TRD Issue 75 - Briefing: Inflation’s Soft Landing, Shopee’s Logistic Move, TikTok Shop’s Growing Pain, and AI Safety at OpenAI

Shopee bets big on in-house logistics, TikTok Shop faces hurdles, OpenAI shifts focus, and economists predict a softer inflation landing. Retail adapts to new realities.

Hello Subscribers,

This week’s news highlights how companies are pivoting their strategies to stay competitive in a challenging global market.

In economics, top minds are giving us a glimpse into the future of global inflation. Ben Bernanke and Olivier Blanchard’s analysis of post-pandemic inflation in 11 economies suggests that this inflationary period might have a softer landing than previous ones. Their findings indicate that the initial shock was primarily due to supply chain issues and geopolitical events rather than tight labor markets. This could mean a less painful adjustment for workers compared to the 1970s and ’80s.

On e-commerce, Shopee is making bold moves by doubling down on in-house logistics. Following a strong Q1 2024, the company is leveraging its SPX Express to fulfill over half of its orders in Asia and a whopping 70% in Brazil. This vertical integration strategy already shows promising results, with improved delivery times and lower costs per order.

Meanwhile, TikTok Shop is facing growing pains as it attempts to establish itself in the US market. Brands grapple with technical issues and inconsistent support, yet many remain optimistic about the platform’s potential. It’s a reminder that even tech giants face challenges when venturing into new territories.

In AI, OpenAI’s decision to disband its long-term safety team has raised eyebrows. This move, along with similar reorganizations at Google and Meta, signals a shift in the industry towards prioritizing rapid product development. It’s a trend that’s sparked about the balance between innovation and responsible AI development.

Lastly, we’re seeing exciting moves in the retail sector in Japan. Adastria, a significant player in apparel and lifestyle products, is aggressively pursuing M&A to fuel its growth. The company’s focus on becoming a “fashion platform” with both online and offline presence showcases the evolving nature of retail in the digital age.

As we dive into these stories and more, it’s clear that the retail and tech industries are constantly in flux. Stay tuned as we unpack the implications of these developments and what they mean for the future of business. Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan’s “NEXT BIG” companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

Economy

Top Economists Give Clues on What’s Next for Global Inflation

Why it is important

- Two leading economic policy experts have analyzed the global inflation surge in the early 2020s. Their findings suggest that this period of inflation may end with a less negative impact on workers compared to the 1970s and ’80s.

What happened

- Ben Bernanke and Olivier Blanchard analyzed post-pandemic inflation in 11 economies. They found that the global inflation shock was mainly due to pandemic-related supply chain issues exacerbated by the Russia-Ukraine war, not tight labor markets.

- As initial price shocks subside, tight labor markets are becoming a significant factor in ongoing inflation in many countries.

- The study suggests that some countries may need to see the labor market weakening to address inflation fully, but the US might achieve this with limited unemployment costs.

- Unlike the 1970s, there is little evidence of a wage-price spiral, which could make inflation easier to manage.

Source: Axios

e-Commerce

Amazon Briefing: With Rising Fees, Amazon Sellers are Rethinking Their Prime Day Discounts

Why it is important

- This situation highlights the growing tension between Amazon and its third-party sellers over fees and profitability.

- It could impact the consumer experience during Prime Day, with fewer or less attractive deals available.

What happened

- Amazon has implemented new fees for third-party sellers, affecting their profits and Prime Day discounts.

- Some sellers are considering alternative platforms like Shopify for better profit margins.

- The changes come as consumers become more price-sensitive due to inflation, potentially impacting Prime Day’s appeal.

Source: Modern Retail

Shopee Doubles Down on In-House Logistics Following Q1 Growth

Why it is important

- Shopee’s focus on in-house logistics highlights a strategic shift in e-commerce towards vertical integration for better cost control and service quality.

- The company’s growth in Q1 2024 and improved unit economics demonstrate the potential benefits of this approach.

- Shopee is actively competing with TikTok Shop regarding social commerce capabilities, particularly in Indonesia.

What happened

- Shopee reported increased revenue and GMV in Q1 2024.

- Over 50% of Shopee’s orders in Asia and 70% in Brazil are now fulfilled by its in-house logistics arm, SPX Express.

- In-house logistics has led to lower costs per order and improved delivery times, with 70% of SPX Express orders in Asia delivered within three days.

- Shopee reduced sales and marketing spending by 23%, partly due to improved marketplace performance and better unit economics from live-streaming.

Source: Tech in Asia

Mercari Reverses Controversial Return Policy Changes

Why it is important

- This case demonstrates the challenges e-commerce platforms face in balancing the needs of buyers and sellers.

- It highlights the power of seller feedback and community reaction in shaping marketplace policies.

- Despite the reversal, some sellers express ongoing concerns about trust in the platform and other fees.

What happened

- Mercari, a resale platform, reversed its controversial return policy less than two months after implementation.

- The original change allowed buyers to return items for any reason, which was met with significant seller backlash.

- The platform has reverted to its previous policy, where buyers have three days to initiate a return, but only for specific reasons like damaged items or inaccurate descriptions.

Source: Modern Retail

‘Buckle Up for the First Thirty Days’: on TikTok Shop, Brands Continue to Deal with a Buggy and Opaque Platform

Why it is important

- TikTok Shop’s performance issues highlight the challenges of launching a new e-commerce platform, especially for a social media company.

- The platform’s struggles could impact its ability to compete with established e-commerce players and retain sellers, particularly given the uncertain future due to potential US legislation.

What happened

- TikTok Shop, launched in the US eight months ago, faces significant technical issues and bugs.

- Sellers report problems with onboarding, AI-powered product flagging, and inconsistent customer support.

- Despite these challenges, many brands view TikTok Shop as worthwhile due to its potential reach and sales opportunities.

- TikTok has implemented safeguards, such as a 30-day probationary period for new sellers, to build trust and prevent fraud.

Source: Modern Retail

AI

OpenAI’splatform’splatform’splatform’s

Why it is important

- The non-profit organization, formed to protect the world from the most critical AI threats, is starting to look more like a dynamic Silicon Valley startup, rapidly churning out new products.

- Other AI leaders, like Google and Meta, have also had reorgs that spread or scattered the members and work of safety and responsibility teams.

- This shift reflects a broader industry trend of prioritizing rapid product development over-cautious safety measures.

What happened

- OpenAI disbanded its “superalignment” team focused on AGI safety, and critical leaders, including co-founders Ilya Sutskever and Jan Leike, left the company.

- AI safety work is now integrated into broader research teams.

Source: Axios

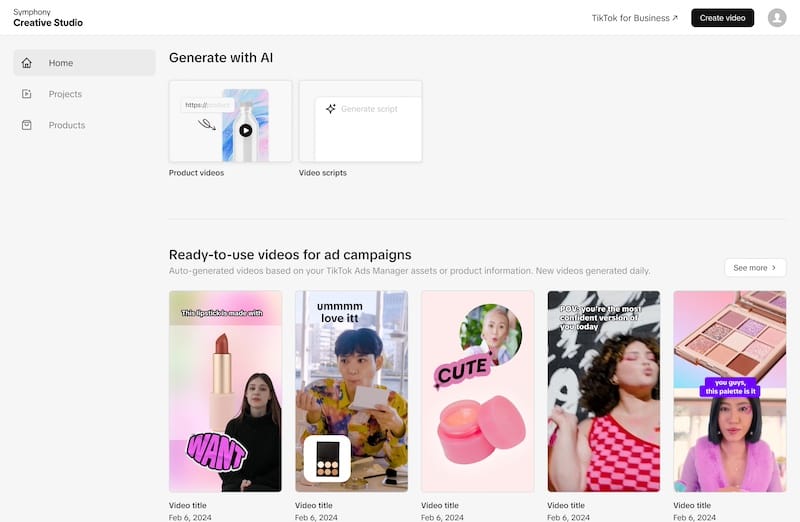

TikTok Turns to Generative AI to Boost Its Ads Business

Why it is important

- Shows AI’s growing role in digital marketing.

- The approach could boost TikTok’s ad revenue and appeal to marketers.

What happened

- TikTok launched “TikTok Symphony,” an AI suite for advertisers that includes an AI video generator, an AI assistant for script refinement, and a tool to optimize existing videos.

- TikTok also Introduced the “TikTok One” platform for marketers, implementing predictive AI for campaign optimization.

- Reported 61% of users make purchases due to TikTok content/ads.

Source: TechCrunch

Asia

Lawson to Delist on July 24; President Says “KDDI and We Will Shoulder the Life of the Town”

Why it is important

- A significant change in Lawson’s corporate structure and ownership.

- Potential impact on the convenience store industry and digital transformation in Japan.

What happened

- Lawson announced it would delist from the stock market on July 24 and become a joint venture, 50% owned by Mitsubishi Corp and 50% by KDDI.

- The company aims to leverage KDDI’s technology to improve physical and online services.

Source: NIKKEI

Adastria Takes Proactive Stance on M&A; Interview with President Kimura

Why it is important

- Adastria is one of the largest retail groups in Japan, specializing in apparel and lifestyle products, and It is actively expanding into more categories and countries.

What happened

- Adastria reported record-high operating profits for FY2024 and announced the acquisition of two lifestyle brands, including “Today’s Special.”

- The company is actively pursuing M&A opportunities to accelerate growth and aims to become a “fashion platform” with both online and offline presence.

- Adastria is also considering M&A opportunities in Asia for global expansion.

Source: NIKKEI

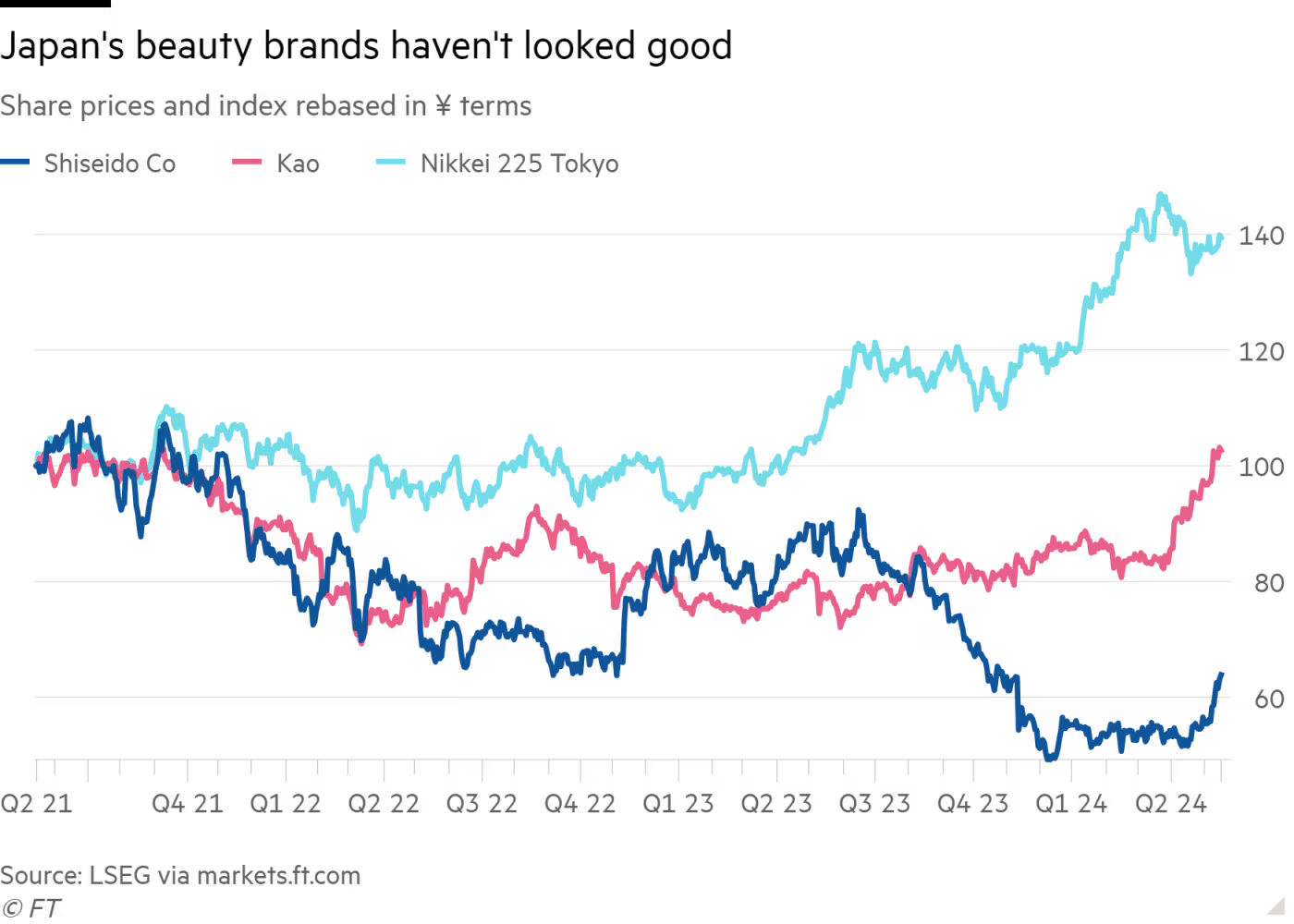

Japanese Beauty Needs to Look Beyond China

Why it is important

- Highlights shifting trends in the Asian beauty market.

- Shows challenges faced by Japanese beauty companies in their critical Chinese market.

- Japanese beauty companies must diversify beyond China to recover in the long term.

What happened

- Shiseido and Kao underperform due to weak China earnings.

- Shift towards local brands in China affects sales.

- Activists push for diversification and new growth strategies.

Source: FT

Comments ()