TRD Issue 68 - Briefing: Amazon's $4B AI Bet, Seller Fee Shakeups, Walmart's Ad Expansion, Google’s Personalized Shopping Tools

Amazon's $2.75B in Anthropic; ChatGPT hype crash; seller fee changes; Mercari drops fees; Walmart & Google ads; Alibaba's $1.1B in S. Korea.

Hello Subscribers,

Currently lagging in the AI race, Amazon recently announced an additional investment in Anthropic, a company founded by former OpenAI employees. The total investment now stands at $4 billion, making it Amazon's largest investment. This investment and strategic partnership will allow Anthropic to utilize Amazon's AWS cloud service resources to train its models, and the Claude model will also be integrated into AWS services for customers, helping Amazon compete with Microsoft and its close collaboration with OpenAI through Azure.

Speaking of OpenAI, the release of ChatGPT in late 2022 sparked an AI frenzy that has continued throughout 2023. Around this time last year, nearly every company's board of directors, shareholders, and investors demanded that CEOs and organizations find ways to apply generative AI, making it a crucial goal for 2024. However, many have now discovered that even highly promising early experiments have proven difficult to scale, and seemingly "good enough" results often fall short. In a blog post titled "What if generative AI turned out to be a dud?" published in mid-2022, Gary Marcus noted that apart from a few areas like coding, many companies have found that GenAI is not the panacea they had envisioned.

I'm more optimistic, but we all must admit that after more than a year of "testing," many companies have realized that there is still much room for improvement in the underlying AI models, such as how to apply and customize their own data. More importantly, applying AI at this stage requires more resources, including time and money.

In e-commerce news, Amazon began its new seller fee structure, including inventory placement and low inventory fees, in March, sparking a backlash from sellers now facing the reality that they can no longer rely solely on this single revenue source. In contrast, Japanese e-commerce giant Mercari's US site announced the elimination of seller fees, becoming the first platform in the US to offer free sales, signaling intensified competition with marketplaces like ThredUp and Poshmark.

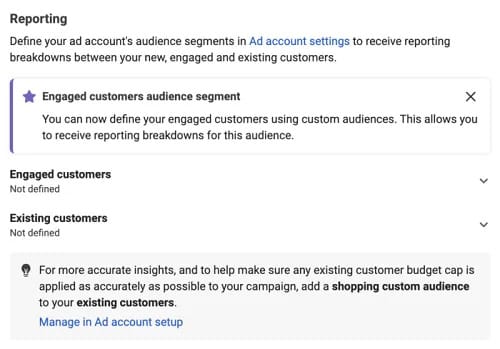

On the marketing front, Google has begun testing a series of tools for shopping ads and search, including adjustable style recommendations, more personalized search results, GenAI search, and try-on previews supporting various body types. Meanwhile, Meta has added an "engaged customer" audience option to its Advantage+ Shopping Campaigns (ASC), providing advertisers with more settings and insights for this AI-optimized advertising product.

We'll see you in the next issue. Happy reading!

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

AI

Amazon Invests $2.75 Billion More in AI Startup Anthropic

Why it is important

- Amazon's $4 billion investment in Anthropic underscores the escalating competition among tech giants in the AI space, with potential implications for market dynamics and regulatory scrutiny.

What happened

- Amazon invested an additional $2.75 billion in AI startup Anthropic, bringing its total stake to $4 billion, marking Amazon's most significant investment in another company to date.

- Anthropic uses AWS Trainium and Inferentia chips to build and deploy models, promising to offer advanced foundation models on AWS.

Source: WSJ

Chatbot Letdown: Hype Hits Rocky Reality

Why it is important

- AI is still changing the world — but improving and integrating the technology is raising more challenging and complex questions than first envisioned, and no chatbot has the magic answers.

What happened

- The hype around generative AI is hitting a "trough of disillusionment" as companies face challenges in scaling and integrating the technology, raising questions about its reliability and potential to revolutionize industries.

- Grumbles about generative AI's shortcomings, such as errors, intellectual property concerns, and bias issues, are growing.

- Some leading AI startups face talent and financial crunches amidst the challenges of implementing the technology.

Source: Axios

e-Commerce

Amazon Briefing: Brands are ‘Losing Their Minds’ Over New Seller Fee Structures

Why it is important

- Amazon's new seller fee structures, including inventory placement and low inventory fees, are causing significant concerns among brands and agencies, potentially leading to higher prices and re-evaluating margins and strategies.

- Sellers need to consider that profits may soon come from sources other than Amazon, and Amazon may be just one piece of the larger pie for these sellers.

What happened

- Amazon introduced new fees for sellers using Fulfilled by Amazon (FBA), requiring them to split inventory across warehouses or pay additional fees.

- Amazon sellers will, on average, see an increase of $0.15 per unit, significantly less than the average fee increases announced by other fulfillment providers for two-day shipping.

- Amazon also charges for low inventory levels, leading to increased logistics costs and potential challenges for seasonal and discontinued products.

Source: Modern Retail

Mercari Eliminates Selling Fees, Heightening Competition with ThredUp & Poshmark

Why it is important

- Mercari's elimination of selling fees aims to attract more sellers and higher-quality inventory to its platform.

- The changes in fee structures and return policies can significantly impact seller acquisition and profitability for marketplaces and intensify competition among online marketplaces like ThredUp and Poshmark.

What happened

- Mercari eliminated its 10% flat commission for every sale made on the platform.

- The company introduced a new return policy allowing buyers to initiate returns within three days for any reason, with a varying service fee deducted from their purchase.

- Mercari plans to improve its platform's look, feel, and communication with sellers and customers in the coming months.

Source: Modern Retail

Marketing

Walmart Connect Opens Up to Small and Non-Endemic Advertisers

Why it is important

- Walmart Connect’s new features and increased access to in-store sales measurement could drive up advertising costs.

- Walmart aims to boost ad revenue by incentivizing advertisers to utilize its platform fully.

What happened

- Walmart’s RMN, Walmart Connect, opened up to small marketers, international suppliers, and non-endemic brands like automotive and financial marketers.

- The platform introduced new features such as search ads targeting competitor brands, expanded in-store sales measurement, and shoppable advertising with Roku and TikTok.

- Walmart Connect aims to build on its successful 2023, which saw ad revenue grow by 28% to $3.4 billion.

Source: Search Engine Land

Google Testing New Tools for a More Personalized Shopping Experience

Image Credit: Google

Why it is important

- Google's new personalized shopping tools offer businesses opportunities to showcase products and engage high-value consumers.

What happened

- Google is testing new tools for personalized shopping experiences, including style recommendations based on your swiping right, like a dating app, and brand preferences that allow users to set up preferred brands for search results.

- Google also introduced GenAI for product search based on search terms and virtual try-on technology, showing what products look like on a diverse set of real models ranging in size from XXS-4XL.

Source: Search Engine Land

Meta Adds New Insight and Targeting Options for Advantage+ Shopping Campaigns

Why it is important

- Meta's new engaged audiences targeting option for ASCs allows businesses to re-engage potential customers who have shown interest but have not purchased, potentially improving conversion rates.

What happened

- Meta introduced a new audience insight and targeting feature within Advantage+ Shopping Campaigns (ASC), enabling advertisers to target "engaged customers."

- Meta defines engaged customers as “people who are aware of your business or interacted with your products or services but have not made a purchase.”

- According to Meta’s research, ASC drives an average +17% improvement in cost per acquisition and a +32% increase in return on ad spend.

Source: Social Media Today

Asia

Alibaba Scraps IPO of Logistics Unit Cainiao, Says It Will Take Full Ownership

Why it is important

- Alibaba's decision reflects the challenging market conditions in China, which have soured investor sentiment towards Chinese tech companies.

What happened

- Alibaba announced it is withdrawing the IPO and listing application for its smart logistics unit Cainiao.

- The company plans to invest up to $3.75 billion to acquire 36% of Cainiao from minority investors and employees.

- The decision comes amidst deteriorating market conditions in China, with the Hang Seng index down 15% in the past 12 months and Chinese tech stocks experiencing significant declines.

Source: CNBC

Coupang to invest 330 billion yen in logistics, offering next-morning delivery nationwide in South Korea

Why it is important

- Coupang's substantial investment in logistics aims to expand high-speed delivery services, improving the quality of life in rural areas and capturing a larger market share.

What happened

- Coupang announced plans to invest over 3 trillion won (approximately 330 billion yen) in logistics by 2027.

- The company is building 8 new large-scale logistics centers to increase its high-speed delivery coverage to 88% of South Korea, up from 70%.

- Coupang has invested 6 trillion won ($4.38 billion) in its logistics network since its service launch in 2010, establishing 100 logistics bases nationwide to acquire customers through high-speed delivery.

Source: NIKKEI

ZOZO to Test "Slow Delivery" Option for Multiple Orders, Offering Reward Points

Why it is important

- ZOZO's "slow delivery" test addresses the anticipated logistics crunch in 2024 by incentivizing customers to opt for slower shipping, potentially improving delivery efficiency.

What happened

- ZOZO will test a "slow delivery" service on its clothing e-commerce site ZOZOTOWN from April 2 to 22. Customers who choose it will receive 10 yen worth of reward points.

- The test aims to build an efficient delivery system in response to the expected logistics challenges in 2024 due to restrictions on truck drivers' overtime hours.

Source: NIKKEI

Comments ()