TRD Issue 61 - Insight: Walmart's Vizio Acquisition and Retail Media Networks Updates

Learn how Walmart's recent acquisition will enhance its retail media offering. Discover the latest developments and upcoming challenges of RMNs in 2024.

Hello subscribers,

Walmart's recent acquisition of Vizio is a bold step that is set to enhance the company's advertising arm, Walmart Connect, and challenge Amazon's dominance in the retail media space.

In this issue, we will delve deeper into how this acquisition will support Walmart's retail media offering and provide an overview of the recent developments of RMNs. We will also explore the challenges and opportunities of RMNs that lie ahead in 2024.

I hope you find this issue informative and engaging. Thank you for your continued support, and I look forward to seeing you in the next issue.

The Retail Direct

About 91APP

Founded in 2013, 91APP is the premier OMO (online-merge-offline) SaaS company, providing one-stop omnichannel retail solutions in Taiwan, Hong Kong, and Malaysia. It offers advanced Commerce Solutions and Marketing Solutions that enable retail brands to penetrate the D2C (Direct-to-Consumer) e-commerce market and drive operational benefits to their full potential. In 2021, 91APP became the first SaaS company to be listed in Taiwan and has been named one of Taiwan's "NEXT BIG" companies by Startup Island TAIWAN.

For more information about 91APP (TWO: 6741), visit www.91app.com.

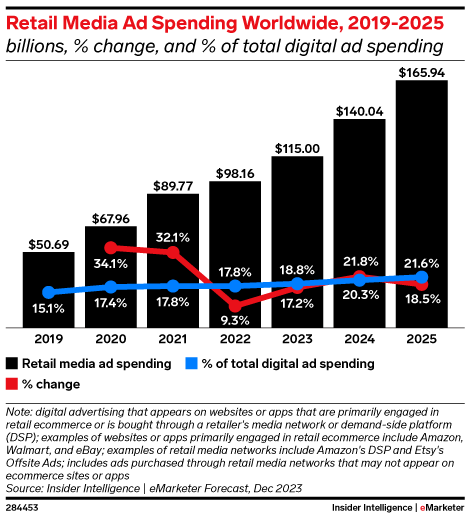

Retail Media is Growing Faster than Other Ad Spend Forms

According to a forecast by eMarketer, worldwide retail media spend will hit $140 billion in 2024.

Retail media is a rapidly expanding form of advertising, with a growth rate of 21.8%, making it one of the fastest-growing forms of advertising.

According to estimates, Amazon is expected to dominate the retail media ads spending market, accounting for about 74.2% of spending in the US and approximately 42% of spending worldwide.

This highlights the significant impact that Amazon has had on the digital advertising industry, and how they have become a dominant player in the retail media space.

The Walmart-Vizio Synergy: A Game Changer

On February 20th, Walmart made a major announcement: it acquired Vizio, a smart TV maker, for $2.3 billion, roughly eight times the market value of Gannett, a 118-year-old media company that owns household-name brands including USA Today, the Detroit Free Press, and hundreds more, according to Axios.

This move is a simple merger of retail and technology and a calculated bet to dominate the retail media network landscape. With Vizio's smart technology and access to data from over 23 million devices, Walmart is not just acquiring technology but also a direct channel to consumers' living rooms.

Bridging Retail and Streaming Worlds

Walmart's acquisition of Vizio is an expansion and a strategic positioning.

The goal is to bridge the gap between traditional retail advertising and streaming media. With Vizio's rich data and Walmart's retail infrastructure, the deal offers unparalleled targeting and measurement capabilities. This will ultimately boost Walmart's ads business with streaming inventory, viewership data, and shoppable ads.

Prioritize Data Over Neutrality in TV Sales

However, the acquisition will end Walmart’s neutrality regarding TV sales. Walmart can lower prices on Vizio TVs to increase sales and undercut competitors like Sony, Samsung, LG, and Roku.

In return, Walmart gains control over Vizio's operating system and hub of first-party viewing data and can link its customer purchase data to serve targeted ads for Walmart products directly to Vizio owners'.

In addition, the deal puts Walmart in a better position to compete against Amazon, which also has CTV and retail media businesses, by owning the Fire TV operating system and Amazon Ads.

Smart TVs are one of the few reliable sources for collecting streaming viewership data since streaming TV operators and app companies like Netflix do not share their own viewership information. Currently, many TV measurement providers, including Nielsen, rely on ACR data from Inscape, which is Vizio's data science subsidiary.

Generally speaking, Walmart may utilize Vizio’s direct relationships with several advertisers and The Trade Desk, on which Walmart DSP is built, to improve audience match rates and enhance ROAS.

How about Shoppable Ads?

One of the areas we are closely monitoring is the shoppable ads business.

Walmart has been experimenting with shoppable ads for a few years, including through a partnership with Roku in 2022. They even created a shoppable miniseries aired on Roku, TikTok, and YouTube during the 2021 holiday season. And Walmart will likely apply the same strategy on Vizio TVs.

Walmart wants to sell advertisers the ability to link TV commercials with real-world purchases, or “closed-loop attribution,” as an advertiser term. This could boost Walmart's ad revenue by tying Walmart’s two RMNs - Walmart and Sam's Club to proprietary CTV supply. Specifically, Walmart could create more shoppable TV ads in streaming partner apps, such as Paramount+, which is included for free with a Walmart+ membership.

Overall, Walmart said its global ad business reached $3.4 billion in the year ended in January, up 28% from the previous year.

The Challenges of Scaling RMNs

The rise of RMNs has increased competition for marketers' advertising budgets, and the growth isn’t yet slowing down.

According to a recent article on DigiDay, this growth also led to complicated relationships between retailers and CPG brands and a lack of clear standardization when running media, as each one operates under its own rules.

The Impact on Marketer-Retailer Relationships

Marketers are now navigating a more complex landscape where their investment in retail media networks could influence their products' shelf placement.

This evolving relationship adds a layer of strategy to negotiations, blending traditional shelf space battles with digital advertising commitments. The intertwining of physical and digital retail strategies underscores the changing nature of retail marketing.

Challenges: Programmatic Buying and Standardization

As RMNs expand their off-site advertising capabilities, they face criticism for not fully embracing self-serve and programmatic buying options.

The lack of these capabilities hinders marketers' ability to optimize campaigns efficiently, leaving many to rely on direct insertion orders (IOs) more than desired.

This limitation points to a broader issue within the RMN ecosystem: a stark lack of standardization.

With each network setting its own rules for media operation and performance metrics, marketers struggle to compare effectiveness across platforms, leading to decision-making challenges.

The industry's call for standardization, spearheaded by initiatives like the IAB's media measurement guidelines, highlights the urgent need for uniformity. However, the timeline for these changes remains uncertain, leaving marketers to navigate a fragmented landscape.

The Future of Retail Media Networks

As retail media evolves, 2024 is poised to bring significant shifts that reshape how brands and retailers engage with consumers. Here are key trends to watch.

Standardization and Consolidation

The diversity in activation and reporting standards across RMNs has long been challenging for brands and agencies. In 2024, we expect to see a move towards standardization driven by market forces.

As supply begins to outstrip demand, emerging retailers will align their data and activation practices with market leaders to remain competitive. This shift will simplify campaign management across various networks, making it easier for advertisers to achieve consistent results.

Additionally, the landscape will consolidate, with smaller retailers joining existing networks or launching collaborative marketplaces. This trend mirrors the strategy of giants like Amazon and Walmart, who have successfully integrated marketplaces into their platforms. Vertical-specific players, such as Ulta in the beauty sector, are also finding success with this model, indicating a broader move towards marketplace-driven revenue strategies.

Off-Site Retail Media Expansion

Retail media is venturing beyond the confines of retailer e-commerce sites, marking a return to its roots in shopper or trade marketing. This expansion is fueled by the digital transformation of trade marketing budgets and the evolving regulatory landscape around privacy and cookies.

As a result, non-endemic brands—those not traditionally selling through the retailer—are increasingly leveraging RMNs to reach audiences off-site. Utilizing high-quality, first-party retailer data, these brands can target known audiences across publisher networks, offering a privacy-compliant way to engage consumers online.

Emerging Technologies Fuel Evolution

Technological advancements are set to accelerate the transformation of RMNs, mainly through integrating non-endemic brands and off-site advertising activities. Data clean room technology, which facilitates privacy-compliant data matching between brands and retailers, will become more accessible and cost-effective. This will enable more sophisticated and secure data collaborations, enhancing targeting capabilities.

Moreover, the digitization of all retail media will revolutionize in-store advertising. Physical media, such as pricing panels and promotional signage, will transition to digital formats, allowing dynamic content updates and programmatic ad buying. This evolution mirrors digital out-of-home advertising, blurring the lines between online and physical retail spaces and offering new opportunities for engaging shoppers.

Conclusion

As we look ahead to the following three quarters of 2024, we can expect significant changes in the world of RMNs. These trends will simplify the advertising landscape and offer new opportunities for brands to connect with consumers in meaningful and innovative ways. Stay tuned to our future issues, which cover more in-depth analyses of retail, e-commerce, AI, ad-tech, and more.

Comments ()