TRD Issue 77 - Briefing: Shareable AI Searches, Foot Locker's Optimism, and Taiwan's E-wallet Race

AI revolutionizes search, PayPal enters the ad market, and Asian e-commerce heats up. Perplexity AI, Foot Locker, Coupang, and digital payments shape retail's future.

Hello Subscribers,

This week, we've seen fascinating developments highlighting the ongoing dance between technology, competition, and consumer behavior.

Perplexity AI is shaking things up with a new feature that turns your searches into shareable pages. They're taking a page out of Arc's playbook with their twist. This could be a game-changer for how we share and consume information online.

Meanwhile, Foot Locker is expressing optimism about Nike in the world of sneakers and sportswear. They believe Nike is "going back on offense," which could signal exciting times for companies and sneaker enthusiasts. This positive outlook comes as Nike began rebuilding its partnership with retailers in late 2023, following a reversal of its D2C strategy.

PayPal is making waves, too. They plan to dive into the ad business, leveraging data from their millions of shoppers. It's a bold move that could reshape our thoughts about payment platforms and targeted advertising.

Over in Taiwan, the electronic payment market is heating up. JKOPay and iPASS surpassed 6 million users, with PX Pay Plus on their heels. It's a testament to how quickly digital payments are becoming the norm in many parts of Asia.

Speaking of Asia, there's quite a stir in South Korea's e-commerce scene. Chinese competitors are launching a fierce offensive, giving market leader Coupang a run for its money. Coupang has fallen into the red for the first time in seven quarters. It's a stark reminder of how quickly the competitive landscape can shift in the digital age.

Now, let's dive deeper into these stories. Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

AI

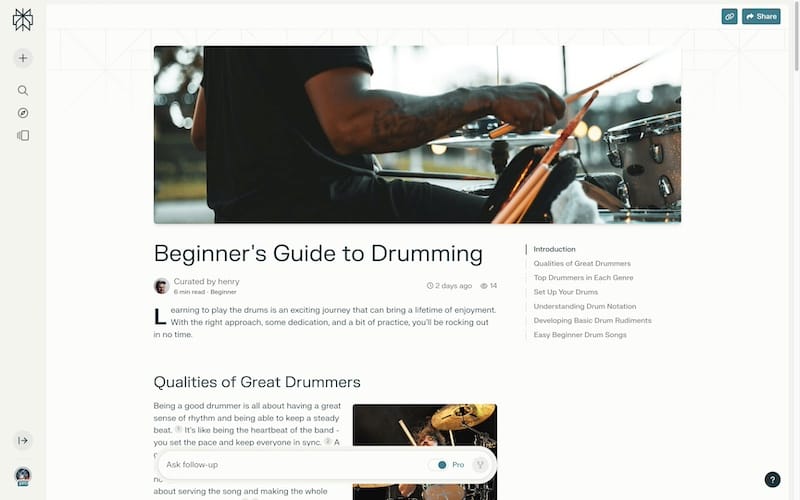

Perplexity AI's New Feature Will Turn Your Searches into Shareable Pages

Why it matters: Perplexity AI's new Pages feature allows users to create and share AI-generated reports, articles, and guides, potentially disrupting content creation and information sharing in the tech industry.

The big picture:

- Perplexity Pages generates detailed, visually appealing content from user prompts.

- Users can customize audience type, edit sections, and add media.

- Pages are searchable on Google and shareable with others

- The feature aims to make Perplexity a more versatile research tool

Key details:

- Available to both free and paid users

- The creation process takes a couple of minutes

- Pages can be created from existing conversation threads

- Initially rolling out to a limited number of users

Between the lines: Perplexity sees this as information curation rather than pure AI content generation, emphasizing the user's role in shaping the final product.

What to watch: How this feature impacts blogging, journalism, and the broader web ecosystem.

Source: TechCrunch

OpenAI Signs 100K PwC Workers to ChatGPT's Enterprise Tier as PwC Becomes Its First Resale Partner

Why it matters: This partnership marks OpenAI's largest enterprise deal and establishes PwC as its first resale partner, potentially reshaping how AI is adopted and sold in the corporate world.

The big picture:

- PwC has become OpenAI's biggest customer, with 100,000 users, and will resell ChatGPT Enterprise to other businesses

- The deal could expand to 328,000 PwC employees globally

Key details:

- ChatGPT Enterprise tier, launched in August 2023, currently has about 600,000 users across 93% of Fortune 500 companies.

- It offers faster, unlimited interactions and customizable models.

Between the lines:

- PwC sees this as a growth opportunity, not a job threat.

- The partnership could help OpenAI scale its enterprise sales

- Pricing details weren't disclosed, but they likely involve significant volume discounts.

What to watch:

- How this partnership influences AI adoption in other industries

- OpenAI's expansion of its partner ecosystem for enterprise sales

- PWC's ability to leverage this partnership for new consulting opportunities

Source: TechCrunch

Retail

Foot Locker: 'I Think It's Fair to Say Nike's Going Back on Offense'

Why it matters: Foot Locker's Q1 results and strategic initiatives signal a potential turnaround, with implications for the broader footwear retail sector.

The big picture:

- Q1 sales were down 2.8%, and comps were down 1.8%, a slower decline than the previous year.

- Net income plunged 78% to $8 million.

- The full-year outlook was maintained: sales were 1% to +1%, and comps were +1% to +3%.

Key initiatives:

- Store fleet transformation

- Net 33 store closures in Q1

- Plan for a 4% smaller footprint by fiscal year-end

- Accelerating store refreshes: 100+ per quarter from Q2

- Off-mall penetration up to 39%, aiming for 50%.

- Brand diversification

- Adding On and Hoka to more stores

- Hoka business doubled in Q1

- Nike partnership revival

- Nike assortment expected to grow from Q4

- Collaborating on multiyear growth plans

- FLX loyalty program relaunch in U.S. (Q2)

Between the lines: Foot Locker is betting on improved store experiences, off-mall locations, and a revitalized Nike partnership to drive growth.

What to watch: Execution of planned initiatives and their impact on sales and margins in coming quarters.

Source: Retail Dive

Is Target Selling Its Excess Inventory on eBay & Poshmark?

Why it matters: Target's apparent strategy for offloading excess inventory through third-party platforms reveals new retail inventory management approaches.

The big picture:

- "Bullseye Deals" accounts on eBay and Poshmark sell Target merchandise at discounted prices.

- The items are available in different conditions, such as new, open box, and pre-owned.

- Liquidity Services, Inc., a reverse supply chain company, manages these accounts.

Key insights:

- Inventory management challenge

- Retail returns hit $613.94 billion in 2023, 8.5% of total retail sales.

- Retailers struggle with unsellable inventory due to returns and other factors

- Target's approach

- Uses third-party to sell excess inventory, including private label items.

- Allows control over liquidation of owned brands

- Avoids potential brand damage from clearance sales

- Industry perspective

- It is unusual for retailers to use e-commerce seller accounts for excess inventory.

- The strategy helps avoid landfill waste

- Provides an alternative to traditional off-price retail channels

Between the lines: This approach allows Target to discreetly manage excess inventory while maintaining brand integrity and exploring new sales channels.

What to watch: How other retailers might adopt similar strategies and the impact on the off-price retail sector.

Source: Modern Retail

e-Commerce

As More Brands Build Out Corporate Gifting Programs, New B2B Solutions Are Emerging

Why it matters: The corporate gifting industry is expected to hit $306 billion by the end of 2024, offering brands a significant opportunity for customer acquisition and revenue diversification.

The big picture:

- D2C brands are increasingly building out corporate gifting programs

- New B2B solutions are emerging to streamline the process

- Corporate gifting offers a way to reach new customer segments

Key insights:

- Industry growth: The corporate gifting market is projected to reach $306 billion by the end of 2024, with D2C brands such as Homesick and Bombas focusing on expanding their corporate gifting businesses.

- Challenges for brands

- Managing bulk orders can be time-consuming

- Customization and logistics pose difficulties

- Existing e-commerce platforms not optimized for large orders

- New solutions

- Zest launches white-label corporate gifting storefront

- Integrates with Shopify for real-time inventory management

- Automates up to 70% of corporate gifting orders

- Brand strategies

- Cariuma: Using corporate gifting to reach new demographics

- Caftari: Generating 25% of sales from corporate gifts in the first year

Between the lines: Corporate gifting offers brands a way to diversify beyond traditional digital customer acquisition strategies.

What to watch: How brands adopt new technologies to streamline corporate gifting and the impact on customer acquisition costs.

Source: Modern Retail

Marketing

Exclusive | PayPal Is Planning an Ad Business Using Data on Its Millions of Shoppers

Why it matters: Advertisers should note this opportunity as PayPal holds extensive purchasing data from 400 million users, suggesting the potential for advanced targeting and advertising across multiple channels. This aligns with PayPal's plans to expand ad serving beyond its platforms.

The big picture:

- PayPal aims to boost growth by creating an ad network using customer data

- The company processed 6.5 billion payments from ~400 million customers in Q1 2024

- This follows a trend of companies leveraging customer data for ad targeting

Key developments:

- Leadership appointments: Mark Grether, former Uber ad chief, now leads the new PayPal Ads division, and John Anderson, who joined as SVP and GM of the consumer group. They both report to Diego Scotti, former Verizon CMO.

- Initial ad products

- Advanced Offers: AI-driven, personalized promotions for merchants.

- Testing with eBay and Zazzle

- Some untargeted merchant offers on Venmo

- Future plans

- Targeting non-endemic advertisers

- Potential for higher ad rates due to detailed consumer data

- Opt-out option for consumers

Between the lines: As PayPal explores new growth avenues amid recent financial challenges, other financial services companies might also consider entering retail media.

What to watch:

- Impact on PayPal's bottom line and stock performance

- Consumer reaction to increased ad presence, especially on Venmo.

- Potential regulatory scrutiny over data usage

Source: WSJ

Asia

Race for Electronic Payment Market: JKOPay and iPASS Surpass 6 Million Users, PX Pay Plus Close Behind

Why it matters: Taiwan's electronic payment and digital banking sectors are experiencing significant growth and changes, with implications for the broader fintech and retail industries.

The big picture:

- Total non-cash payment transactions in Taiwan reached NT$69.12 billion in 2023

- 10 specialized and 20 concurrent e-payment institutions operating in Q1 2024

- 3 internet-only banks expanding their services

Key insights:

- E-payment market leaders

- JKOPay: 6.47 million users (7.3% YoY growth)

- iPASS: 6.28 million users (11.1% YoY growth)

- PX Pay Plus: 4.75 million users (51.3% YoY growth)

- Third-party payment developments

- 7 providers with daily average balances over NT$1 billion in 2023

- IPO trend among third-party payment companies

- Uber Eats is acquiring Foodpanda Taiwan, potentially qualifying for an e-payment license.

- Strategic moves: Cross-border payment partnerships, such as those with Japan's PayPay and internet-only banks, are venturing into wealth management, mortgages, and forex expansion.

What to watch: The Uber-Foodpanda merger's effect on the e-payment sector, the journey of internet-only banks toward profitability, and the continued global growth of Taiwanese e-payment services encapsulate significant industry movements.

Source: CW

Korea's BC Card Starts QR Code Payment Service in Malaysia

Why it matters: This move signifies growing cross-border payment integration in Asia and highlights the expansion strategies of South Korean fintech companies.

The big picture:

- BC Card introduced its Paybooc QR code payment service in Malaysia

- Partnership with PayNet, Malaysia's national payments network.

- Part of BC Card's broader Southeast Asian expansion strategy

Key details:

- South Korean Paybooc customers can now use their service in Malaysia, reducing currency exchange hassles, costs, and risks of credit card cloning and privacy leaks.

- BC Card and PayNet are collaborating to launch a Malaysian QR code payment service in South Korea, focusing on expanding the scan-to-pay infrastructure.

- BC Card aims to expand its global footprint by offering payment services in Indonesia and Vietnam and plans to extend services to foreign visitors in South Korea.

What to watch: The implementation and adoption of the new service in Malaysia, along with the launch of Malaysian QR payments in South Korea and BC Card's expansion in Southeast Asia, are progressing.

Source: KED Global

Grab to End E-Wallet Service in Vietnam from July 1

Why it matters: The exit of Grab's e-wallet service signals broader challenges and evolving dynamics in Vietnam's digital payments landscape, with implications for fintech players and traditional banks.

The big picture:

- Grab will discontinue e-wallet service in Vietnam from July 1, 2024.

- 50 intermediary payment service providers compete in a crowded market

- 36.23 million active e-wallets as of end-2023, expected to reach 50 million by end-2024.

Key insights:

- Market concentration: Smaller e-wallets face competition challenges with dominant players like MoMo, Shopee Pay, and VNPay, where user numbers are primarily concentrated.

- Profitability challenges

- Most e-wallet payment services struggle to be profitable

- E-wallets targeting niche products or specific ecosystems

- Shift towards financial services (e.g., MoMo's postpaid wallet service) for higher profits

Competition with banks:

- Mobile banking ubiquitous in Vietnam, challenging e-wallet growth

- Banks enter the market once e-wallets achieve scale

- E-wallets need to transition to financial services to remain competitive

Future trends: As bank apps improve, there may be a decline in the use of e-wallets for payments, yet e-wallets are expected to expand their financial services, including deposits, investments, and loans, leading to anticipated consolidation through mergers and partnerships.

What to watch: The consolidation and emergence of dominant super apps alongside e-wallet strategies for profitability and differentiation are prompting banks to respond to e-wallet competition and fintech innovations.

Source: Tech in Asia

Chinese Competitors Launch Fierce Offensive in E-Commerce Giant South Korea; Market Leader Coupang Falls into the Red

Why it matters: The shifting dynamics in South Korea's mature e-commerce market highlight broader trends in Asian digital retail, including the growing influence of Chinese players and the challenges of maintaining profitability.

The big picture: In Q1 2024, Coupang reported its first loss in 7 quarters, as Chinese competitors such as AliExpress and Temu rapidly gained market share in the increasingly saturated South Korean e-commerce market, where online sales now constitute 30% of retail.

Coupang's challenges:

- Q1 2024: $71 billion in sales (up 23% YoY), but $24 million net loss.

- Investing heavily in AI-controlled robotics and logistics infrastructure

- Acquired Farfetch for $500 million to expand luxury offerings

Chinese competition:

- AliExpress: 8.58 million users in April 2024 (doubled YoY)

- Temu: 8.23 million users, rapid growth.

- Offering meager prices, attracting price-sensitive consumers.

Market dynamics:

- Naver (2nd largest player) closely trails Coupang with a 20% market share

- Intense competition leads to price wars and new service offerings

- The government is considering regulations on direct overseas purchases

Coupang's strategy:

- Focusing on fresh food delivery and prepared meals

- Investing 3 trillion won in logistics by 2027

- Aiming to become an essential "living infrastructure" for consumers

What to watch: Exploring the regulatory responses to Chinese e-commerce platforms, Coupang's success in maintaining market share and achieving profitability, and the potential for consolidation within the Korean e-commerce market.

Source: NIKKEI

Comments ()