically lower valuation

- Close operations entirely

Looking ahead: While some brands may achieve turnarounds, the industry reset suggests many more will face tough decisions about their future in 2024, leading to more acquisitions, quiet closures, and strategic pivots.

The bottom line: The D2C landscape transforms from growth-at-all-costs to survival-of-the-profitable, forcing founders to confront hard truths about sustainable business models.

Source: Modern Retail

Asia

Vietnam's Biometric Banking Push: From Face Scans to Banh Mi

Why it matters: Vietnam's mandate for facial authentication on bank transfers over $393 marks a significant shift in financial security, potentially reshaping the future of payments in one of Asia's fastest-growing digital economies.

The new landscape:

- 19 million people registered for biometric authentication, and an estimated 37 million still need to enroll.

- US$393 million lost to online fraud in 2023

Market impact:

- Banks and fintech:

- Large banks partnering with tech providers

- Smaller fintech struggling with compliance costs

- New opportunities for biometric service providers

- Consumer trust:

- Enhanced security for digital transactions

- Initial confusion and technical issues

- Potential boost for new financial services (BNPL)

Key challenges:

- Technical implementation:

- Database management of millions of users

- Need for rapid authentication (<500ms)

- System reliability concerns

- Security concerns:

- Biometric data protection

- AI-driven fraud risks

- Photo spoofing vulnerabilities

Looking ahead: Industry experts predict 100% biometric certification for all transactions within five years, suggesting Vietnam's ambitious push toward a cashless society.

The bottom line: While the transition creates short-term challenges, it positions Vietnam as a leader in financial security innovation, though success depends on balancing security with accessibility.

Source: Tech in Asia

Ponta Partners with Temu: Japanese Loyalty Program Expands into Fast-Growing E-commerce

Why it matters: Major Japanese points provider Ponta is partnering with Chinese e-commerce platform Temu, marking a significant expansion of both companies' reach in Japan's competitive digital retail space.

Key details:

- Base reward rate: 1% points back on purchases

- New user bonus: 13% back (20% until August 18)

- Points credited: 3 months after purchase

- Temu's Japan reach: 19M monthly active users (June 2024)

Strategic importance:

- For Ponta:

- Expands beyond limited e-commerce presence

- Plans to enable direct point payments on Temu

- Competes with other loyalty programs (Rakuten, d-Point)

- For Temu:

- Strengthens Japanese market presence since the July 2023 launch

- Adds established loyalty program to discount strategy

- Builds consumer trust through local partnership

The bottom line: The partnership reflects intensifying competition in Japan's e-commerce loyalty space, as traditional point providers seek partnerships with emerging platforms while new entrants seek local credibility.

Source: NIKKEI

Comments ()