TRD Issue 80 - Briefing: Premium beauty brands embrace Amazon, China's EC goes global, SEA tightens EC rules

From Amazon's beauty surge to retail media's evolution: how luxury brands embrace e-commerce, Meta's AI challenges, and Asia's changing retail landscape reshape digital commerce.

Hello Subscribers,

Amazon's becoming a serious beauty destination, with luxury brands like Estée Lauder joining the platform – a sign that premium retailers can't ignore the e-commerce giant's pull anymore.

Meanwhile, Meta is causing headaches for photographers by mistakenly labeling real photos as AI-generated, highlighting the growing pains of content authentication.

China's retail slowdown pushes its e-commerce players to look overseas, while Southeast Asia is getting stricter with cross-border sales through new VAT rules.

Perhaps most intriguingly, retail media networks are experiencing a renaissance moment, with Walmart and Target catching up to Amazon's advertising dominance.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

AI

Meta is tagging real photos as ‘Made with AI,’ say photographers

Meta's AI detection system is misfiring.

Meta's new "Made with AI" labeling system incorrectly flags real photos as AI-generated, frustrating photographers worldwide.

Why it matters: The false positives raise concerns about content authenticity and Meta's ability to identify AI-generated content before the US elections.

The big picture:

- Labels have appeared on mobile apps (not the web) since May 2024

- Affects regular edits and professional photos, including work by former White House photographer Pete Souza

- Meta relies on metadata and industry standards to detect AI content

Behind the scenes: Many false flags seem triggered by common editing tools.

- Adobe's cropping tool

- Basic photo cleanup features

- Object removal functions

What's next: Meta says it's "evaluating its approach" and working with AI tool companies to improve detection accuracy. The company aims to reflect the varying degrees of AI usage in images.

The catch: While real photos get mislabeled, many AI-generated images remain untagged on Meta's platforms.

Source: TechCrunch

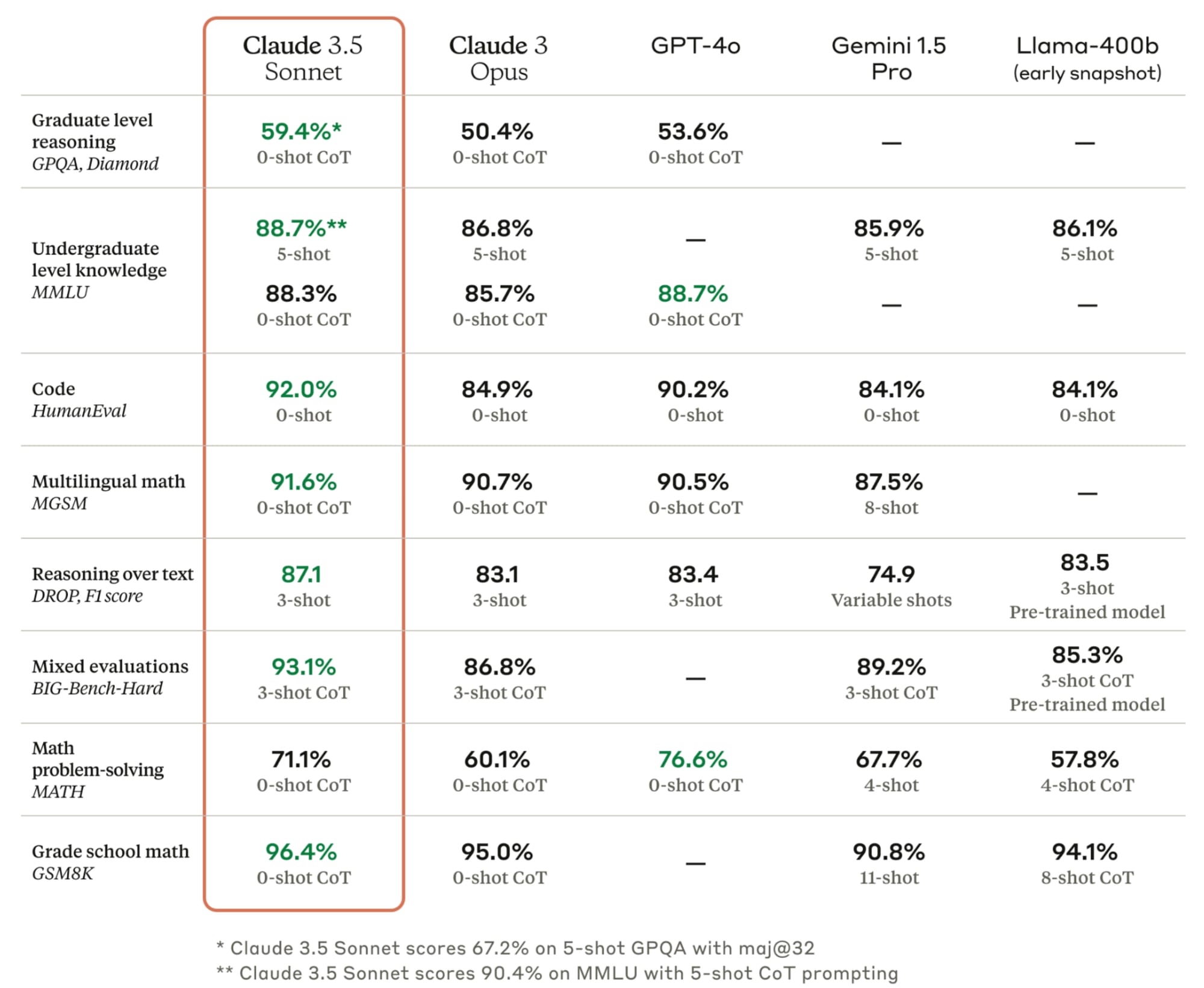

Anthropic claims its latest model is best-in-class

The latest Anthropic model aims for speed rather than breakthroughs.

Why it matters: Claude 3.5 Sonnet represents Anthropic's shift toward practical business applications rather than dramatic AI advances as the company works to close the revenue gap with OpenAI.

The big picture:

- The model shows incremental improvements over previous versions

- Focuses on speed - 2X faster than Claude 3 Opus

- Maintains the same 200,000 token context window

- Priced identically to the previous version ($3/M input tokens, $15/M output tokens).

Key improvements:

- Better vision capabilities for charts and imperfect images

- Enhanced understanding of complex instructions

- New "Artifacts" workspace for content editing

- Available on web client, iOS app, and major cloud platforms.

Behind the numbers: Anthropic projects $1 billion in revenue by the end of 2024, although it still lags behind OpenAI's $3.4 billion annual revenue, with notable clients including Bridgewater, Brave, Slack, and DuckDuckGo.

Looking ahead: Anthropic is betting on ecosystem building and practical tools rather than just model capabilities to attract enterprise customers in an increasingly competitive AI market.

The catch: While incrementally better on benchmarks, the model doesn't solve fundamental AI challenges like hallucinations.

Source: TechCrunch

e-Commerce

Fast fashion retailer Shein confidentially files for London IPO as U.S. listing stalls

Shein pivots to London for IPO ambitions.

Why it matters: The fast-fashion giant's shift from the US to London markets signals mounting challenges for Chinese-linked companies seeking to go public in America amid geopolitical tensions.

The big picture: Shein has confidentially filed for a London IPO after its US listing stalled in November 2023, facing significant hurdles and requiring Beijing's approval for any public listing, although it still prefers US markets.

Key challenges:

- US lawmakers' concerns over forced labor allegations

- Scrutiny of tax exemption usage (de minimis rule)

- Rejection from the National Retail Federation

- Questions about the Chinese government's influence

Business context: Since 2021, Shein has been headquartered in Singapore while maintaining the majority of its supply chain in China, gaining prominence during the COVID-19 pandemic by disrupting US fashion retail with its ultra-fast, low-cost model.

Looking ahead: While seeking transparency through public listing, Shein must navigate complex regulatory environments in multiple jurisdictions while maintaining its rapid growth trajectory.

The catch: Even with London filing, IPO success is not guaranteed as regulatory and political challenges persist.

Source: CNBC

Amazon Briefing: Why more high-end beauty brands like Estée Lauder are joining Amazon

Amazon has become beauty's fastest-growing retail channel.

Why it matters: Premium beauty brands are reversing their long-held resistance to Amazon, signaling a significant shift in luxury retail strategy as the platform is set to overtake Walmart as the top beauty retailer by 2025.

The big picture:

- Amazon is projected to capture 14.5% of the US beauty market by 2025

- Beauty searches for "luxury" up 262% in two years

- Major brands like Estée Lauder and L'Oréal joining the platform

- Industry expected to reach $580 billion by 2027

Key drivers:

- 300 million global customers

- Improved brand control features

- Rising consumer trust in the platform

- Protection against unauthorized sellers

Market dynamics:

- Beauty purchases on Amazon are 2x higher than Walmart

- Competitive pressure from TikTok Shop

- Brands seeking growth amid consumer spending pressure

- Rising costs forcing retail strategy shifts

Looking ahead: More premium brands will likely join Amazon as competition intensifies and consumer shopping habits continue shifting online.

The catch: Traditional beauty retailers like Walmart and Ulta face increasing pressure as Amazon gains market share.

Source: Modern Retail

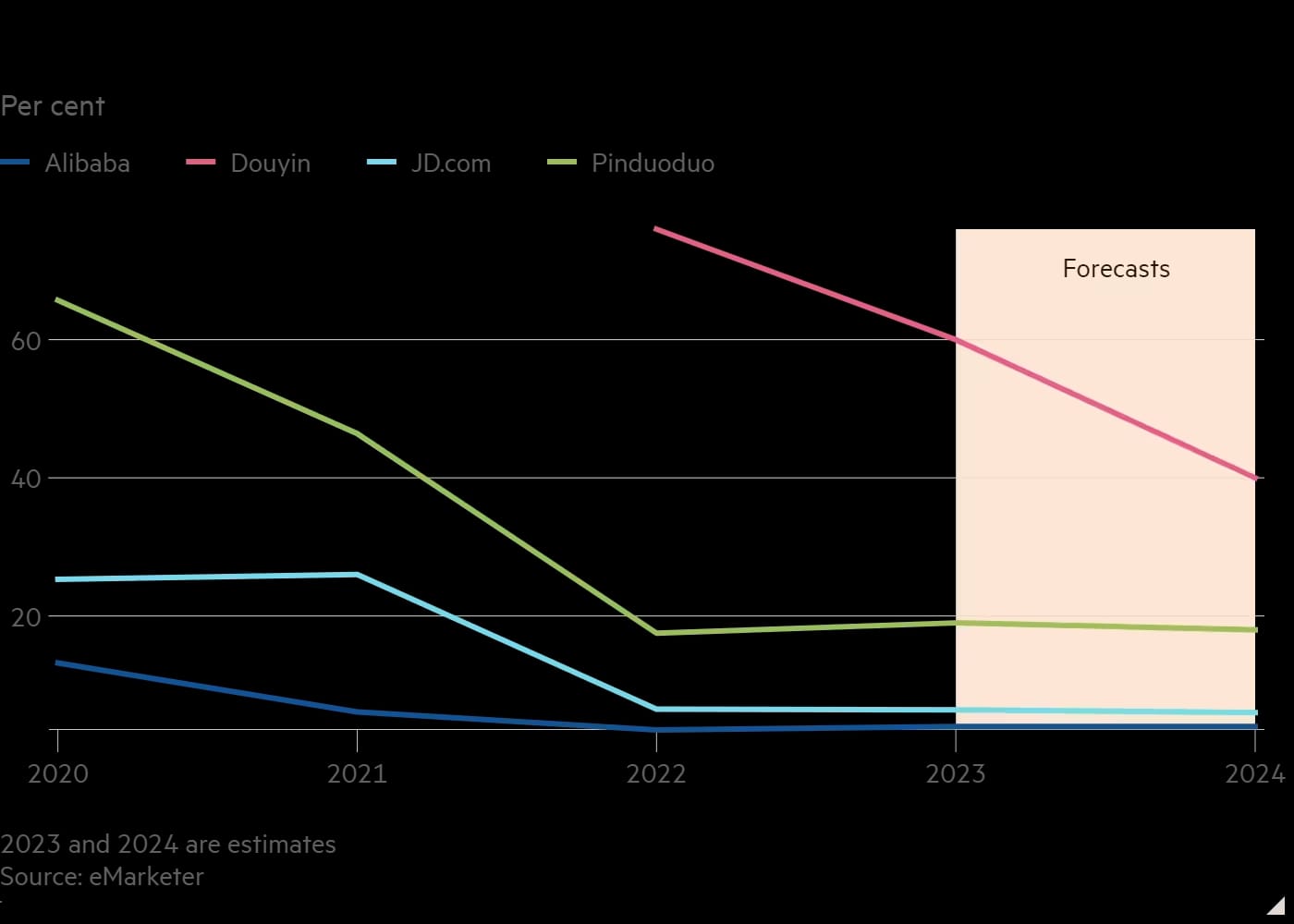

China’s shopping slump will force ecommerce laggards overseas

China's ecommerce giants face historic sales decline.

Why it matters: The first-ever drop in China's massive 618 shopping festival signals persistent consumer weakness, pushing domestic-focused platforms to seek growth internationally.

The big picture:

- Total sales fell 7% to $102 billion during 618 festival

- The drop occurred despite record discounts from major brands

- Traditional leaders are losing ground to newer players

- Stock performance reflects market share shifts:

- PDD Holdings (Temu): Up 100%

- JD.com: Down 25%

- Alibaba: Down 17%

Key trends:

- Alibaba shifting focus to international markets

- Heavy investment in global cloud infrastructure

- Aggressive price cuts to gain market share

- Growing competition in Southeast Asian markets

Market dynamics:

- Alibaba trades at 9x forward earnings vs peers at 36x

- Free cash flow down 52% from international expansion

- TikTok Shop partnership threatening regional growth

- Consumer sentiment remains below pre-pandemic levels

Looking ahead: Recovery for China's traditional ecommerce leaders increasingly depends on successful international expansion amid domestic market saturation.

The catch: Global expansion comes at a significant cost, pressuring margins even as companies seek new growth.

Source: FT

Will Amazon Live Become a Dominant Streaming Player?

Amazon Live bets big on shoppable streaming.

Why it matters: Amazon's partnership with GroupM marks a significant push into shoppable streaming content, combining entertainment with e-commerce in a way that could reshape how people shop while watching TV.

The big picture:

- New FAST Channel launches on Prime Video and Freevee

- The partnership focuses on creating original shoppable content

- 75% of US adults use mobile devices while watching TV

- Features synchronized second-screen shopping experience

Key features:

- "Shop the show" enables instant mobile purchases

- 24/7 streaming with popular creators

- Brand integrations in entertainment content

- Interactive viewer engagement

Notable partnerships:

- Unilever's Nexxus

- Danone's Silk

- Virgin Voyages

- Celebrity creators like Paige DeSorbo

Looking ahead: Success will depend on Amazon's ability to create engaging content that naturally integrates shopping without disrupting the viewing experience.

The catch: Effectiveness remains unproven in an increasingly crowded streaming market.

Source: Retail Wire

Marketing

CMO Strategies: Retail Media’s Renaissance — from Amazon to eBay

Retail media networks see major growth beyond Amazon.

Why it matters: Retail media has evolved into marketers' third most-used channel, with significant shifts in adoption and spending patterns across multiple platforms as retailers compete for advertising dollars.

The big picture:

- Usage increased from 40% to 51% year-over-year

- The market grew by $10B in 2023, reaching $119.4B.

- Expected to represent 20% of digital ad spend by 2025

- Shift from pure bottom-funnel to potential top-funnel strategy

Key trends:

- Amazon remains dominant but is losing its share

- Walmart Connect adoption doubled to 46%

- Target's Roundel is growing in parallel

- Specialty retailers launching their networks

Market dynamics:

- 86% measure success through sales metrics

- Cost remains the biggest challenge

- Measurement standardization issues emerging

- First-party data drives targeting capabilities

Looking ahead: The success of RMN will depend on solving measurement challenges and justifying increased budget allocation across platforms.

The catch: The proliferation of new networks may not be sustainable as marketers struggle to spread budgets across platforms.

Source: Modern Retail

Omnicom wraps Cannes with an Instacart API deal to buy directly off influencer content

Omnicom streamlines social commerce with the Instacart deal.

Why it matters: The first-of-its-kind partnership connects creator content directly to shopping carts, potentially revolutionizing how influencer marketing drives sales.

The big picture:

- Integration with Instacart Developer Platform (IDP)

- Access to 1,500+ retailers across 85,000 stores

- Same-day fulfillment capability

- Launch planned for fall 2024

Key features:

- Direct shopping from creator content

- Cross-platform compatibility

- Full attribution tracking

- Instant cart addition from any social platform

Market context:

- Global influencer marketing: $34B

- U.S. influencer spending: $26.1B

- Growing demand for seamless shopping

- Traditional channels lack similar measurement

Looking ahead: Through clearer attribution and sales tracking, success could strengthen influencers' position as a legitimate media channel.

The catch: Effectiveness will depend on creator content quality and consumer adoption of the integrated shopping experience.

Source: DigiDay

Asia

Vietnam’s Sendo bets on groceries to revive ecommerce fortunes

Sendo shifts focus to online grocery in Vietnam.

Why it matters: Sendo, once a leading marketplace, now trails behind Shopee, Lazada, and TikTok Shop, its shift to groceries shows how local players carve out niches to compete with regional giants.

The big picture:

- Marketplace sales dropped to 0.1% market share

- The new grocery unit handles 50 tonnes daily

- Serves 10,000 customers per day

- Network of 5,000 pickup partners

Key strategy shifts:

- First-party retail model vs marketplace

- Focus on fresh food delivery

- Next-day delivery optimization

- Limited but targeted inventory

- No marketing spend approach

Business context:

- Raised $130M in past funding

- Expects marketplace profitability by end-2024

- Plans local IPO within 5-7 years

- Operates in Hanoi and Ho Chi Minh City

Looking ahead: Success depends on achieving scale in the thin-margin grocery business while managing complex logistics.

The catch: Regional players continue to dominate Vietnam's broader e-commerce market

Source: Tech in Asia

Vietnam mulls VAT on imported goods sold on ecommerce sites: report

Vietnam considers new tax on cross-border e-commerce.

Why it matters: The proposed VAT on imported goods could reshape Vietnam's e-commerce landscape and protect local businesses from the flood of Chinese imports that are currently exempt from taxes.

The big picture: Following the regional trend of tighter regulations

- 4-5M items shipped daily from China

- $45-63M daily import value

- Current tax exemption: Under $39

Regional context: Growing protection for local sellers

- Thailand: 7% VAT since May 2024 (source)

- Philippines: VAT on digital services pending (source)

- Indonesia: Ban on imports under $100 (source)

Key numbers:

- Individual orders: $3.90-$11.70

- Major platforms affected include Shopee, Lazada, and Tiki.

Looking ahead: Implementation would align Vietnam with Southeast Asian efforts to level the playing field between domestic and foreign sellers.

The catch: It could impact platforms' growth and raise costs for price-sensitive consumers.

Source: Tech in Asia

Comments ()