TRD Issue 72 - Briefing: Amazon's Q1 beats, Uncertain Future of TikTok Shop in the US, OpenAI-FT Deal, Alibaba's 1st Investment in South Korea

Amazon's Q1 earnings soar with AI and ads; TikTok Shop faces uncertainty in the US; OpenAI partners with FT; Alibaba eyes first South Korean investment.

Hello Subscribers,

Here's what's happening in the world of retail, e-commerce, AI, and Asia recently.

Thanks to AI and ads, Amazon knocked it out of the park in Q1. However, when it comes to getting grocery stores to buy their fancy smart carts, Amazon might have difficulty sealing the deal.

Meanwhile, brands on TikTok Shop are facing higher fees and an uncertain future as the platform figures things out. And OpenAI, the company behind ChatGPT, has teamed up with the Financial Times to use their articles to train AI models.

In other news, Alibaba, the Chinese e-commerce giant, is looking to make its first investment in a Korean online shopping platform. This could be a big move for Alibaba as it tries to expand its reach in the region.

There you have it - the latest and greatest in the ever-changing world of retail and tech. Stay tuned for more updates and insights. Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

Retail

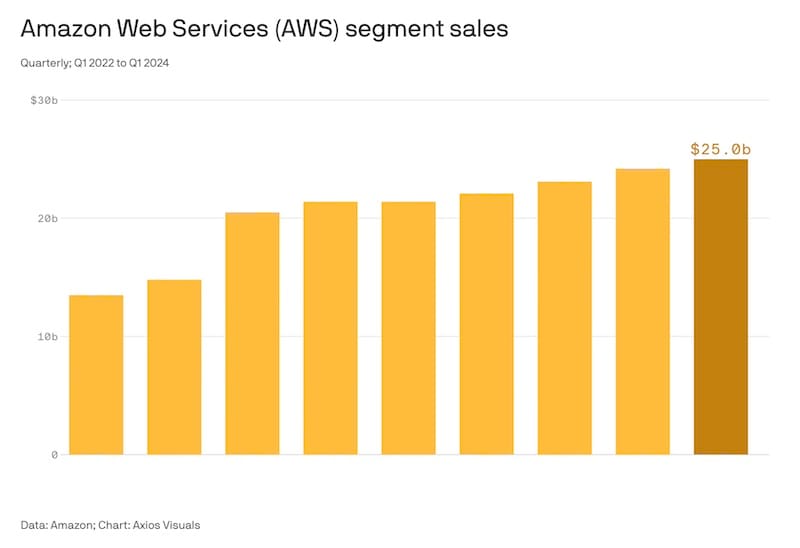

Amazon Rides AI, Advertising in First Quarter Earnings Beat

Why it is important

- Amazon's strong Q1 performance demonstrates the company's resilience and growth potential, driven by its cloud computing and advertising businesses.

- AWS 's success and AI capabilities highlight the increasing demand for cloud infrastructure and AI-powered solutions.

What happened

- Amazon reported $143.3 billion in revenue for Q1, a 13% increase YoY, surpassing analyst expectations.

- AWS grew 17% YoY, while advertising services grew 24%, partly due to new ads on Prime Video.

- Amazon CEO Andy Jassy is optimistic about the company's growth prospects and highlighted its improved delivery performance for Prime members, with nearly 60% of Prime member orders in the top 60 US metro areas arriving the same or the next day.

- Amazon forecasts revenue growth between 7% and 11% for Q2 2023, with operating income expected to be between $10.0 billion and $14.0 billion.

Source: Axios

Amazon Briefing: Why Amazon’s Smart Cart Pitch to Grocers May Be a ‘Tough Pill to Swallow’

Why it is important

- Amazon's pivot from Just Walk Out technology to Dash Carts in grocery stores highlights the company's ongoing efforts to innovate and dominate the brick-and-mortar retail space.

- The adoption of smart cart technology by grocers and consumers could revolutionize the shopping experience and provide valuable data for retailers and advertisers.

- Amazon and Instacart are leveraging their advertising businesses to make smart carts more appealing to retailers by sharing ad revenue generated from the carts.

What happened

- Amazon is scaling back its Just Walk Out technology in favor of Dash Carts, which will be sold to other retailers.

- Smart carts are gaining traction among some grocers, but adoption remains low due to high costs ranging from $5,000 to $10,000 each and thin profit margins in the grocery industry.

- However, retailers are wary of partnering with Amazon and Instacart, seeing them as competitors in the grocery space.

Source: Moder Retail

Why Fashion Retailers are Opening Brand Cafés and Restaurants

Why it is important

- Fashion brands are expanding into hospitality to create unique experiences and engage with customers in new ways, moving beyond traditional retail offerings.

- Branded cafés and restaurants allow fashion retailers to build stronger emotional connections with their target audience and attract new customers.

What happened

- Tapestry, which owns Coach and Kate Spade, is expanding into hospitality. Kate Spade opened a pop-up café in Dubai, and Coach launched a restaurant and coffee shop in Jakarta. Other luxury brands like Dior, Jacquemus, and Ralph Lauren have also opened trendy restaurants and cafés.

- These hospitality concepts help expand brand ecosystems, drive social media exposure, boost brand awareness, and encourage store visits.

Source: Forbes

e-Commerce

Brands on TikTok Shop Face Increased Fees & an Uncertain Future

Why it is important

- TikTok Shop's increasing seller fees and reduced subsidies force brands to reevaluate their strategies on the platform.

- The uncertain future of TikTok in the US, due to potential bans and legislation, adds to the challenges faced by sellers on the platform.

What happened

- TikTok Shop's seller fees have increased from 2% to 6%, with plans to reach 8% by July, while some subsidies have been cut back.

- Sellers consider absorbing costs, raising prices, or reducing their reliance on TikTok ads and affiliates.

- Despite challenges, some brands still see potential in TikTok Shop and are willing to adapt to the changing fee structure.

Source: Modern Retail

D2C

How Lulus is Marketing Itself to a National Audience

Why it is important

- Lulus' strategy reflects a growing trend among digitally-native brands to use out-of-home advertising to engage with customers offline.

What happened

- Lulus launched its first major national out-of-home campaign via billboards and posters in four major US cities.

- The company also plans in-person brunches for influencers and shoppers to learn more about the brand.

- Lulus reported a 19% decrease in net revenue and a 12% decrease in active customers for fiscal year 2023.

- The retailer uses the campaign to measure its effectiveness through website visits, social media engagement, and sales.

Source: Modern Retail

AI

OpenAI to Use FT Content for Training AI Models in Latest Media Tie-up

Why it is important

- OpenAI and the Financial Times partnership highlight the growing interest in AI for enhancing media content.

- The collaboration reflects a wider trend of media companies exploring GAI’s applications in journalism.

- The deal could establish a model for AI-news organization partnerships, emphasizing content attribution and traffic redirection.

What happened

- OpenAI signed a deal with the Financial Times to license its content for training AI models and allow ChatGPT to provide summaries attributable to the newspaper.

- The agreement follows similar partnerships between OpenAI and other media companies, including Axel Springer, Le Monde, and Prisa Media.

- The companies will collaborate to develop new AI products and features for FT readers, with ChatGPT-generated summaries linking back to the Financial Times.

Source: Reuters

Sam’s Club’s AI-powered Exit Tech Reaches 20% of Stores

Why it is important

- Sam's Club's AI-powered exit technology showcases the retail industry's commitment to using AI to improve customer experiences and operations.

- This technology has been implemented in 20% of Sam's stores, contrasting with Amazon's reduction of its Just Walk Out technology.

- Implementing it has significantly reduced exit times for customers, indicating its potential to improve efficiency and customer satisfaction.

What happened

- Sam's Club has deployed AI-powered exit technology “Scan & Go” in over 120 stores across the US, allowing customers to leave without having their purchases double-checked by staff.

- The system uses computer vision and digital technology to capture images of customers' carts and verify payment for the items.

- Since the rollout, the company has reported a 23% increase in the speed at which members leave the store.

- Sam's Club plans to expand the technology to all its stores by the end of the year, highlighting its commitment to the system despite Amazon's recent pullback on similar technology.

Source: Tech Crunch

Asia

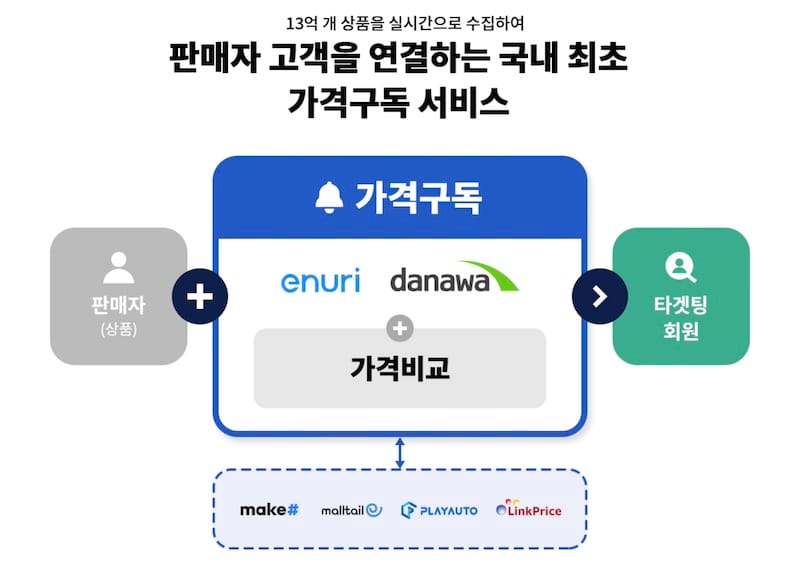

MBK to Delist Korean E-commerce Connectwave After Tender Offer

Why it is important

- Connectwave operates several popular e-commerce platforms in South Korea, including Danawa, Enuri, Malltail, and e-commerce website builder Makeshop.

- The tender offer and subsequent delisting could allow MBK Partners to streamline operations and implement strategic changes without the scrutiny and regulatory requirements of being a publicly listed company.

- Connectwave's strong financial performance in 2022, with significant operating profit and revenue increases, may have made it an attractive target.

What happened

- MBK Partners, a North Asia-focused private equity firm, has initiated a tender offer to acquire an additional 29.6% stake in Connectwave Co., a leading South Korean e-commerce operator.

- The tender offer runs from April 29 to May 24 and aims to increase MBK Partners' ownership in Connectwave from 58.0% to 87.6%.

- MBK Partners plans to delist Connectwave from the junior bourse Kosdaq if successful.

Source: KED

Alibaba Eyes 1st Investment in Korean E-commerce Platform

Why it is important

- The investment could help Alibaba gain a competitive edge in South Korea, which is seeing increased competition from Chinese players like Temu and Shein.

- Ably's strong performance and position as the leading women's fashion platform in South Korea makes it an attractive investment target for Alibaba.

What happened

- Alibaba is in talks to invest 100 billion won ($72.4 million) for a 5% stake in Ably Corp., the operator of South Korea's top women's clothing shopping app.

- Ably also seeks an additional 100 billion won investment from global investors such as Ontario Teachers' Pension Plan, Permira, and CVC Capital Partners.

- The investment is expected to expand Alibaba’s Korean business via AliExpress and strengthen its influence.

- Ably has experienced rapid growth, surpassing 1 trillion won in cumulative transactions in 2020 and managing over 50,000 sellers, the largest number for a Korean shopping app.

Source: KED

Malaysia E-commerce Sales Set to Continue Double-digit Growth in 2024

Why it is important

- The ongoing double-digit growth in Malaysia's e-commerce sales reflects the shift in consumer preferences from offline to online shopping, highlighting the increasing importance of e-commerce in the country's retail landscape.

- The rise of alternative payment methods showcases the changing payment preferences of Malaysian consumers and the need for retailers to adapt.

What happened

- Malaysia's e-commerce sales are expected to grow by 12.8% to MYR 50.3 billion (USD 11 billion) in 2024.

- In 2023, the Malaysian e-commerce market grew by 15% to reach MYR 44.6 billion.

- Alternative payment methods accounted for a 35.7% market share in 2023, followed by payment cards (24.9%) and bank transfers.

- GlobalData predicts that the Malaysian e-commerce market will grow at a compound annual growth rate of 11.7% between 2024 and 2028, reaching MYR 78.4 billion (USD 16.6 billion) by 2028.

Source: Retail in Asia

Comments ()