TRD Issue 79 - Briefing: Financial Firms Join Ad Race, Amazon Sellers Adapt, as APAC Embraces Seamless Retail

From fintech's ad ambitions to Amazon's fee shake-up: How retailers and platforms find new revenue streams as APAC retail evolves toward seamless commerce.

Hello Subscribers,

The retail media landscape is getting pretty crowded these days. Banks and financial services are diving into the ad game, leveraging their treasure trove of consumer spending data - something even tech giants like Meta and Google can't fully access. Meanwhile, Amazon sellers are doing what they do best: adapting. As new fee structures squeeze their margins, they're getting creative with inventory management and exploring alternative sales channels.

Shein's potential London listing is particularly intriguing as it diversifies beyond fast fashion and builds warehouse capacity to cut delivery times. Speaking of evolution, TikTok's new AI avatar feature could be a game-changer for brands looking to scale their content across markets and languages - though the platform's uncertain future in the US adds an interesting twist. And in APAC, we're seeing a fascinating shift toward "seamless commerce" that goes beyond traditional omni-channel, pushing retailers to rethink everything from store layouts to digital integration.

Let's dive into this week's stories about how retail is transforming - and who's leading the charge.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit 91app.com.

Marketing

Even financial services businesses want a piece of the ad pie now

Financial giants are becoming ad sellers.

Why it matters: Banks and fintech companies leverage their massive customer data and purchase insights to build advertising networks, potentially reshaping the $140 billion retail media landscape.

By the numbers:

- Retail media spending is expected to hit $140B in 2024 (+21.8% YoY)

- PayPal processes 6.5B payments from 400M customers quarterly

- Klarna reaches 42.8M U.S. users (≈20% of digital buyers)

Key players making moves:

- Klarna: Launched a comprehensive ad suite that includes in-app, programmatic, and creator programs.

- PayPal: Hired former Uber ad chief Mark Grether to lead a new ad initiative

- JP Morgan Chase: Entering the ad space

The edge: Financial firms claim superior purchase data compared to tech giants:

- Full-funnel attribution

- Actual purchase behavior vs. just clicks

- Cross-merchant spending insights

Yes, but: Privacy concerns loom as financial institutions look to monetize sensitive customer data.

What's next: Global retail media spend is projected to reach $165.9B in 2025, representing 18.5% of total digital ad spend.

Source: Digiday

Amazon Briefing: As competition grows, sellers invest heavy — and early — in Prime Day advertising

Sellers are starting Prime Day prep earlier and spending more on diverse ad channels as competition intensifies.

Why it matters: With 375M+ items sold during Prime Day 2023, the stakes are massive for third-party sellers, who make up 60% of Amazon's marketplace sales.

By the numbers:

- 38% of sellers prioritize external traffic to listings (survey)

- 60% increase in streaming TV ad investment YTD (Brett Bardsley, Pattern)

- Amazon ad revenue: $47B in 2023

Key changes in 2024:

- Earlier preparation (starting in January)

- Expanded ad channels (streaming, social media, Reddit)

- New challenges from Amazon's fee structure

Smart moves by sellers:

- Leveraging streaming platforms with shopping QR codes

- Tapping into Meta and Snap direct buying partnerships

- Testing emerging platforms like Reddit for cost-effective reach

What's working: One vitamin brand saw a 166% lift in awareness through streaming campaigns

Yes, but: Rising costs are squeezing margins:

- Increased shipping costs

- Higher advertising expenses

- Growing cost of goods

What's next: Amazon plans to roll out shoppable ad formats for Prime Video, potentially changing sellers' advertising strategies.

Source: Modern Retail

AI

Perplexity AI searches for users in Japan, via SoftBank deal

AI search engine Perplexity partners with SoftBank to expand in Japan through free premium subscriptions.

Why it matters: The deal signals how telecom carriers leverage AI partnerships to attract customers while AI companies seek international growth through established networks.

By the numbers:

- Perplexity valuation: $1B (doubled in 3 months)

- Current fundraising target: $250M at $2.5-3B valuation

- Subscription pricing:

- iOS: ¥3,000/month or ¥30,000/year

- Web: $20/month or $200/year

Key details:

- Starting June 19: Free 1-year Perplexity Pro subscriptions for Y!mobile and LINEMO customers

- Users can choose their preferred LLM for searches

- Features include advanced search capabilities and AI-powered image generation

Strategic context:

- Similar to the Deutsche Telekom partnership in Germany

- Part of SoftBank's broader AI push, including:

- Vision Fund's AI startup interests

- $100B AI chip venture plans

- SB Intuitions (Japanese LLM venture)

Yes, but: Perplexity faces ongoing challenges with publishers over content attribution and revenue sharing.

What's next: Partnership could expand beyond subscriptions to deeper AI service integration.

Source: TechCrunch

TikTok ads will now include AI avatars of creators and stock actors

TikTok launches AI avatars and dubbing tools for ads, enabling creators and brands to scale content globally

Why it matters: With 61% of users making purchases through TikTok, these AI tools could dramatically expand advertising reach and effectiveness across languages and markets.

New features include:

- Custom Avatars: AI-generated versions of creators/spokespersons

- Stock Avatars: Pre-built AI characters using licensed actors

- AI Dubbing: Translate into 10 languages, including English, Japanese, Korean, and Spanish.

- Key safeguards: Creators control likeness usage, licensing terms, avatar access, and pricing.

Business context:

- Part of the "TikTok Symphony" AI ad suite launched in May

- Aims to help marketers with:

- Scriptwriting

- Video production

- Asset enhancement

Yes, but:

- Raises AI likeness concerns similar to the 2023 Hollywood strikes

- TikTok faces potential U.S. ban if ByteDance doesn't sell within a year

What's next: These tools could reshape how brands approach global marketing campaigns, particularly in multilingual markets.

Source: TechCrunch

e-Commerce

How Amazon brands are adjusting to a new normal as fee changes squeeze margins

Amazon sellers face profit squeeze from new fees, forcing strategic business model adjustments.

Why it matters: Amazon's fee structure changes are reshaping how third-party sellers operate, potentially affecting product availability and consumer prices.

Key fee changes:

- New surcharge for non-distributed inventory shipments

- Penalties for low inventory levels

- Partial offset through reduced fulfillment fees

By the numbers:

- Shipping costs up to $0.55 per unit for some sellers

- FBA fee reduction of only $0.17

- 35% of sellers cite increased costs as the top concern

- 300% increase in single-product sellers (2023 vs 2022)

How sellers are adapting:

- Reducing product catalogs, one brand cutting from 300 to 200 items.

- Raising prices, i.e., $2/lb increase on coffee products.

- Exploring alternative platforms, 20% plan TikTok Shop expansion in 2024.

- Switching to Fulfilled by Merchant for slower items

Yes, but: Some sellers report unexpected benefits:

- Price increases lead to higher sales

- Operational improvements from inventory optimization

What's next: Expect continued marketplace evolution as sellers test new strategies and platforms to maintain profitability.

Source: Modern Retail

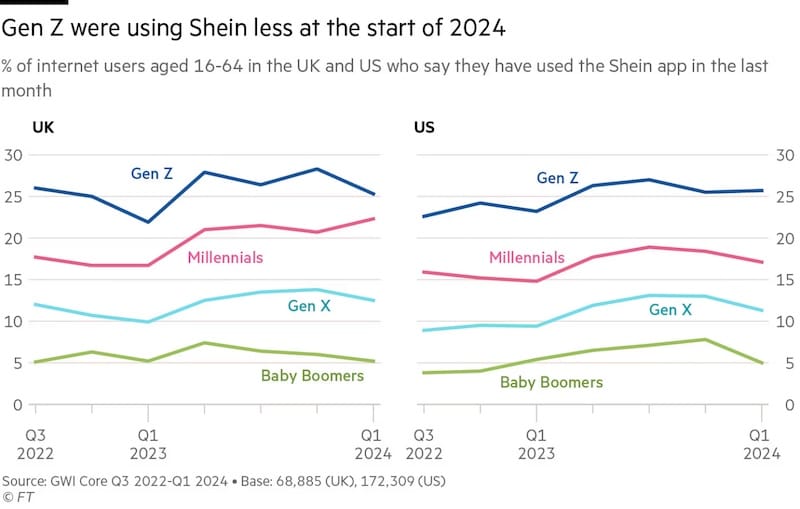

Shein chases new revenue streams as it prepares for London listing

Shein seeks to diversify beyond fast fashion and improve logistics ahead of a potential London IPO.

Why it matters: Valued at over $60B and generating $2B+ in profits last year, Shein must prove it can sustain growth to attract investors in a challenging market.

By the numbers:

- The fast-fashion giant captures 25% of Gen Z shoppers in US/UK markets, though its marketplace represents only 10% of total sales.

- Current delivery times stretch to 7-10 days for US customers, significantly longer than competitors' same-day options.

Key business evolution:

- Shifting focus from the US to the London listing

- Expanding into furniture and electronics

- Partnering with Forever 21 for returns

Mounting challenges: Warehouse expansion has stalled in the US while shipping costs from China continue to rise. The company's marketplace struggles to attract merchants, and global app usage has plateaued. Meanwhile, its competitor, Temu, is rapidly gaining market share.

Yes, but: Chinese regulatory hurdles and uncertain IPO market conditions could further complicate Shein's expansion plans.

What's next: Success depends on Shein's ability to improve delivery times and diversify product offerings while maintaining its core fashion business in an increasingly competitive market.

Source: FT

How TikTok-viral brands are switching gears amid threat of U.S. ban

TikTok-viral brands are diversifying their marketing channels amid uncertainty over a potential US ban.

Why it matters: With TikTok facing a possible shutdown within a year, brands that built their success on the platform must find alternative growth strategies to protect their revenue streams.

Success at stake: NightCap's story illustrates the platform's power - a single 8-second video generated $40,000 in two weeks, with TikTok now driving $4 million (80%) of their total sales.

Key adaptation strategies:

- Expanding to YouTube Shorts and Instagram Reels

- Testing streaming platform advertising

- Moving into brick-and-mortar retail

- Increasing investment in Meta and Google ads

Platform challenges: Brands report different content requirements across platforms, with TikTok favoring casual content, while Instagram demands more polished presentations. Achieving viral success proves harder on alternative platforms.

Yes, but: Many brands aren't abandoning TikTok yet. Cakes Body reports strong performance on TikTok Shop, projecting it could represent 20% of revenue by year-end.

What's next: Brands are building an omni-channel presence while maximizing TikTok's remaining potential, preparing for any outcome of the ByteDance deadline.

Source: Modern Retail

Asia

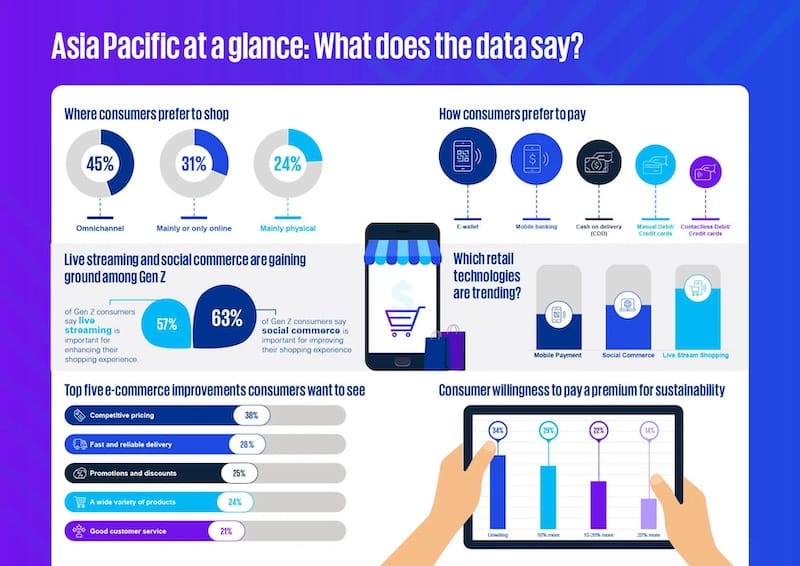

The future of ‘seamless commerce’ in APAC

APAC retailers must shift from traditional omni-channel to seamless commerce as consumer expectations evolve.

Why it matters: A KPMG survey of 7,000 consumers across 14 APAC markets reveals changing shopping preferences, with 45% favoring omnichannel experiences. This signals a crucial transition period for retailers.

Market dynamics: Consumer priorities show clear patterns:

- Competitive pricing leads at 57%

- Product variety follows at 54%

- Fast delivery ranks third at 46%

Regional variations tell the story:

- Japan still prefers physical stores

- Indonesia leads online shopping

- The Philippines (61%) and India (54%) show the strongest omni-channel adoption

Future challenges: Economic uncertainty and Gen Z preferences are reshaping retail. Key focus areas include:

- Supply chain transparency

- AI-driven customer experiences

- Sustainable business practices

What's next: Retailers must deliver consistent experiences across all channels while adapting to regional preferences and economic pressures. Success depends on balancing competitive pricing with enhanced digital capabilities.

Source: Retail in Asia

Coupang fined $102 mn for alleged search algorithm manipulation

South Korea fines Coupang for allegedly manipulating search results to favor its private label products.

Why it matters: As South Korea's largest e-commerce platform with 31.11M monthly active users, Coupang's practices significantly impact market competition and consumer choices.

Key allegations:

- Algorithm manipulation benefited 64,250 private-label products.

- 72,614 fake reviews posted by 2,297 employees

- Private label sales grew to 70% of total sales by 2022

Coupang's response:

- Filed immediate injunction

- Threatens to halt Rocket Delivery service

- Canceled $3T won logistics center groundbreaking

- Claims that the fine is unprecedented in size

Yes, but: Industry observers suggest Coupang's strong opposition may be a legal strategy rather than an operational necessity.

What's next: Case heads to prosecutors while Coupang's planned investments and delivery services hang in the balance.

Source: KED Global

Mapping Singapore’s leading D2C brands

Despite the funding slowdown, Singapore's D2C brands are bypassing Southeast Asia to target US expansion.

Why it matters: With Singaporeans spending US$785 on average for online shopping (2x regional average), local D2C brands need larger markets to scale. VC funding dropped from US$61.4M in 2022 to US$27.7M in 2023.

Success stories tell the strategy:

- Castlery: Hit US$180M revenue, driven by US growth

- Allies of Skin: Secured US$20M for US expansion

- Skin Inc: 65% of volume from the US market

Market dynamics:

- Beauty and healthcare brands lead in funding success

- Fashion faces challenges (Love Bonito: US$8.2M loss in 2021)

- US listing requires a US$2-3B market cap threshold

Yes, but: Growth barriers include:

- Limited local market size

- High product price points

- Challenging IPO environment

What's next: Success hinges on brands' ability to navigate US market entry while managing costs during the current funding slowdown.

Source: Tech in Asia

Comments ()