TRD Issue 76 - Briefing: Elon’s xAI, Retail Price Wars, Recovery Signs, and Digital Disruptions

Retailers slash prices as foot traffic rebounds. Amazon leads online, but Walmart gains ground. DTC brands pivot strategies. Adani eyes e-commerce expansion in India.

Hello Subscribers,

Starting this issue, we are experimenting with a new writing style called Smart Brevity by Axios.

It is a communication formula designed to present information in a clear, engaging, and memorable format. Although it took us longer to write, we believe it will ultimately save you time and provide deeper insights. Let’s see how it goes, and we will share our thoughts after a few issues.

Let’s return to the topic.

Major U.S. retailers like Target and Walmart are slashing prices on thousands of items, from groceries to household staples, in response to persistent inflation. This move signals a potential end to years of price increases and highlights the growing pressure on consumers' wallets.

On a more optimistic note, foot traffic in prime retail districts is expected to fully recover to pre-pandemic levels by the third quarter of this year, according to a report from CBRE. This rebound suggests that brick-and-mortar stores are still very much in the game despite the e-commerce boom.

Speaking of e-commerce, while Amazon continues to dominate online sales, Walmart is making impressive strides. Walmart+ subscribers spend nearly twice as much annually as Amazon Prime members, showcasing the effectiveness of Walmart's omnichannel strategy.

In the direct-to-consumer space, brands grapple with soaring customer acquisition costs and more discerning shoppers. This has led to a shift in marketing strategies, focusing on brand storytelling and unique value propositions.

Lastly, India's retail landscape could see a shake-up as the Adani Group's eyes expand into e-commerce and digital payments. This move by the conglomerate could potentially disrupt the country's fast-growing digital economy.

Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

AI

Elon Musk's xAI Valued at $24 Billion After Latest Fundraising Round

Elon Musk's AI startup - xAI, announced that it has raised $6B, valued at $24B.

Why it matters: The massive funding round makes xAI the second most valuable AI startup after OpenAI. Meanwhile, this could help Musk catch up with OpenAI, which he co-founded and left in a dispute.

- Funding doubled from the initial $3B target due to high demand.

- Investors include Sequoia Capital, Andreessen Horowitz, who also backed OpenAI, and Saudi Prince al-Waleed bin Talal.

- Total fundraising is now at $7B, approaching OpenAI's $10B from Microsoft.

xAI's competitive edge

- Access to valuable data from Musk's other companies (X, Tesla).

- Partnership with Oracle for computing resources.

- Grok chatbot is already available to X subscribers.

What's next: xAI plans to use funds to bring products to market, build infrastructure, and accelerate R&D.

Bottom line: While playing catch-up, xAI's massive funding and Musk's ecosystem advantages position it as a serious contender in the AI race.

Source: WSJ

Retail

Biggest US Retailers Cut Prices as Inflation Hits Shoppers

Target and Walmart slash prices, signaling a retail shift.

Why it matters: Major retailers are cutting prices on thousands of items, indicating a potential end to inflation and a new focus on attracting budget-conscious consumers.

- Target is lowering prices on 5,000 items, including household staples.

- Walmart increased "rollbacks" on grocery items by 45% year-over-year.

- Both moves are likely to influence pricing across the retail sector.

Economic indicators:

- Target reported a 3.7% drop in same-store sales.

- Walmart saw a 3.8% increase in comparable sales, driven by transactions, not prices.

- 71% of Americans view economic conditions negatively (FT-Michigan Ross poll).

Industry trends:

- Retail prices leveling off after years of increases.

- Consumers show fatigue after prolonged inflation.

- Other retailers (Lowe's, Macy's) are reporting sales declines.

Yes, but: Not all retailers have been focused on price cuts. Dollar Tree has been raising prices and adding new items.

Bottom line: Major retailers are adjusting strategies to attract price-sensitive shoppers, potentially marking the end of widespread price increases in the sector.

Source: FT

Foot Traffic Expected to Rebound to Pre-Pandemic Levels: Report

Foot traffic poised to surpass pre-pandemic levels by 2025

Why it matters: The rebound in physical store visits signals a strong recovery for brick-and-mortar retail despite the e-commerce boom during the pandemic.

- Foot traffic is expected to reach 2019 levels by Q3 2024. (CBRE report)

- Offline sales surged to 78.1% in 2022, while digital growth slowed.

- Physical stores drive digital sales: opening a store temporarily boosts online sales by 6.9%. (ISCS report)

Challenges for retailers:

- Rising costs: Rent for prime retail is up 9% in the Americas and 4.8% globally.

- Low availability of prime retail space.

- Need to balance online and offline strategies.

Industry trends:

- 70% of retail sales are digitally influenced.

- Brick-and-mortar became the primary driver of sales growth by 2022.

- Street retail offers unique experiences that can't be replicated online.

Bottom line: While e-commerce remains important, physical retail is proving resilient and essential for overall retail growth, with experts asserting it won't become obsolete.

Source: Retail Dive

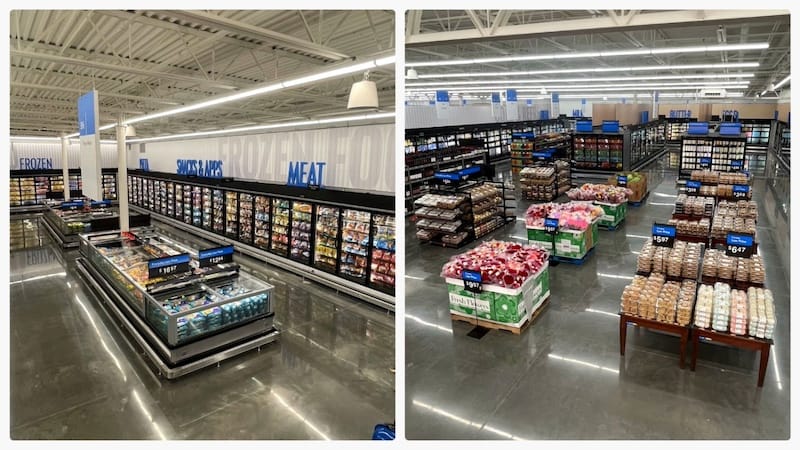

Walmart Goes Bigger with New Neighborhood Markets

Walmart is expanding the Neighborhood Market format with larger, tech-focused stores.

Why it matters: Walmart's new Neighborhood Market stores signal a shift towards omni-channel retail, balancing in-store experience with e-commerce capabilities.

- Two new locations: Santa Rosa Beach, FL (opened) and Atlanta, GA (opening soon).

- Larger format: 57,000 sq ft, up from traditional size.

- Part of Walmart's 5-year plan to open 150 new stores.

New features:

- Expanded fresh sections and wider aisles

- Enhanced pharmacy with Health Services Room.

- Dedicated space for pickup and delivery.

Strategic drivers: Growing e-commerce sales and digital order fulfillment have improved, and there is an increased focus on fresh grocery offerings.

Industry context:

- Walmart is seeing mid-single-digit growth in grocery.

- Improved e-commerce profitability through lower fulfillment costs.

- Balancing physical expansion with digital capabilities.

Bottom line: Walmart's new Neighborhood Market prototypes demonstrate the retailer's commitment to integrating physical and digital retail experiences, particularly in the grocery sector.

Source: Retail Dive

e-Commerce

Amazon Briefing: Amazon Still Dominates Online Commerce, but Walmart Shoppers Are Spending More on Average

Amazon faces intense competition from Walmart in e-commerce.

Why it matters: Walmart's higher average customer spending online signals it's gaining ground on Amazon in e-commerce, particularly in groceries. (CIRP)

- Walmart+ subscribers spend $2,200/year vs. Amazon Prime's $1,100/year.

- Non-members: Walmart $1,000/year vs. Amazon $600/year.

- Amazon still leads in total e-commerce sales and Prime memberships.

Walmart's competitive edges:

- Strong grocery business, including online.

- Robust curbside pickup leveraging store network.

- Fast delivery capabilities (4.4 billion items same/next day in 2023).

Strategic similarities: They are expanding subscription perks beyond shipping, targeting affluent shoppers, and investing in advertising and streaming.

Industry context:

- Walmart doubling third-party sellers in 18 months. (Market Pulse)

- There is a high overlap of sellers on both platforms.

- Both are pushing for faster delivery times.

Bottom line: While Amazon remains the e-commerce leader, Walmart's higher average spending and grocery strength pose a significant challenge, primarily as both companies pursue similar strategies for growth.

Source: Modern Retail

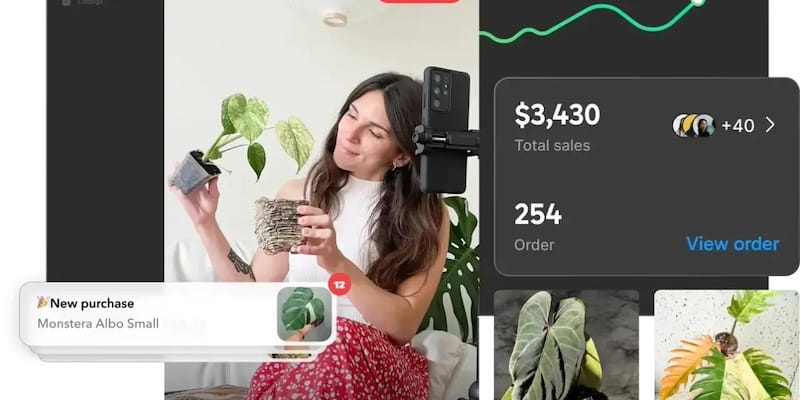

‘Definitely Not on My Bingo Card’: Plants Are the Latest Live Shopping Trend

Live shopping trend emerges for plants.

Why it matters: The unexpected rise of plant live shopping demonstrates the versatility of livestream commerce and reveals a new opportunity for retailers in the home and garden space.

Success stories:

- Steve's Leaves: $2,000-$4,000 in sales per hour-long livestream.

- Palmstreet: Revenue doubled since launching live selling.

- Whatnot: 8x increase in plant sales, 3x growth in plant sellers.

Driving factors:

- Real-time product updates (size, color, condition).

- Interactive elements (games, Q&A, advice).

- Expanded reach beyond local markets.

- Normalization of online plant shopping (e.g., Amazon's entry).

Industry impact:

- New revenue stream for nurseries and independent sellers.

- Potential for established retailers to enter the space.

- Blending of entertainment and commerce in niche categories.

Bottom line: The success of plant live shopping highlights consumer demand for interactive, visual shopping experiences, even in unexpected product categories. This trend could signal opportunities for retailers to explore live commerce in other niche markets.

Source: Modern Retail

D2C

DTC Briefing: Brands Rethink Their Marketing as Customer Acquisition Costs Soar & Shoppers Get Pickier

DTC/D2C brands adapt to the challenging customer acquisition landscape.

Why it matters: Rising costs and changing consumer behavior force D2C brands to rethink their marketing strategies and customer engagement approaches.

Key challenges:

- 25-40% increase in customer acquisition costs across channels.

- Decreased customer engagement and conversion rates.

- Longer purchase consideration cycles.

- Loss of novelty for the D2C business model.

Industry trends: Shifting from lifestyle-focused campaigns to product differentiation, mission-driven messaging is expanding and exploring new channels to engage customers before purchasing.

Bottom line: D2C brands are adapting to a more challenging acquisition environment by focusing on deeper brand storytelling, unique value propositions, and creative ways to engage potential customers throughout the consideration process.

Source: Modern Retail

Asia

India's Adani Group Plans E-commerce, Payments Ventures, FT Reports

India’s conglomerate Adani Group eyes expansion into digital payments and e-commerce.

Why it matters: The move signals Adani's ambition to diversify into consumer-facing businesses, including:

- Considering an application for a digital payments license.

- In talks for a co-branded credit card.

- Plans to offer online shopping through the government-backed ONDC platform.

- Services are to be available through the Adani One consumer app.

Market context:

- India's payments market is expected to reach $814.43 billion by 2029. (Mordor Intelligence)

- PhonePe leads with 48.9% market share, followed by Google Pay at 37.7%.

Strategic implications: Exploring diversification beyond infrastructure and energy holds the potential to leverage the existing business ecosystem, posing increased competition for established tech giants.

Recovery from short-seller report:

- Four of seven Adani companies surpassed pre-Hindenburg report levels.

- Flagship Adani Enterprises is nearing full recovery.

Bottom line: Adani Group's initiatives could reshape India's tech landscape while helping the conglomerate rebuild its image and diversify revenue streams following recent controversies.

Source: Reuters

Indonesia's Shopee Accused of Antitrust Behavior in Delivery Services

Shopee faces an antitrust probe regarding delivery services in Indonesia.

Why it matters: The ban of TikTok Shop in late 2023 and the antitrust investigation of Shopee and Lazada signal that Indonesia, the largest economy in the region, is taking regulations more seriously.

- Indonesia's antitrust agency KPPU accuses Shopee of violating competition rules.

- Shopee allegedly limited delivery service options for customers.

- One of the remaining options has a Shopee Indonesia executive on its board.

Context:

- Shopee is the market leader in Indonesia's e-commerce sector.

- KPPU is also investigating Lazada, Alibaba's Southeast Asian arm.

Potential implications: Increased regulatory scrutiny of e-commerce platforms, possible changes to Shopee's delivery service partnerships, and the impact on consumer choice and pricing in e-commerce logistics are interrelated.

What’s next: Shopee will present its defense in June, and there will be an ongoing investigation into both Shopee and Lazada.

Bottom line: This case highlights the growing tension between e-commerce platforms' efforts to control their ecosystems and regulators' concerns about fair competition, potentially setting precedents for the industry in Indonesia and beyond.

Source: Reuters

ZOZO's Cosmetics Sales Exceed 10 Billion Yen for First Time, Chasing @cosme

Why it matters: ZOZO's rapid growth in cosmetics e-commerce signals increasing competition in Japan's online beauty market.

- ZOZO's cosmetics sales reached 11.3 billion yen in FY2024, up 24% year-over-year.

- This is the first time exceeding 10 billion yen since launching ZOZO Cosme in March 2021.

- It is targeting 15% growth to 13 billion yen in FY2025.

Strategies driving growth:

- Expanding high-end brand offerings (e.g., PRADA BEAUTY).

- Adding customer review features.

- Planning to add more affordable K-beauty and drugstore brands.

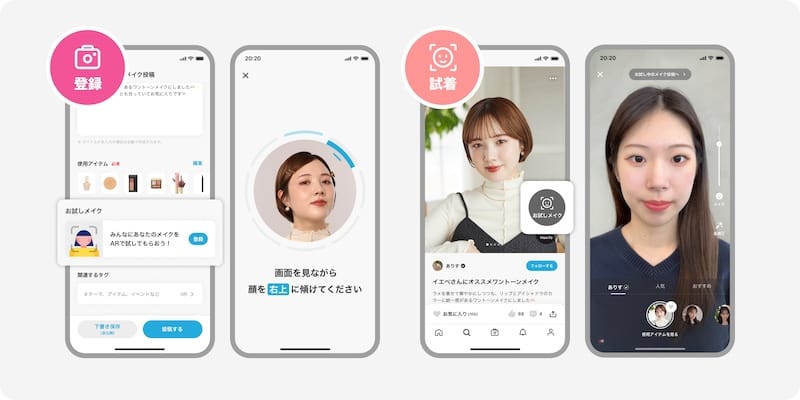

- Introducing the AR "try-on" feature in the WEAR app.

Market context: Japan's cosmetics market reached 2.37 trillion yen in FY2022, up 4% YoY. E-commerce penetration remains below 10% for cosmetics.

Competition:

- @cosme parent company istyle reported 13.1 billion yen in e-commerce sales.

- Department stores like Isetan Mitsukoshi and Daimaru Matsuzakaya also expand online cosmetics offerings.

Bottom line: ZOZO's investment in cosmetics e-commerce and innovative features like AR try-ons could help it capture a larger share of Japan's beauty market, potentially boosting overall company performance if it can build the same brand recognition for cosmetics as it has for clothing.

Source: NIKKEI

Comments ()